Tax Funds

Tax Funds

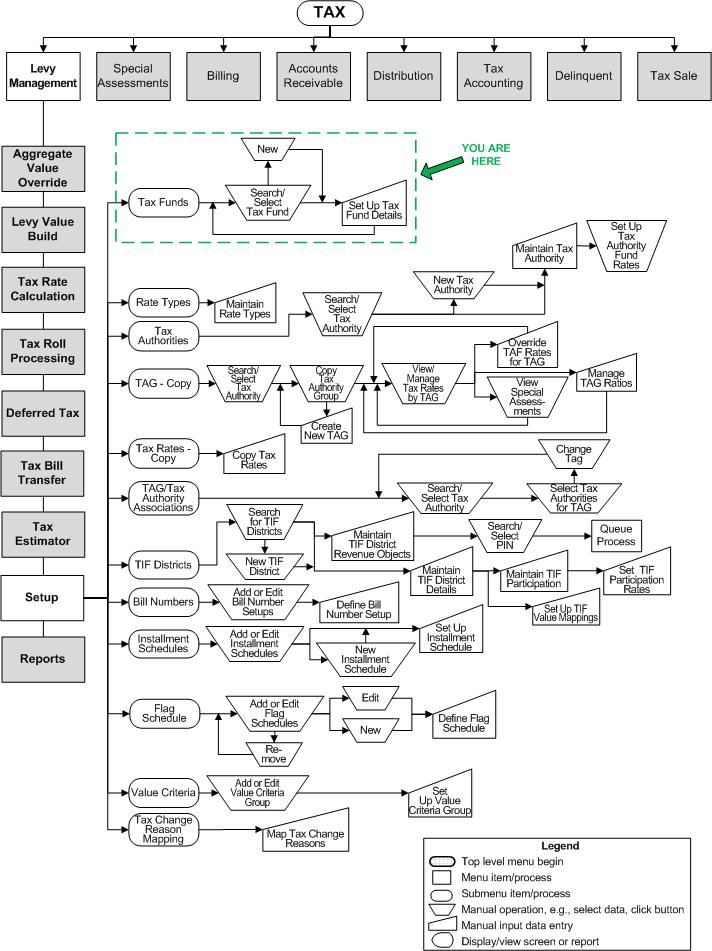

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

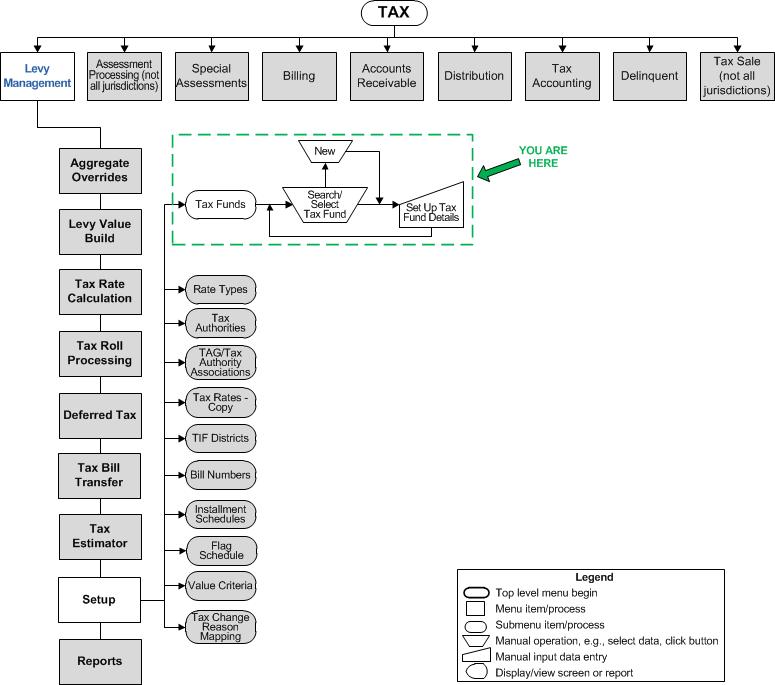

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Aumentum tax funds, when associated with a tax authority, are the fundamental mechanism for setting tax rates. These funds are distinct from tax accounting funds. Tax funds set up is required before creating a tax authority fund association.

Steps

-

Search for Tax Funds to edit or create a new tax fund.

-

Enter or edit the tax fund information on Set Up Tax Fund Details.

Valuable Vocabulary

Valuable Vocabulary

Related Topics

Prerequisites

Configuration Menu

-

Systype Maintenance

Fund Category - any systypes you will need to use for reporting on funds

Fund Subcategory - any systypes you will need to use for reporting on funds

Fund Type and Levy Basis Type are system-defined systype categories and cannot be modified by the user.

Dependencies

You must set up tax funds before associating them with tax authorities.