TIF Districts

TIF Districts

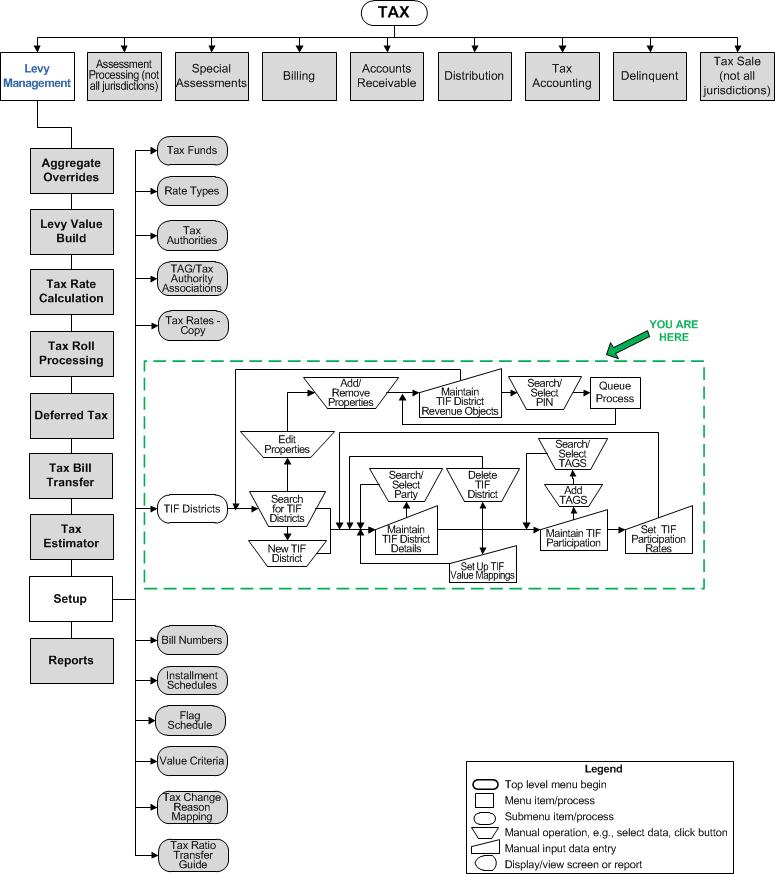

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

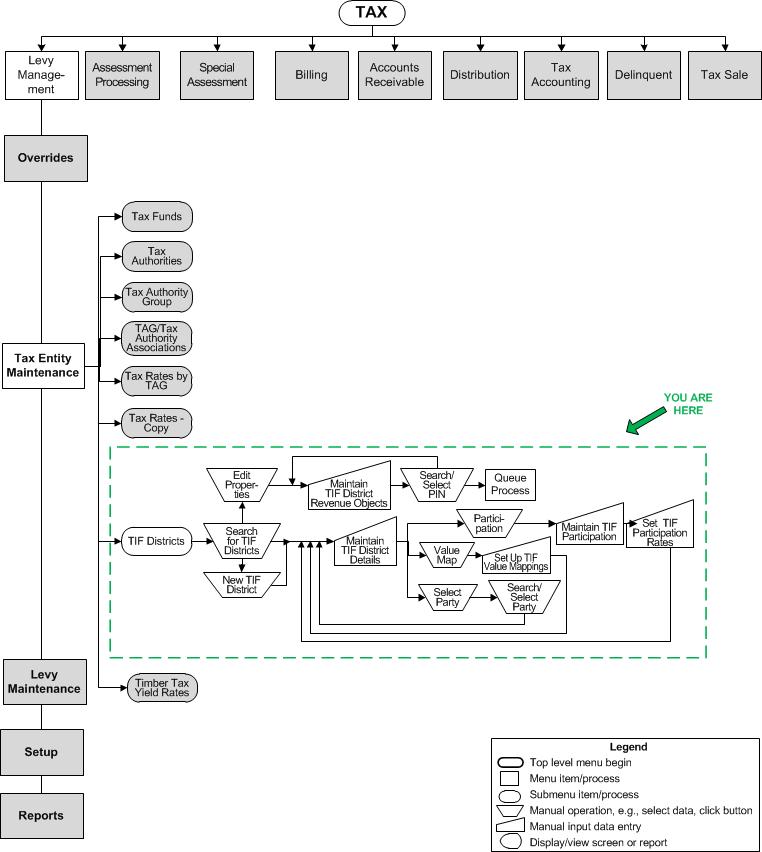

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

A tax increment financing (TIF) district is a geographical area, usually economically depressed, where the tax levies from incremental increases in property value are used to finance economic development projects. A TIF district does not itself levy taxes, but instead receives the incremental portion of taxes from the tax authorities within the district, depending on their level of participation.

Use this task to maintain the details of TIF districts, including related tax authority groups and value mappings, as well as to maintain the revenue objects which are associated with the TIF district.

Steps

-

Begin on the Search for TIF Districts screen to create a TIF district, select TIF districts to edit, or select a TIF district to maintain properties for.

-

Enter the details of the TIF district on Maintain TIF District Details.

-

Select the TAGs which participate in the TIF district on Maintain TIF Participation in order to set the participation rate of each tax authority-fund-rate in the TIF on Set TIF Participation Rates.

-

Select the value types which should be substituted for the regular taxable values when calculating base and incremental TIF taxes on Set Up TIF Value Mappings.

-

-

Associate revenue objects with a TIF district on Maintain TIF District Revenue Objects.

Tips

Tips

Various TIF reports are available through the SRS Levy Management Reports.

Prerequisites

Levy Management

-

Tax Authorities

Tax Authority Fund Rates

TAG/Tax Authority Associations

Set up tax authorities and tax authority fund rates, and TAG/tax authority associations before setting up TIF participation. -

In this task: Set up primary TIF districts first before creating sub-districts, and select TAGs for TIF participation before maintaining TIF district revenue objects.

Records

-

Tax Authority Groups - Set up the tax authority groups which will participate in TIF districts.

Configuration Menu

-

Systype Maintenance

Set up any TIF Type systypes you will need to use for reporting.

TIF Category and TIF Rate Source are system-defined systype categories and cannot be modified by the user. -

User-Defined Fields Maintenance - The user-defined fields must be set up for the Levy Management module and the Tax Increment Financing object type before they will be available for entry here.

Other Sources

-

TIF Value Mappings are defined in ValueTypeList tab of MCCC-BEC AA Setup.xls.

Dependencies

TIF districts must be set up and associated with revenue objects before calculating taxes in Tax Roll Processing.