Search for Tax Authorities

Search for Tax Authorities

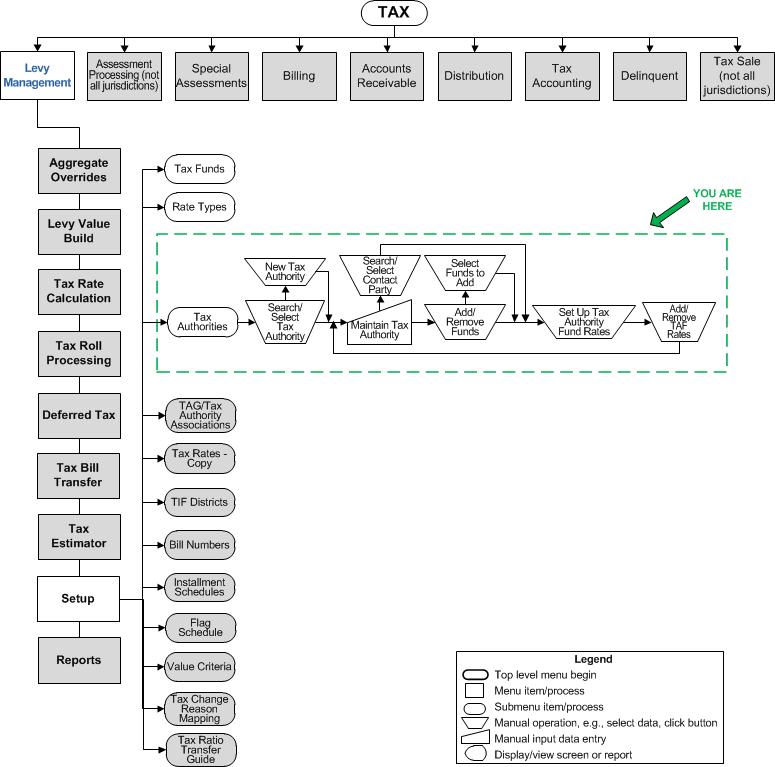

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

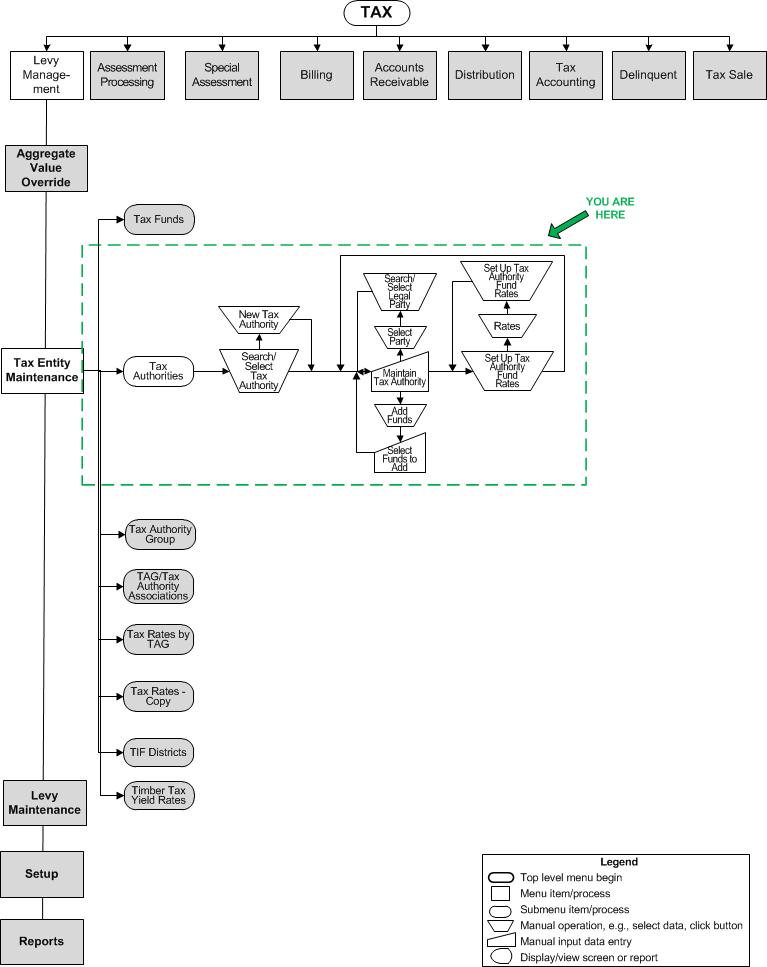

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Search for tax authorities. Then select one or multiple tax authorities to maintain on the Maintain Tax Authority screen.

SETUP: See Levy Management and Levy Management Setup for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Select the correct Effective year.

-

Enter search criteria to limit the list of tax authorities, as applicable.

-

-

Enter all or part of the tax authority Code or Description

-

Select the Type and/or Category of the tax authority

-

-

Click Search to display the tax authorities matching the criteria.

-

Select the tax authorities you want to edit.

-

click Next to go to the Maintain Tax Authority screen,

OR

Click New to add a new tax authority.

-

-

Click Close to end the task.

-

Valuable Vocabulary

Valuable Vocabulary