Copy Tax Rates

Copy Tax Rates

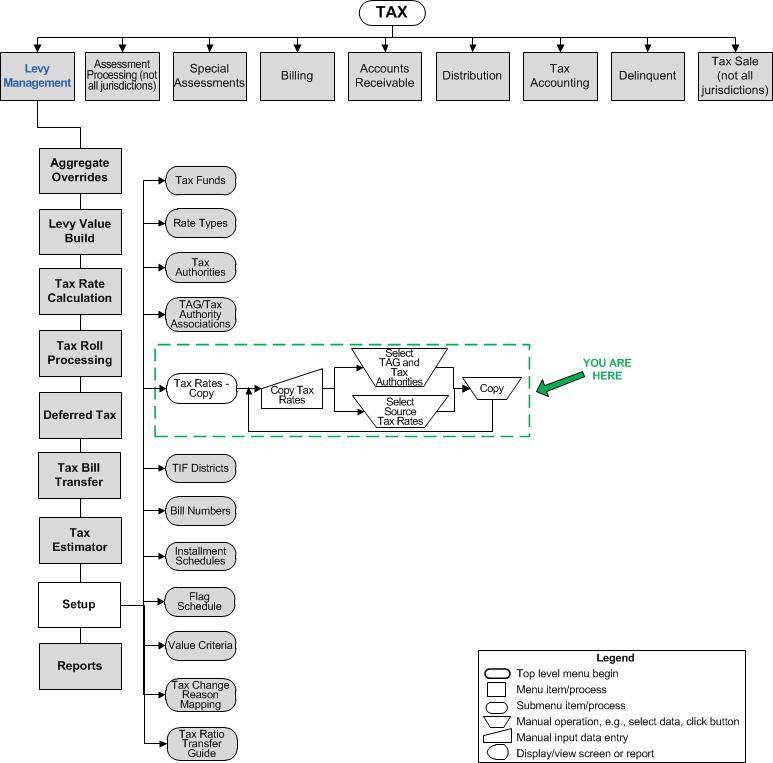

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

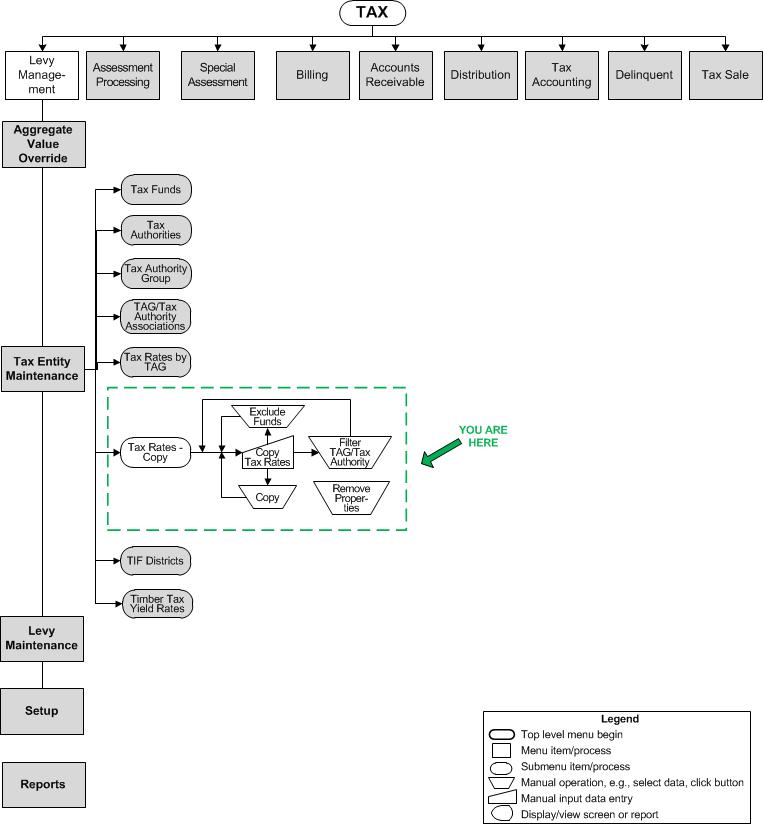

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Because of the change from tax-year effective date to non tax-year effective date, you must copy tax rates each year. Typically, you would copy from the existing year to the subsequent year.

-

Select tax rates to copy from one year to the target tax year and from a source rate type to a target rate type. Select TAGs and Tax Authorities to include or exclude in the copy process.

-

Exclude Funds from Copying for the selected source tax year.

SETUP: See Levy Management and Levy Management Setup for any applicable prerequisites, dependencies and setup information for this task.

Select and Copy Tax Rates

Steps for Selecting and Copying Tax Rates

-

Select the Source tax year. The current year is the default.

-

Select the Target tax year.

-

Select the Source rate type and the Target rate type.

-

Check the Update existing rates to update the rates from the source to the target year. This is checked by default.

-

Optionally filter the TAX and Tax Authorities by entering the Code and all or part of the Description and click Filter.

-

Check the checkbox associated with the TAGs to copy in the TAG Code TAG Description panel or check the panel header checkbox to select all.

-

Check the checkbox associated with the Tax Authority Codes in the Tax Authority Code Tax Authority Description panel or check the panel header checkbox to select all.

Note: Whenever you select a new Source tax year or Target tax year, the TAG/Tax Authority fields clear and you will need to select them again to copy. -

Click Copy. The message Tax Rates have been copied successfully is displayed at the top of the screen.

-

Click Refresh to view source tax rate details.

Exclude Funds from Copying

-

To exclude funds from copying, after selecting the funds as just described, click the Exclude button in the TAG and Tax Authorities panel header. The Select Funds to Exclude - Webpage dialog box is displayed.

-

Click the checkbox associated with any funds you want to remove or click the checkbox in the header to remove all funds.

-

Click Finish to close the dialog box.

-

Click Cancel to cancel the removal of funds.

Clear the Screen

Click the Clear button in the TAG and Tax Authorities panel header to clear all currently selected items.

-

Click Close to end the task.

Tips

Tips

You must first set up tax rates and types for the year before you can view them in the Source Tax Rates panel. To set these up, go to Levy Management > Tax Rate Calculation > Tax Rate Calculation > Maintain Tax Rate Calculations.