Tax Roll Processing Overview

Tax Roll Processing Overview

Description

A tax roll is a permanent record of the original values, exemptions, charges, savings, deferred taxes, and legal parties for the annual tax billing cycle. Values used to create the tax roll come from a levy value build, which is based on one or more annual assessment rolls (cadastres).

Tax roll processing:

-

Extends ad-valorem taxes, deferrals, credits, use fees, and late filing penalties.

-

In versions 8 and earlier, also extends SA charges from values stored in the Assessment Roll against a tax rate of 1.00000.

-

In version 9 and later, imports SA charges to the tax bill directly from the Special Assessments module.

-

Creates tax bills from the extended charges and applies rounding rules.

-

Splits the tax bills into installments based on the Installment Schedule setup.

-

Posts charges, credits, fees, and late file penalties to A/R. (Deferrals are not posted to A/R.)

If the Tax Roll category is Preliminary, the tax bill transactions are set to a status of Closed and the tax bills can be viewed in Info Center, but not collected.

If the Tax Roll category is Final, the tax bill transactions are set to a status of Posted, the tax bill charges are copied to A/R (FnclDetail table), the tax bills can be viewed in Info Center, and can be collected.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Supplemental Assessments

When Levy bills a supplemental assessment followed by a transfer, the system performs a check to determine if the tax amounts for each of the supplementals was correct as follows:

-

When any supplemental is billed (Supplemental roll process), the process checks to verify whether a transfer exists with an event date after the event date of the supplemental being billed. If so, the process changes the proration on the supplemental being billed so that it only extends to the start of the transfer

-

When a transfer is billed, the process checks to see if any previous transfer exists for the current tax year that has already been billed. If so, the proration period of the first transfer overlaps the second transfer. The assumption is that the second transfer grantee paid the grantor for the tax due on the first supplemental during closing. Therefore, the tax on the second transfer is adjusted so that it does not include the amount of tax in the first transfer supplemental that would be due for the period of overlap with the second transfer.

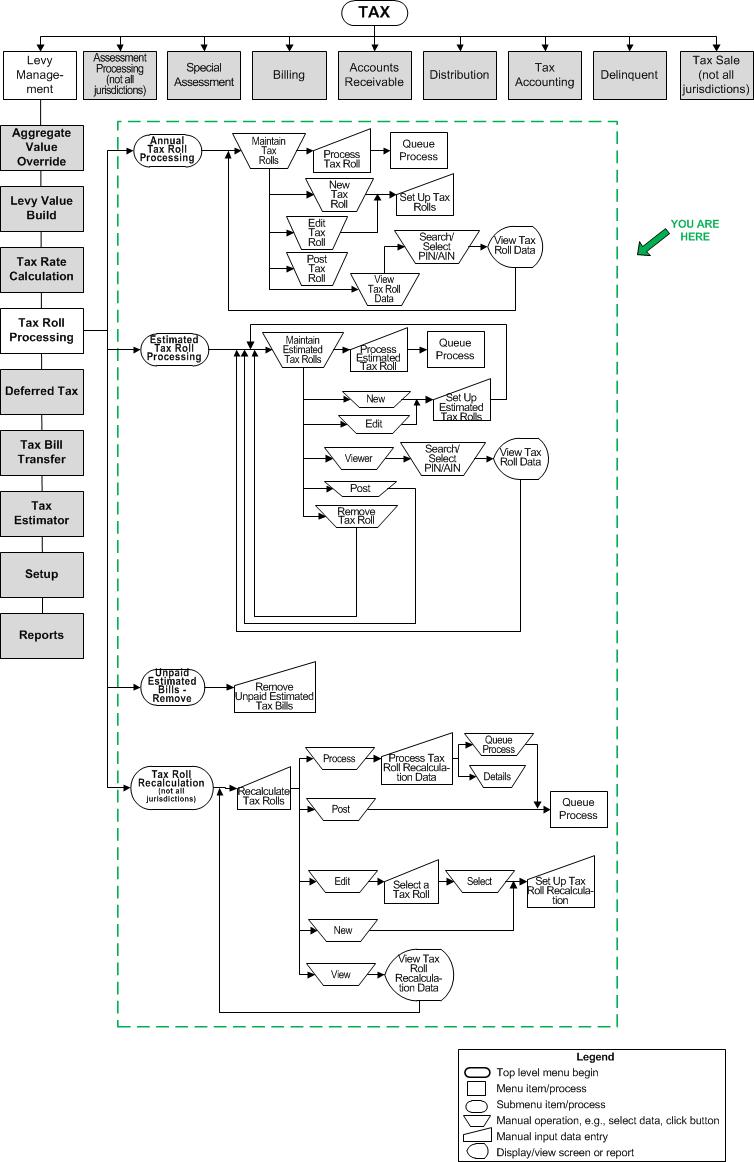

Tax Roll Processing

Tax roll processing involves calculation of taxes, credits, and other amounts; bill number and installment assignment; and the creation and posting of tax roll data. You can also view tax roll data for specific revenue objects.

-

Maintain Tax Rolls - This is the starting screen for tax roll processing. From this screen you can view a list of the existing tax rolls with the dates various processes were run and access the following screens to create a new tax roll or edit an existing tax roll's configuration, run the process steps to create the tax roll, view detailed tax roll data for specific revenue objects, post a tax roll, or remove the tax roll data.

-

Set Up Tax Roll - Create a new tax roll or change the settings of an existing roll.

-

Process Tax Roll - Processing the tax roll is a multi-step process which includes primary tax calculation, calculation of additional charges and credits, assignment of bill numbers and installment due dates, and finalizing the creation of tax roll data from all the previous steps.

-

View Tax Roll Data - View the tax roll data for a specific revenue object.

