Select Levy to Maintain

Select Levy to Maintain

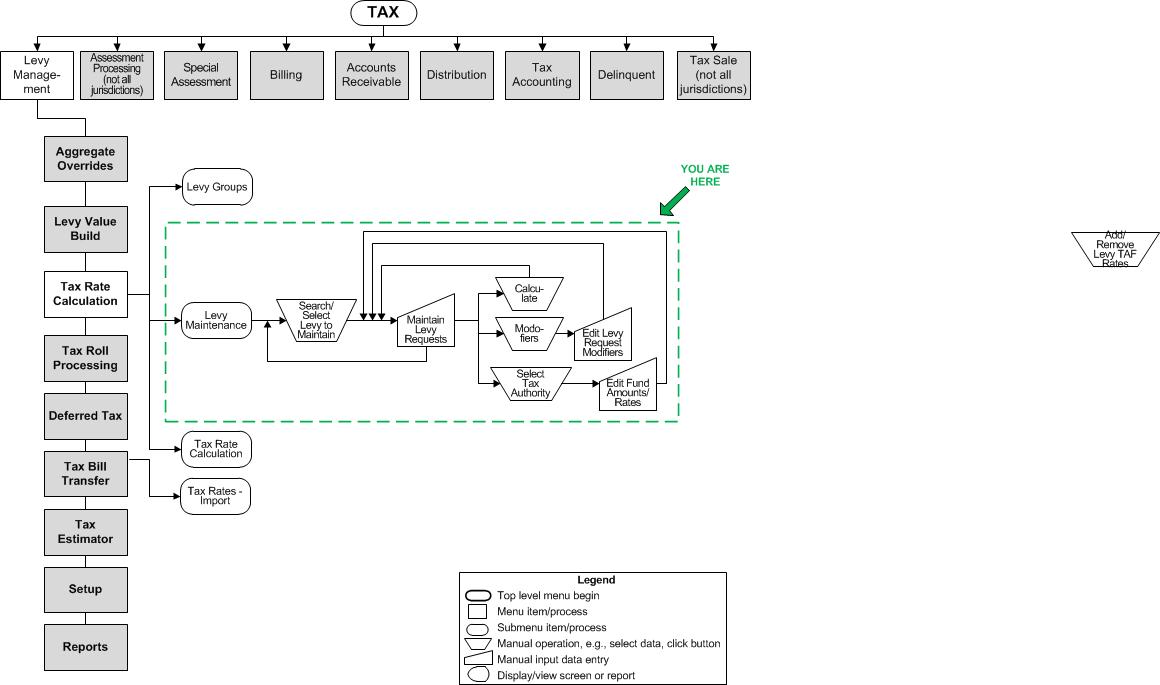

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

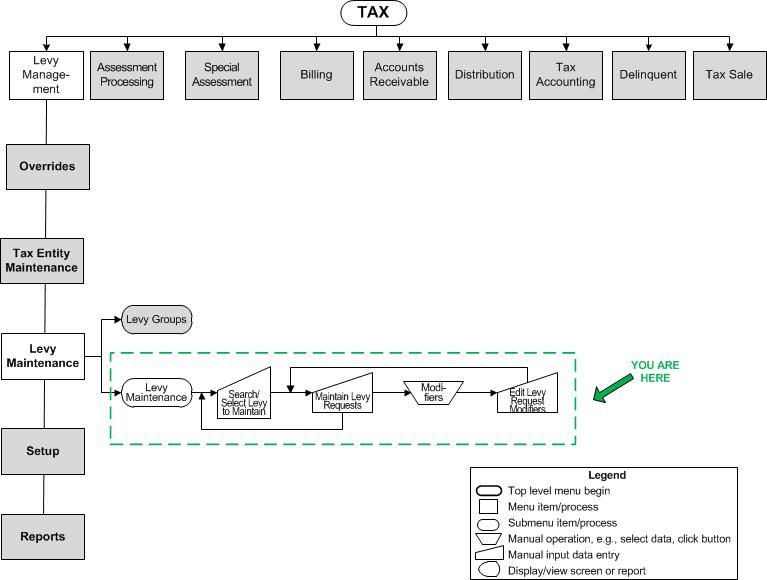

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Search for existing levies to maintain.

SETUP: See Levy Management, Levy Management Setup, and Tax Rate Calculation for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Accept the tax year or select the Tax year and any other search criteria you want, including all or part of the Code and/or Description, the Levy basis type, the Source county, or the Levy reason code.

-

Click Search to find the levies matching the criteria.

-

Select the Aggregate process for the tax year that you want to associate with the levy, which will determine the levy basis value.

-

Select the checkbox for each levy you want to maintain from the Available Levies panel.

-

Click Next to navigate to the Maintain Levy Requests screen.

-

Click Clear to clear the screen for a new search.

-

Click Close to end the task.

-

Valuable Vocabulary

Valuable Vocabulary