Setup

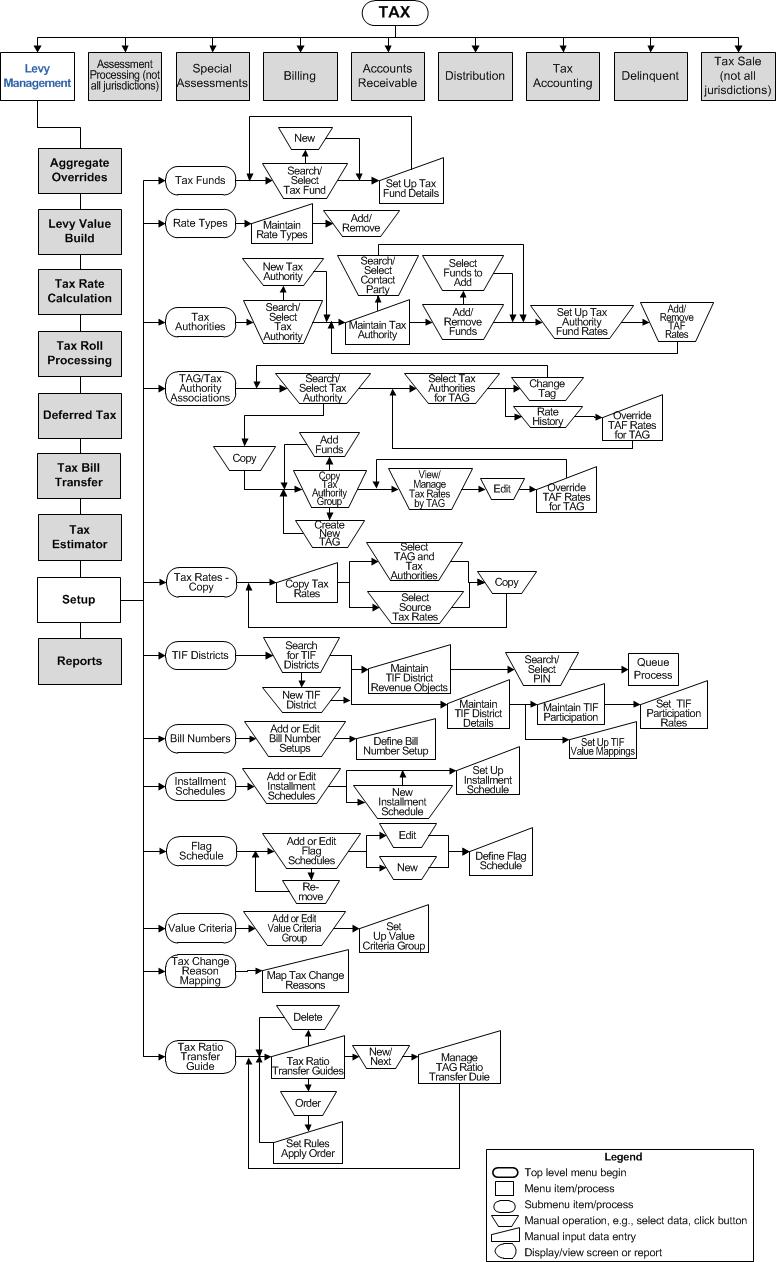

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

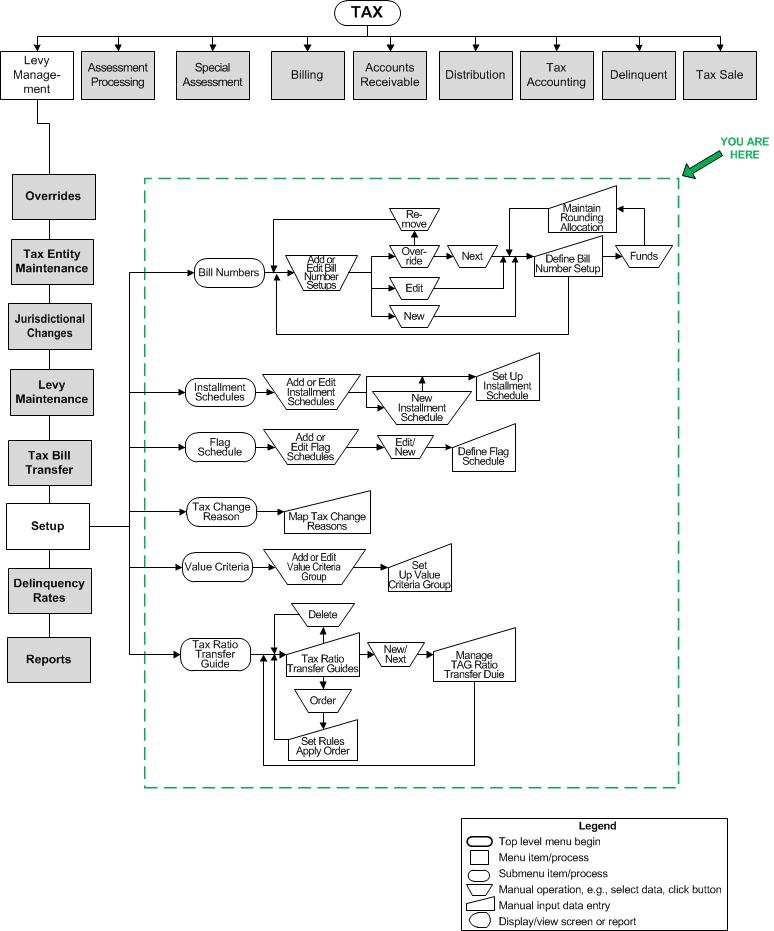

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Set up the information needed to calculate and extend taxes, as well as other settings used in tax roll and corrections processing.

-

Tax Funds - Aumentum funds, when associated with a tax authority, are the fundamental mechanism for setting tax rates. Funds must be set up before a tax authority fund association can be created.

-

Rate Types - Each tax rate and credit rate has an associated rate type that defines whether the rate will be an actual tax calculation rate, a future budget rate, or some other special use rate. Because more than one rate can exist for a tax authority fund for the same tax year, rate types are used to distinguish between these rates.

-

Tax Authorities - Tax authorities are the jurisdictions authorized to levy taxes. Each tax authority can have one or many funds attached to it, which determine the tax rate for the tax authority. Tax authorities sharing the same geographical area are combined into tax authority groups (TAGs) so that the properties within them can be taxed at a single rate.

-

TAG-Tax Authority Associations - Tax authorities must be associated with tax authority groups (TAGs), which are set up under the Records module. You can also set different rates for tax authority funds by TAG. The TAG Rate Report (under the Levy Management > Reports menu) lists the net tax rate for selected tax authority groups.

-

Copy TAGs - search for TAGs, copy them, and if available in your jurisdiction, override TAF rates and manage TAG ratios.

NOTE: An application setting called Allow TAGTAF Rate Override determines whether overriding TAF Rates for TAG is available when copying. To set this, go to Configuration > Application Settings > Maintain Application Settings and select the Setting type of Effective Date, Tax Levy Management as the Sort by module. Select the Allow TAGTAF Rate Override application setting and set to true to allow overriding.

NOTE: An application setting called Show Special Assessments in TAG Relationships determines whether to display special assessments on TAG screens in Aumentum, determined by at least one active Revenue Object membership in both TAG and SPA. To set this up, go toConfiguration > Application Settings > Maintain Application Settings, select the Setting type of Tax Year and select the Sort by module of Tax Levy Management. Select the Show Special Assessments in TAG Relationships application setting and set to true to view special assessments on TAG screens. -

Tax Rates - Copy - Because of the change from tax-year effective date to non tax-year effective date, you must copy tax rates each year. Typically, you would copy from the existing year to the subsequent year.

