Maintain Tax Authority

Maintain Tax Authority

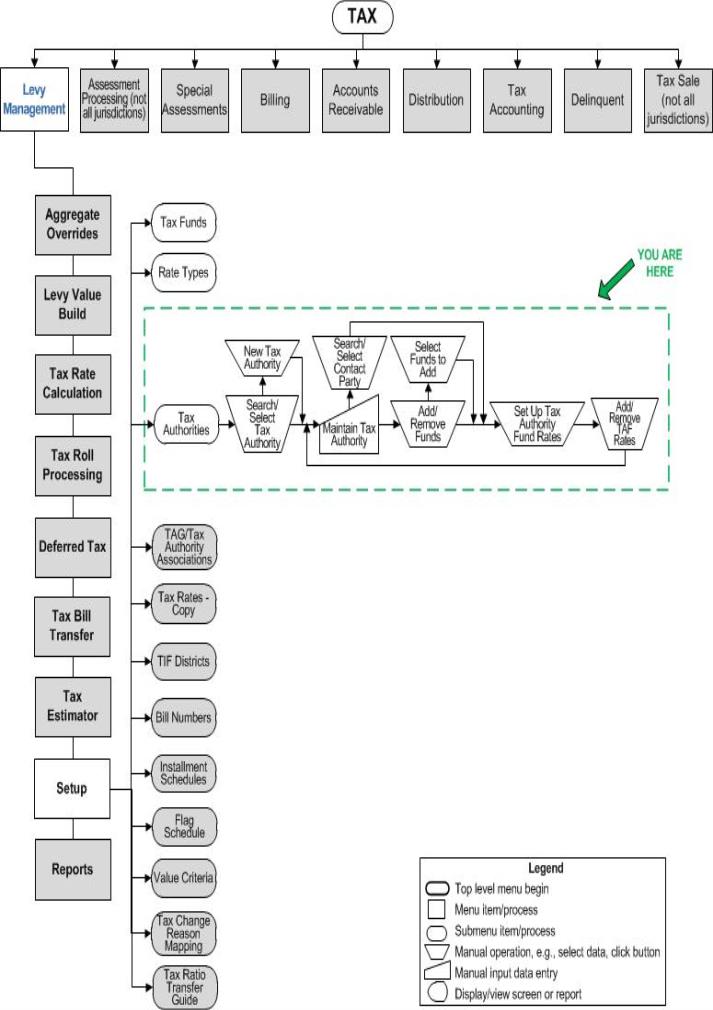

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

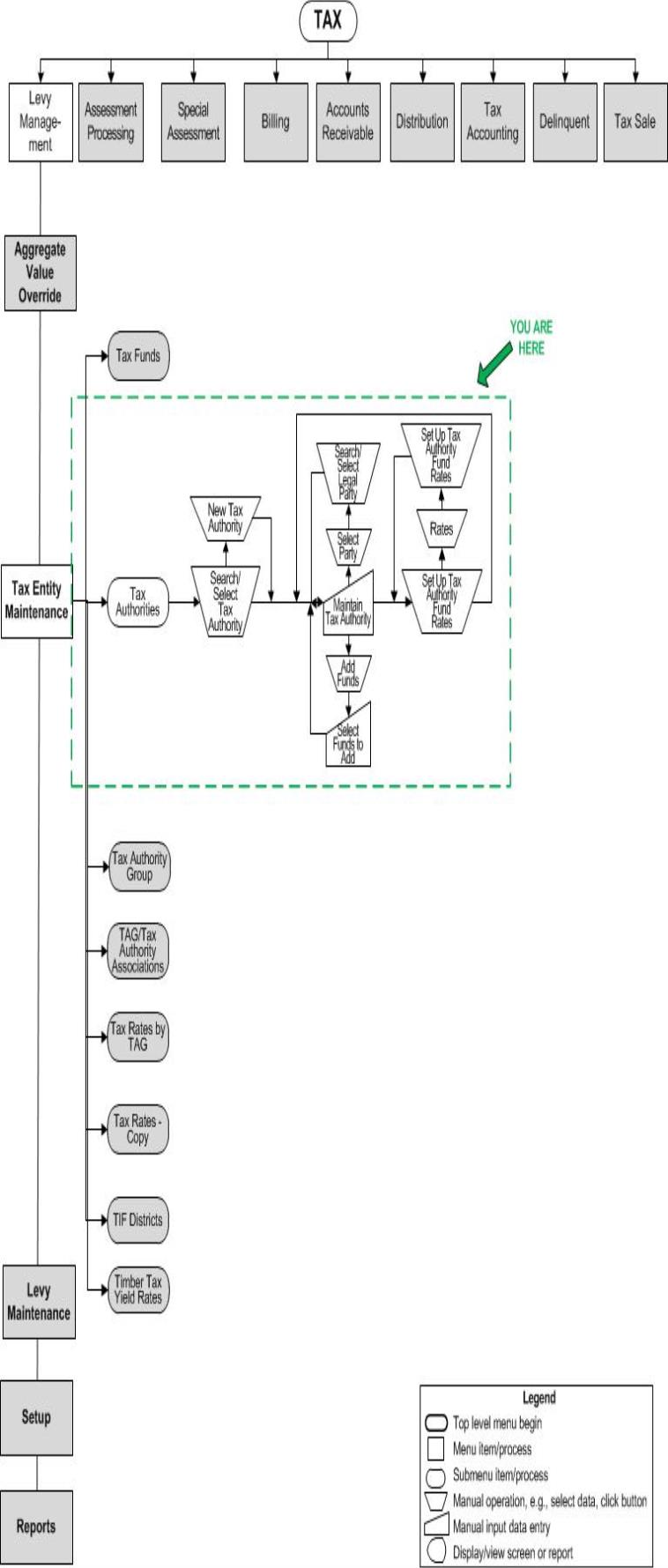

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

The tax authorities you selected are loaded into the screen, with the first tax authority displayed. If you have selected multiple authorities, the others are accessible from the work list.

![]() IMPORTANT

IMPORTANT

-

You cannot remove any funds from any Tax Authority that is currently in use.

-

TAFs cannot be removed from a TA in any particular effective year if the following conditions are true:

-

Apportionment factors are configured for the TAF in which the tax year >= TAF effective year

-

TAG-TAF Rate overrides are configured for the TAF in which the tax year >= TAF effective year

-

Any Tax Bill is using that TAF for any tax year >= TAF effective year

-

The TAG Ratios are configured for any TAF in which the tax year >= TAF effective year

-

The TAF is in any Levy Group in which LevyEntity effective year >= TAF Effective Year

Steps

-

Enter or edit the Code used to identify the tax authority.

-

Enter or edit theDescription used to identify the tax authority.

-

Select the Type.

-

Select the Category.

-

Select the Bill Method that applies to the tax authority.

-

Select theSub category.

-

Enter an optional External id, for example a state-provided identifier for the authority, for reporting purposes.

-

Enter a Display order.

-

Select the checkbox if a Separate bill is required for an authority, for example, a special assessment or a city which bills separately from the county.

-

Click:

-

Select Party to search for the primary contact party for the tax authority on the Records Search for Legal Party screen.

-

Add Party to optionally search for and add a secondary contact party using the Records Search for Legal Party screen.

-

-

Select the Fund Type from the dropdown field.

-

Click Add in the Funds grid to open the Select Funds to Add popup window. Click Search to find all funds or define one or all of the Fund code, Fund description, or Fund Type and then click Search. Select the funds and click Finish. When you return to this screen, the selected funds will be loaded into the grid.

