Levy Management Reports

Levy Management Reports

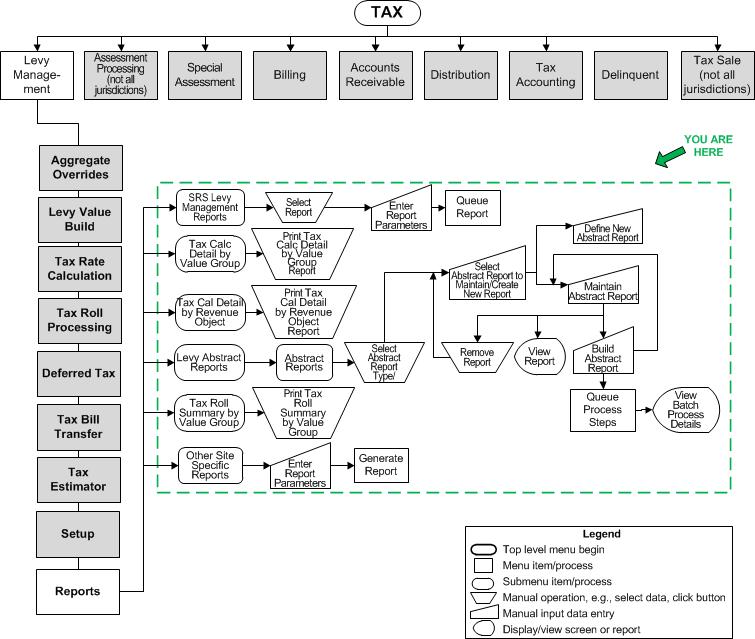

![]() Navigation Flowchart

- Roll-Based Assessment

Navigation Flowchart

- Roll-Based Assessment

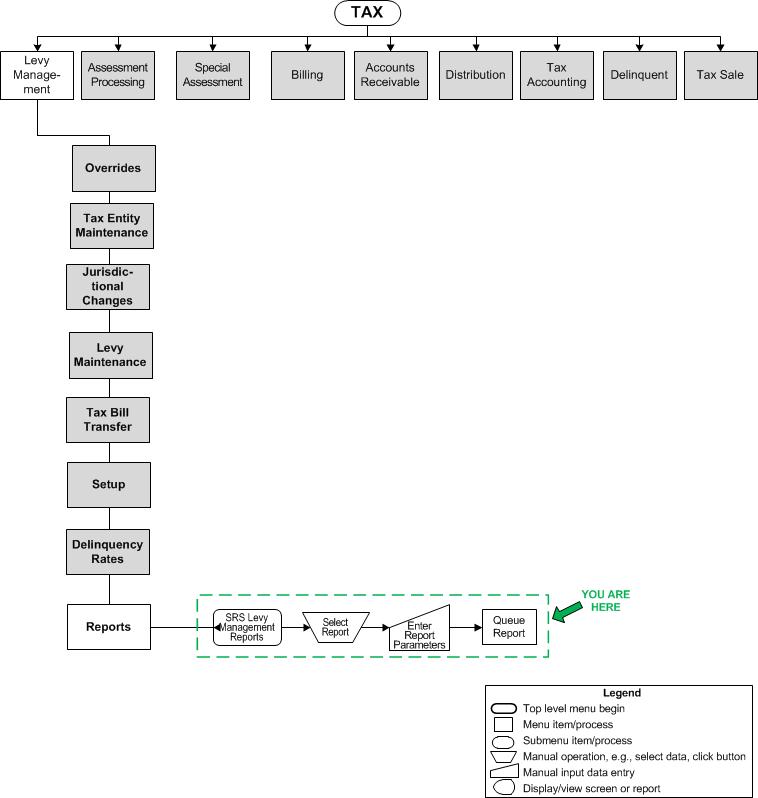

![]() Navigation Flowchart

- Event-Based Assessment

Navigation Flowchart

- Event-Based Assessment

Levy Management SRS Reports

A variety of Levy Management and tax roll-related reports are generated from this screen. The reports are powered by SQL Server Reporting Services and can be generated interactively for immediate display or sent to batch processing for lengthy report jobs.

NOTE: Not all reports may apply to your jurisdiction.

