Tax Rate Calculation

Tax Rate Calculation

Description

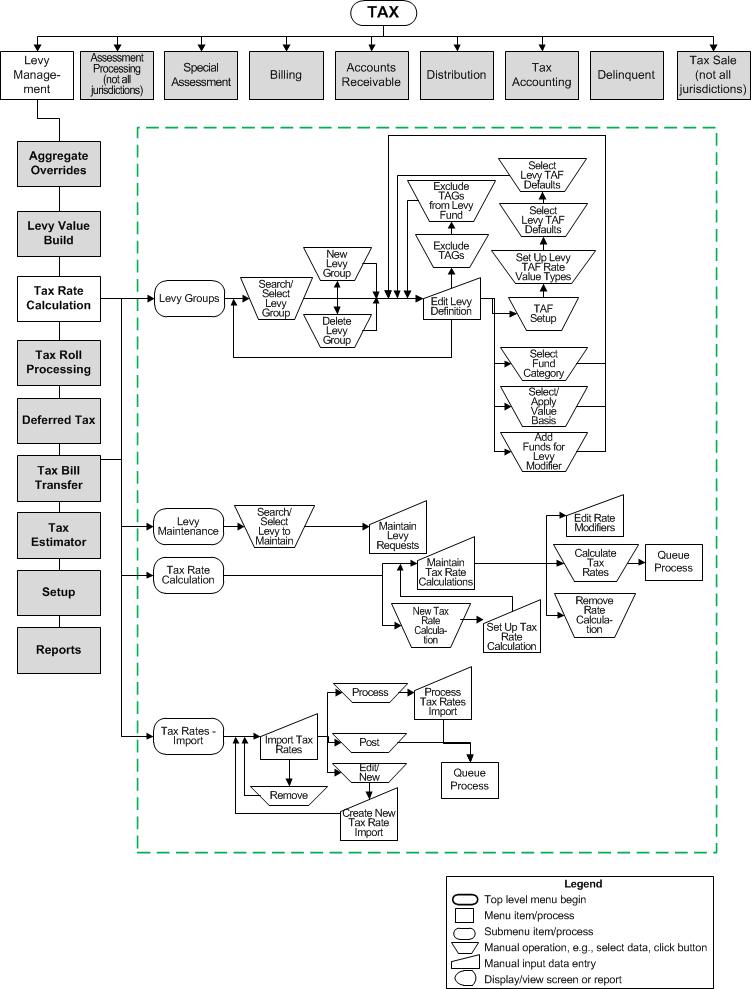

Use the tax rate calculation programs to determine the levies requested by tax authorities and calculate rates for those levies based on the values provided by the Levy Value Builds.

-

Levy Groups - Search for levy groups and edit levy definitions. Define the types of levies that will be used to enter levy requests and then to calculate tax rates.

-

Levy Maintenance - Maintain the requested and actual levies which will be used to calculate tax rates.

-

Tax Rate Calculation - Calculate tax rates from levy request amounts and the levy basis from levy value builds.

-

Tax Rates - Import - Allows importing, processing, and posting of tax rates.

Calculate tax rates from levy requests amounts and the levy basis value from levy value builds, which are based on assessment rolls. A basic tax rate per unit (of value) is calculated by dividing a levy basis value (from a levy value build) into a requested levy amount. Rate calculation is a multi-step process which uses batch processing. The final step is posting, which must be done for the rates to be available for tax calculation.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Steps

-

View existing rate calculation configurations on the Maintain Tax Rate Calculations screen.

-

Create or edit a rate calculation configuration for a selected levy value build and one or more levies for the tax year on the Set Up Tax Rate Calculation screen.

-

Enter tax rate modifiers on the Edit Rate Modifiers screen.

-

Run the actual calculation through batch processing using the Calculate Tax Rates screen.

Tips

Tips

Each rate calculation event is a unique combination of tax year, rate type, and levy. Although you can run multiple calculations on the same combination, only one rate calculation event can be posted.

Valuable Vocabulary

Valuable Vocabulary

Related Topics

Rate Calculation by Tax Authority Group Report

Rate Calculation by Tax Authority Report

Prerequisites

Levy Management

-

Levy Groups and Levy Maintenance must be completed for the year prior to tax rate calculation.

-

Levy Value Build - A levy value build is required for tax rate calculation.

Configuration

The variance tolerance must be defined for tax rate calculation on the Maintain Levy Request screen.

-

Go to Configuration > Application Settings > Maintain Application Settings.

-

Select the setting type of Effective Date and the filter by module of Tax Levy Management.

-

Click Edit on the Tax Rate Variance Tolerance application setting and set the tolerance as applicable.

Dependencies

If you are using calculated rates, rather than entering rates manually for tax authority funds, rates must be calculated prior to Tax Roll Processing.