-

TIF Districts - A tax increment financing (TIF) district is a geographical area, usually economically depressed, where the tax levies from incremental increases in property value are used to finance economic development projects. You can specify the level of participation for each tax authority fund within the district. You can also associate revenue objects with a TIF district through this task.

-

Bill Number Setup - Bill numbers are assigned during tax roll processing based on revenue object criteria specified for different settings. For example, you can add a certain prefix to all bill numbers with the real property roll type.

-

Installment Schedules - Installment schedules are assigned during tax roll processing based on revenue object criteria specified for different schedules. For example, you can create different numbers of installments for different roll types.

-

Flag Schedules - Flag schedules are assigned by effective year and can be used to override bill number setup. This is a similar schedule to the installment or the bill number schedule. It is used to apply flags to tax bills during Estimated Tax Roll Processing. Although it is typically only used for estimated billing, in can also be applied to Annual Tax Roll Processing.

NOTE: The Flag Schedule task may not be available in your jurisdiction. -

Value Criteria - Create groupings of value type selection criteria to retrieve records for use in setting up installment schedules.

-

Value Types- Value types need to be associated with various Levy Management processes. Use this task to associate value types with value type classes for tax roll processing and reporting, to set up dropdown lists of value types for various screens, and to map Assessment Administration value types to Levy Management value types for tax calculation.

IMPORTANT: This task is only to be used by qualified personnel. -

Tax Change Reason Mapping (Corrections) - The rules for processing corrections and supplements to tax bills need to be defined, including whether to update an existing bill or create a new bill for different types of changes.

-

NOTE: The ability to combine all special assessments on one bill is available. This is defined based on two Special Assessment application settings: 1.) Create Separate SPA Bill (One Bill for All Specials), and 2.) Create Separate SPA Bill (Individual Bills per SPA). Setup: Go to Configuration > Application Settings > Maintain Application Settings. Select the setting type of Tax Year, the filter by module of Special Assessments, and the applicable filter by tax year. Click Edit on the two application settings to set them as applicable.

-

NOTE: Supplemental tax charges are part of the tax levy calculation. They are applied after regular taxes and special assessments are calculated.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information