-

Fiscal Disparity Reports - (Minnesota only) Print the Fiscal Disparity data from the following tables:

-

-

Fiscal Disparity Table IX

-

Fiscal Disparity Table IV

-

Fiscal Disparity Table IV Supplemental

-

Fiscal Disparity Table V

-

Fiscal Disparity Table V Supplemental

-

Fiscal Disparity Table VIII

-

Fiscal Disparity Table X

Fiscal disparity is a tax used in the state of Minnesota tax assessed on commercial and industrial property in metropolitan counties surrounding the Minneapolis/St. Paul and in the northern Minnesota mining region. These monies are then distributed among certain jurisdictions within a geographic area.

-

Fiscal disparity values and taxes are calculated through the Levy Value Build and secondary tax calculation in Tax Roll Processing.

-

Reports on all the Fiscal Disparity tables are available from the Levy Management Reports task.

-

The Distribution module offers the option to include Fiscal Disparity taxes in distributions.

-

-

Agricultural Deferred Parcels (Nevada only) - This report generates parcels by date and PIN and shows any deferred taxes or values for agricultural parcels.

-

Apportionment Total for Supplemental Property Tax (California only) - Generate a Non-RDA with School Adjustments report for AB8 Supplemental Apportionment Factors for County Job # 429-21-001 and 429-21-002.

-

Assessment Roll Corrections Detail by Revenue Object Report (Palm Beach only) - Generate a report that shows corrections to the assessment roll before it is posted to the tax roll. The report shows the before and after values of the correction.

-

Assessed Valuations by Tax Authority and Tax Type Report - Generate a report that shows assessed valuations for tax authority by year, including real estate, personal property, and state assessed values including a grand total.

-

BOE 822 Report (California only) - Generate a report that shows assessment roll totals for supplementals, including land/mineral rights, improvements, other tangible personal property, homeowner's exemptions and all other enrolled exemptions, separated by secured, unsecured, and total.

-

BOE 822-B Report (California only) - Generate a report that shows supplemental taxes billed and/or collected by tax year.

-

Charge Summary Report - Generate a report that shows a history of changes to charges that affect charge balances.

-

Comparative Tax Roll Detail by TAG Report - Generate a report that compares tax roll detail by TAG. You can run the report for one or more tax year, by change reason, TAG, and value type criteria. Values included in the report are appraised, assessed, exemptions, and taxable. Tax information includes net tax rate by taxable base, exemption amounts, and taxes. Also included are attributes for land and improvements and class code. The report also includes county-wide totals at the end.

-

Debt Service Bond Supporting Details for School 51/51A Report - Generate a report that shows debt bond service for schools and includes the fund and fund name, HOPTR exemption value, secured tax rate, net HOPTR, secured/unsecured estimated revenue, estimated interest, estimated revenues, and total revenues.

-

Distribution of Tax Increment By Fund by TAG report (California only) - Generate a report that accommodates County Job # 420-86-001. ATI is allocated by TRA to the funds making up each TRA, using TRA ratios. This report shows this breakout by TRA and by Fund and uses TRA Ratios to take TRA Increment to the TAF level.

Also, this report combines the Distribution of Tax Increment by Fund by TAG report and the AB8 Tax Increment Amount by Tax Authority Fund report.

-

Errors and Insolvencies Report - Print a report that shows adjustments and write offs that have occurred during the tax year that impact the original amount charged for collection. The report includes a list of errors, insolvencies, double assessments, and discounts and shows the reason code, count, original amount, current amount, and difference.

-

Estimated to Annual Roll Reconciliation Report - Print a report that shows the reconciliation between the estimated installment roll and the annual roll. Information includes tax year, PIN, owner, bill number, estimated charges, annual charges, paid amount, due amount, suplus amount, and notes.

-

Extended Tax Abstract (PTOC only) - Generate a report that provides the amount of taxable value and charges by roll type. Input for this report is from the tax roll, cadastre inventory, and value information. This report can be run for any tax roll, regardless of posting status, as well as for a selected set of TAGs or Tax Authorities.

-

Fund Listing Report - Print a report that shows funds by code, description, type, category, Levy basis type, and whether it is securable.

-

Heavy Trucks Revenue Summary Report - Generate a report for heavy trucks that shows taxes, cancelled taxes, values, and penalties.