Tax Roll Processing - California

Tax roll processing in California is based on events rather than tax rolls. .

-

Search for Roll Process - This is the starting screen for tax roll processing in California. Use this screen to search for and select the process.

-

Select Roll Processes - Select the roll process instance from this screen.

-

Click New on the Select Roll Processes screen to create a new instance on the Create New Roll Process screen.

-

After selecting or creating a new roll, manage it on the Manage Roll Process screen.

-

Perform the calculations and build the roll on the Build Roll Processes screen.

Estimated Tax Roll Processing

NOTE: This task may not apply to your jurisdiction.

This task is used to create estimated installment bills. The batch process component of this task identifies estimated bills that were not paid between the first and second installment and indicates whether a property is on an installment plan, thus triggering a correction that zeroes the tax bill. This tax roll processing reconciles the annual tax bills to estimated installment bills.

-

Maintain Estimated Tax Rolls - This is the starting screen for estimated billing tax roll processing. From this screen you can view a list of the existing estimated billing tax rolls with the dates various processes were run and access the following screens to create a new estimated billing tax roll or edit an existing estimated billing tax roll's configuration, run the process steps to create the estimated billing tax roll, view detailed estimated billing tax roll data for specific revenue objects, post an estimated billing tax roll, or remove the estimated billing tax roll data.

-

Set Up Estimated Tax Roll - Create a new estimated billing tax roll or change the settings of an existing estimated billing tax roll.

-

Process Estimated Tax Roll - Processing the tax roll is a multi-step process that includes primary tax calculation, calculation of additional charges and credits, assignment of bill numbers and installment due date, and finalizing the creation of estimated billing tax roll date from all the previous steps.

-

View Estimated Tax Roll Data - View the estimated billing tax roll date for a specific revenue object.

Unpaid Estimated Tax Bill - Remove

Use this task to remove estimated tax bills that have not yet been paid.

-

Remove Unpaid Estimated Bills - This process finds all items that have a modifier indicating that the taxpayer is on the estimated installment roll but has not made the first installment payment yet. When removing the tax roll, the modifier is then removed and the tax bills are flagged so that payments cannot be made against them. Any unpaid installment items are removed from the estimated installment billing tax roll.

Aggregate Values and Levy Value Build

The following tasks are required to prepare values provided by Assessment Administration for Tax Roll Processing.

-

Aggregate Value Override - Maintain aggregate value data, such as state aid tax from adjoining county governments for use in various calculation processes, including secondary tax calculation.

-

Levy Value Build - The levy value build creates, calculates and stores value types to allow final modification of tax calculation values for Tax Roll Processing beyond that provided by the cadastres (assessment rolls) from Assessment Administration.

Tax Roll Processing and Corrections

Tax Roll Processing determines the tax charges and bill information using values from assessment rolls and the levy value build. Tax charges can be corrected either due to valuation changes or by manual adjustments to posted charges.

-

Tax Roll Processing - Tax Roll Processing is a multi-step process involving tax calculation, bill number and installment assignment, and the creation and posting of tax roll data.

-

Corrections Processing - There are two types of changes to tax charges.

-

-

Roll Corrections - Changes to value are processed through the Roll Corrections Queue in Assessment Administration. After changes are accepted to the assessment roll, they must be accepted to the tax roll in the Tax Office Review Queues before tax charges will be changed and posted to Accounts Receivable. See the Assessment Administration Training Manual for details.

-

Adjust Charges - You can make manual adjustments to posted charges on a tax bill via the Process Corrections Common Action in Information Center. You can add or remove penalties, fees, or special assessment charges; adjust tax amounts and write off charges.

-

Tips

Tips

Many tax roll reports are generated in SQL Server Reporting Services, accessible from the Levy Management Reports menu.

Related Topics

Prerequisites

Levy Management

-

Perform all the Levy Management Setup steps for the tax year:

Tax Funds

Rate Types

Tax Authorities, including tax authority fund rate setup

TAG and Tax Authority Associations, including TAG rate overrides

TIF Districts

Bill Numbers

Installment Schedules -

Aggregate Value Override - Enter any aggregate values needed to build the tax roll for each year.

Washoe, NV needs to have County Wide Value overrides for the Low Cap - Residential, High Cap - Commercial, and Assessment Ratio value types and TIF overrides for the TIF Capture Ratio value type.

Washoe, NV needs to have County Wide Value overrides for the Low Cap - Residential, High Cap - Commercial, and Assessment Ratio value types and TIF overrides for the TIF Capture Ratio value type. Minnesota Powerline Tax Credit - The following aggregate values must be entered in order for this credit to be calculated and allocated:

Minnesota Powerline Tax Credit - The following aggregate values must be entered in order for this credit to be calculated and allocated: -

Levy Value Build - Create the levy value build to make value data available for processing the tax roll.

Configuration Menu

-

Application Settings - Make sure all tax-year based application settings are set for the year before processing the tax roll.

-

Functional Calendars - Set up the functional calendars for the Levy Management functional area. The functional calendar designates the start and end of the levy processing year and specifies the installment periods and various event dates related to taxes, such as billing dates, due dates, and penalty dates.

Dependencies

The tax roll must be posted to make charges available to Accounts Receivable and to create tax bills.

Abatements for the state of Nevada are calculated through tax roll processing. Abatements are based on capping the percentage increase of limited taxes from the previous year to the current year. Only revenue objects that have a FinalCapPercent value type calculated by Assessment Administration will be considered in the calculations. Aumentum looks at the previous year to determine the taxes levied, unless Prior Year data is provided for this year, in which case the base for the previous year will be recalculated for the purposes of abatement calculation, although the prior year will not actually be changed.