-

Click Legal Parties to navigate to the Set Up TAF Legal Parties screen on which you can define primary and secondary legal parties associated to the TAF.

NOTE: When you return to this screen, any legal parties you defined for the TAF are indicated with a ... button in the Funds panel in the Description column. Click the button to expand the text for viewing.

-

Click the UDF button to enter the UDF information on the Add/Edit TAF UDFs -- Webpage Dialog popup. Select the UDFs and click Finish

NOTE: UDFs for the Tax Authority may not apply to your jurisdiction. If applicable, set up the UDF via Configuration > User-Defined fields > Search for User-Defined Fields > New > Maintain User-Defined Fields. Select the Module of Tax Levy Management, Object type of Tax Authority, and define the UDF.

-

Enter the Display order for each fund which determines how the funds will be ordered in a report, tax bill, or the Info Center.

-

ClickRates to set up rates for all the attached funds on the Set Up Tax Authority Fund Rates screen.

-

Enter any additional information in any user-defined fields (UDFs) created during setup. To set up UDFs, go to Configuration > User-Defined Fields > Search for User-Defined Fields. Select Tax Levy Management as the Module. Click Search to search for existing UDFs or click NEW to create new UDFs. The UDFs you create are then displayed on this screen. If no UDFs are created, the message There are no user defined fields to render is displayed at the bottom of the screen.

-

Click Save to save all changes to the tax authority.

-

-

Select another tax authority from the work list tab

, if you are working with multiple authorities.

, if you are working with multiple authorities.

-

Tips

Tips

If the Allow TAG-TAF Rate Override application setting is set to true, a message displays when you save a tax authority asking if you want to override TAG TAF rates as well. If you have overridden rates at the TAG level in the TAG/Tax Authority Associations task and do not want to change them, click Cancel.

To delete a tax authority, you must first remove all attached funds.

The tax authority sub categories are user-defined systypes used to group authorities for reporting purposes.

Valuable Vocabulary

Valuable Vocabulary