-

HOPTR - State Property Tax Loss Reimbursement Report - Generate a report that shows state reimbursement of lost taxes.

-

HOPTR Claim Schedule A - Summary Report - Generate a summary report of homestead property tax claims.

-

HOPTR Claim Schedule B - Detail Report - Shows Homestead Property Tax Credit Claim Schedule A that shows a summary of the property tax claims by assessment type for the current year, prior year supplements and prior year adjustments by assessment type..

-

HOPTR Claim Schedule C - Claim by Fund - Homestead Property Tax Credit Claim Schedule C that shows the current year claim by fund.

-

HOPTR Schedule D - Supplemental Claim By Fund - (Santa Cruz only) Generate a report that shows the prior year supplemental claims by fund for homestead property claims.

-

HOPTR Schedule E - Supplemental Claim By Fund - (Santa Cruz only) Generate a report that shows the prior year net adjustment by fund for supplemental homestead property claims.

-

Levy Verification Report (KS only) - Generate a levy verification report by tax year that shows rate type and rate calculations.

-

MN Auditors Certificate Report (MN only) - Generate a certificate that shows valuation data, property type, taxable, and total real and personal property taxes and taxable.

-

Non Unitary Growth Percentage Excluding NonComm Aircraft (California only) - Generate a report that supports AB8 Apportionment Factor development, excluding non commercial aircraft. The report shows the ERAF Non Unitary Growth Percentages.

-

Penalty/Tax Report - PT 12 - Generate a report that shows penalty and taxes by roll type and tax authority.

-

Rate Calculation by Tax Authority Group - Lists calculated rates by tax authority group, tax authority, and fund.

-

Rate Calculation by Tax Authority - Details rate calculation information, including basis type, requested and adjusted levies, and initial and adjusted rates, by tax authority and fund.

-

Roll Corrections Detail by Value Group - This report lists the value-based tax changes which result from roll corrections, including prior and new amounts, at the tax authority fund level for the entire revenue object as well as each value group.

-

Rural and Urban Value & Tax by School District Report (KS only) -

-

School Tax Abatement Report (Minnesota only) - Breaks down changes in net tax capacity and referendum market value due to abatements and added values, as well as the changes to school taxes based on those changes, for each school district.

-

Debt Service Bond Supporting Detail for School 51/51A Report (California only) - Shows state reporting for schools, including homestead exemptions, secured tax rate, net homestead, secured estimated revenue, unsecured estimated revenue, estimated interested, estimated revenue, total local revenue, and total estimated revenue.

-

State Assessed by TA/Fund/TAG (C06) Report (KS only) - Generate a report that shows state assessed values by tax authority, fund, and tax authority group, including fund, tax rate, TAG, total value, penalty tax and value, and real and personal property taxes and values.

-

State Assessed by TA/Owner (C05) Report (KS only) - Generate a report that shows taxes by tax authority and owner, including penalty, personal property and real values, total tax, and total value

-

State Assessed by Tax Authority (C03) (KS only) - Generate a report that shows tax authority, penalty, value, personal property and real values, tax and totals

-

State Assessed by Tax Authority and TAG (C04) Report - (KS only) Generate a report that shows state assessed taxes by Tax Authority, Fund, and TAG.

-

State Assessed Tax Roll (C02) Report (KS only) - Generate a report that shows state assessed utility detail including TAG, type, total value, penalty value, personal property value, tax, and totals.

-

State Assessed Tax Roll Recap (C01) Report (KS only) - Generate a report that shows state assessed utility detail including account, total value, penalty, personal property value, tax, and totals

-

Tax Apportionment Worksheet After ERAF (California only) - Generate a tax apportionment worksheet for annual AB8 apportionment factors.

-

Tax Apportionment Worksheet Total Gross AB8 and Unitary Report (California only) - This report (legacy 420-88-001 Total Gross AB8 & Unitary report) is used for state reporting for LGRS.

-

Tax Apportionment Worksheet Total Tax Amount Due Agencies (California only) - This report shows the Total Tax Amount Due to Agencies from homestead property taxes and includes a breakdown by group, fund, fund name, gross secured, unitary RR unitary, gross secured and unitary, net unsecured, HOPTR, and total tax net of delinquent.

