Tax Authorities

Tax Authorities

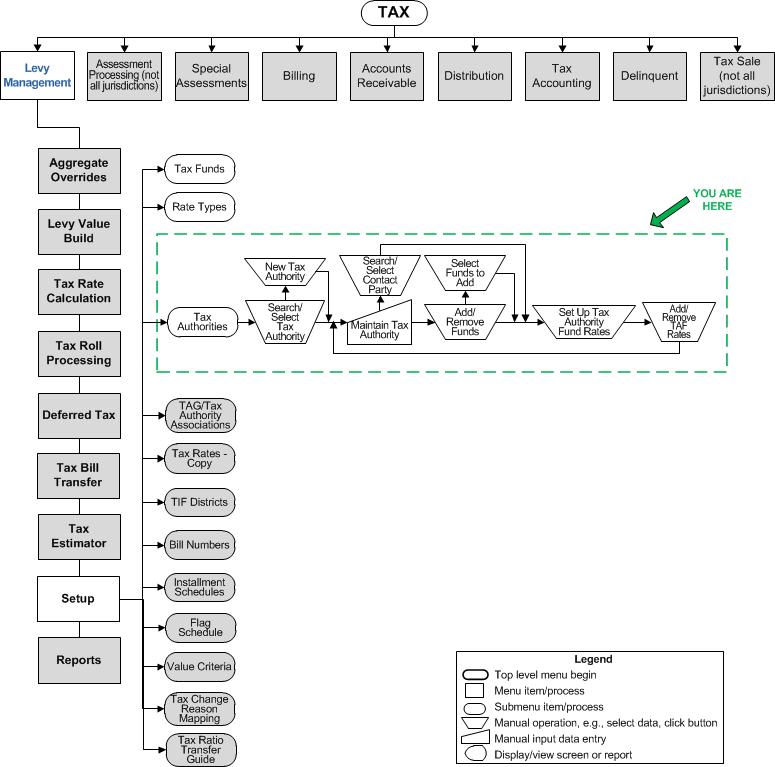

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

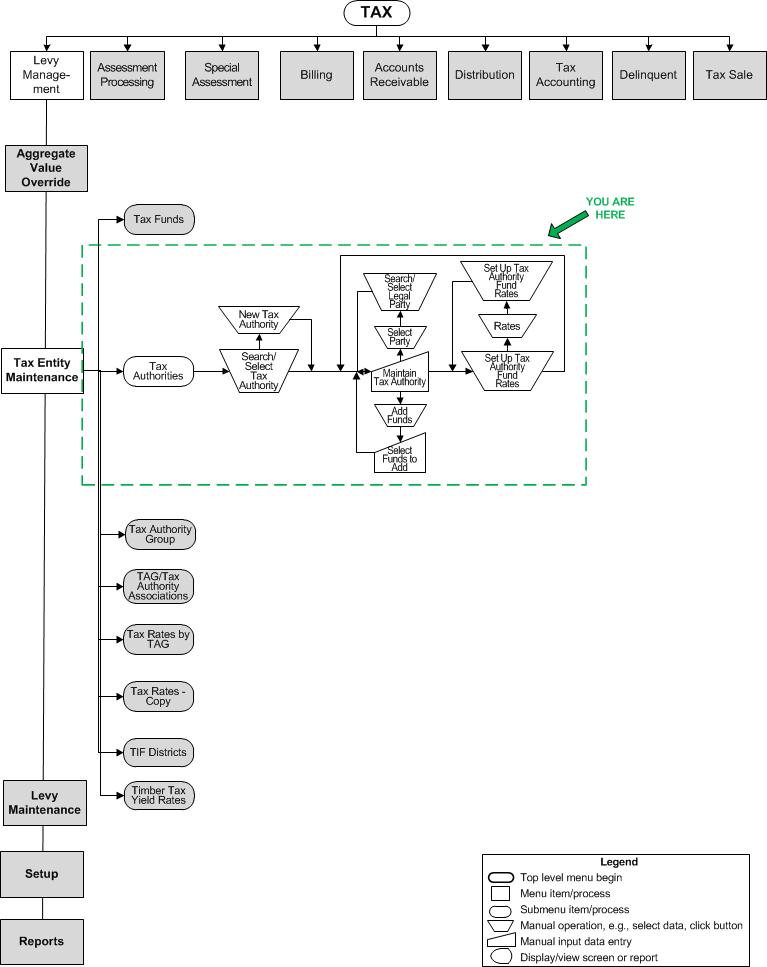

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Tax authorities are the jurisdictions authorized to levy taxes. Each tax authority can have one or many funds attached to it. These funds determine the tax rate for the tax authority. Tax authorities sharing the same geographical area are combined into tax authority groups (TAGs) so that the properties within them can be taxed at a single rate.

Steps

-

Begin on the Search for Tax Authorities screen to select tax authorities to edit or to create a new one.

-

Enter the details of the tax authority on Maintain Tax Authority and select the funds to add.

-

Set up all the rates for each attached fund on the Set Up Tax Authority Fund Rates screen.

Related Topics

Prerequisites

Levy Management

-

Tax Funds - Set up tax funds before setting up tax authorities.

-

Rate Types - Set up rate types before setting up tax authorities.

Configuration Menu

-

Systype Maintenance

Tax Authority Category - for reporting

Tax Authority Subcategory - for reporting

Rate Class for classifying tax authority fund rates

Charge Codes for classifying tax authority fund rates*

Charge Subcodes for classifying tax authority fund rates IMPORTANT: To make Charge Code systypes available on Set Up Tax Authority Fund Rates, select the Charge Type systype category and edit the Tax systype to select the Charge Codes you want to associate with it.

IMPORTANT: To make Charge Code systypes available on Set Up Tax Authority Fund Rates, select the Charge Type systype category and edit the Tax systype to select the Charge Codes you want to associate with it.

Tax Authority Type and Tax Authority Bill Method are system-defined systype categories and you cannot modify them.

Records

-

County Maintenance - Set up the counties that will be the source of the tax authority fund rates.

Dependencies

-

TAG-Tax Authority Associations - You must set up tax authorities before associating them with tax authority groups.

-

Tax Roll Processing - You must set up tax authorities and TAF rates before calculating taxes.

-

Many processes depend on the correct setup of tax authority fund rates.

-

-

Project Special Assessments - The Original Principal rate needs to have an amount type other than Charge or Credit, such as None, so that it will not be posted to AR and included on the bill.

-