Business Maintenance

Description

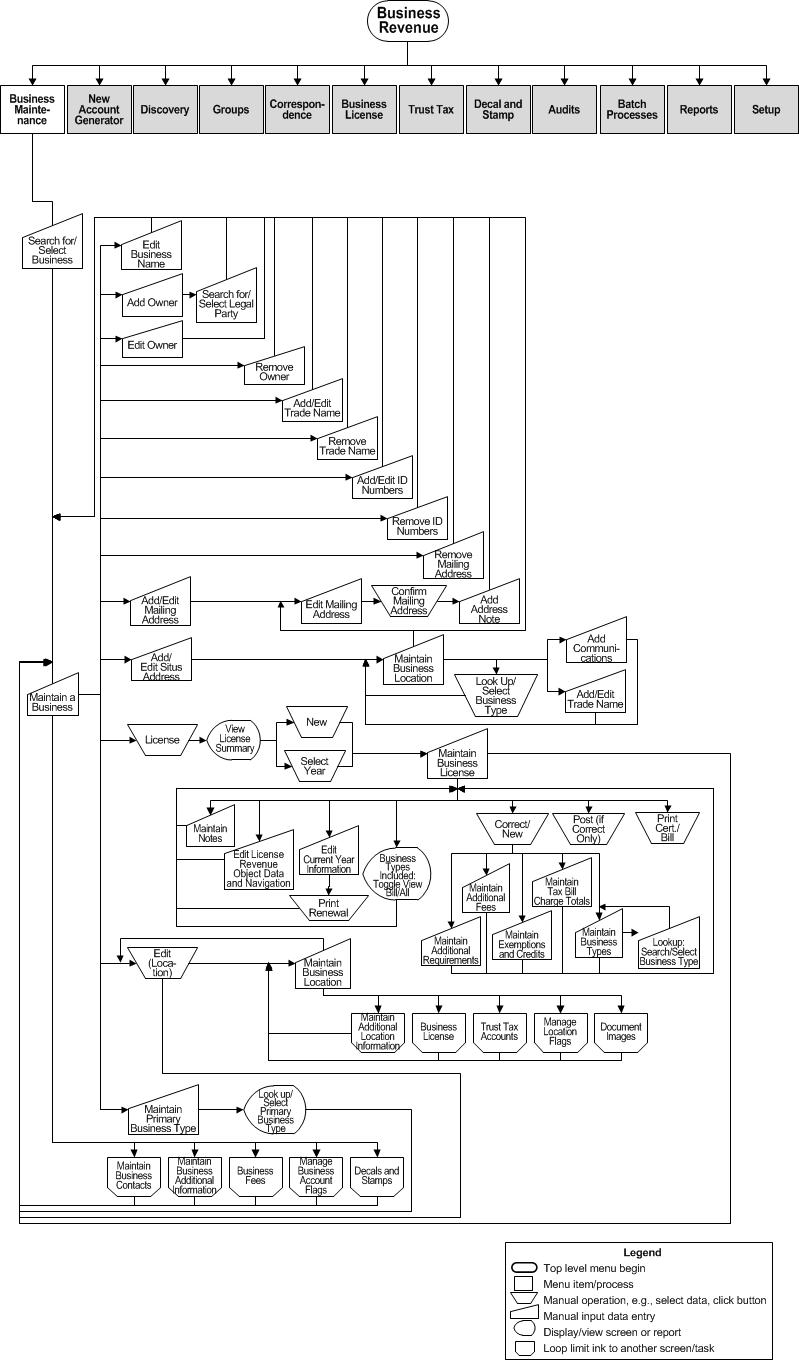

Set up a business account and maintain the core business information for Aumentum Business Revenue. A business is any organization that might be required to obtain a license or permit or pay certain types of business related taxes. This includes traditional business as well as non-profit organizations.

In Aumentum Business Revenue, the business entity refers to information about the organization and not the location where business activities are performed. The business is a legal party under the official name of the business. This might be a legal party that was already created through the Records module or one that is created directly within this screen, then saved automatically as a Records legal party.

Steps

-

Search for a Business - Find a business legal party or business account. If there is not an existing match for your search request, add a new business.

-

Maintain a Business - Add or edit business information, including owners and percent ownership, trade names, identification numbers, mailing addresses, locations, business dates, type and class, and status.

-

-

Maintain Business Contacts [Common Actions] - View the contact information for a contact associated with the business, or change the contact type.

-

Maintain Additional Business Information [Common Actions] - Add any information about the business that your jurisdiction tracks, using the fields established in Set Up Additional Information Fields.

-

Charge Business Fees [Common Actions] - Add or edit fees on a business bill.

-

Issue Decals and Stamps [Common Actions] - Issue a decal or stamp for the business.

-

Manage Business Account Flags [Common Actions] - Add or remove flags on the business.

-

Maintain Business Location [Location panel] - Add and maintain one or more business operational locations for the business. It is the location that actually obtains the license or has the trust tax account.

-

Maintain Business License (License [License link for location in Location panel]) - Use to issue a business license or license supplement for particular business activities performed at a business location, or view and maintain the details of the business license/supplement.

-

Create New Business Tax Receipt Roll

NOTE: Trust tax may not apply to your jurisdiction.

-

Prerequisites

Configuration Module

Application Settings

-

Trust Tax Late Filing BRFeeRule

Trust Tax Lock Late Payment Penalty

License Late Filing BRFeeRule

Business License Lock Late Payment Penalty

Functional Calendar

-

Set up the tax years for a business calendar. The current tax year must be set up.

Systypes

-

Supplement Reason sets the available reasons available when adding a supplement to a business license.

-

Set up business contact types as a systype of the systype category "Legal Party Role Types".