-

Tax Authority Summary-PP02 Report - Generate a report that shows clerks by taxing authority for personal property.

-

Tax Authority/TAG Summary-PP01 Report - Generate a report that shows the clerk's authority by tax group and includes TAG, total assessed, tax assessed, adjusted taxes, exemptions and penalties.

-

Tax Bill Summary By Fund Report - Shows a summary list of tax bills by fund.

-

Tax Bill Summary by Tax Authority Report - Shows a summary of tax bills by tax authority.

-

Tax Bill Summary by Tax Authority Group - Shows a summary report of tax bills by Tax Authority Group (TAG)

-

Tax Calculation Verification Report (Kansas only) - This report shows significant differences for budgets and calculated taxes at the fund level.

-

Tax Charge Corrections Detail - This report lists the manual tax changes, including prior and new amounts, at the tax authority fund level for the entire revenue object as well as each value group.

-

Tax Extension Failed PINs Report - This report is generated as part of the Apply Special Assessments tax roll processing and is available from the Output Files tab on the Manage Roll Processes screen. The report shows the Tax Year, PIN number, and the error message. Here is a sample layout with no data.

-

Tax Rates by TAG - Breaks down tax rates by basis type, tax authority and fund, rate type, and rate class for selected TAGs. The report displays rates for the selected tax year and for the two prior years.

-

Tax Rates by TAG/Tax Authority Report - Generate a report that shows tax rates by TAG and tax authority.

-

Tax Roll Property Summary by TAF Report - Generate a report that shows tax roll property summary by TAF and includes PIN count, assessed, exempt, taxable, tax rate, and tax charges.

-

Tax Roll Recapitulation Ad Valorem Report (FL only) Generate an ad valorem report by tax year, tax roll, and tax sale end date that shows the assessed value of real estate and personal property taxes for the tax roll

-

Tax Roll Recapitulation Non-Ad Valorem Report (FL only) - Generate an non-ad valorem report by tax year, tax roll, and tax sale end date that shows the assessed value of real estate and personal property taxes for the tax roll.

-

Tax Roll Summary by TAG (Proof) - Use this report to verify calculations and conversion data.

-

Tax Roll Summary by Tax Authority - Breaks the tax roll data down the by tax authority. Compare this report to the Assessment Roll Summary report to verify values.

-

Tax Roll Summary by Tax Authority Group - Breaks the tax roll data down the by tax authority group. Compare this report to the Assessment Roll Summary report to verify values.

-

Tax Roll Summary by Fund Report - Print a report that shows a summary of the tax roll by year and fund.

-

Tax Roll Value by Tax Authority Fund Report - This report replaces the 420-53-001 District Valuations by Fund legacy report. It is used for state reporting for LGRS.

-

Tax Roll Value by Tax Authority Group Report - This report replaces the legacy 420-67 Code Area [TAG] Tax Roll Summaries report. This report is used for state reporting for LGRS.

-

Tax Roll Verification Report (Sedgwick only) - This report shows significant differences for budgets and calculated taxes at fund level.

-

Tax Summary by Category/Tax Authority/Fund Report (KS only) - Generate a report that shows tax summaries by category, tax authority, and fund.

-

TIF Abstract by Tax Authority/Fund Report (KS only) - Generate a report that shows the Tax Authority Fund (TAF), tax amount and totals, TIF tax to abstract, and other tax to abstract.

-

TIF Excess Calculation and Distribution (Minnesota only) - Lists the excess TIF taxes attributable to tax rate increases over the base year rates broken down by county, city, and school taxes.

-

TIF Increment Summary by Base Type Report (California only) - Generate a report that shows details of the TIF Pass Through process results.

-

TIF Overall Valuation Difference Report (KS only) - Generate a report that shows the TIF, TAG, base value, current value, increment value, and totals.

-

TIF PIN Detail Report - Generate a report that shows for the tax year and TIF(s), the TIF number/name, PINs in the TIF, the base assessment, current assessment, and difference for each PIN, and a total for each TIF.

-

TIF Property Association Report - Shows TIFS with a detailed listing of property information including owner, address, location(situs), and property description.

-

TIF Recap-Base & Incremental Values by Taxing Unit Report - Generate a report that shows TIF, TIF base value, current value, TIF incremental value, tax rate, and taxes for each tax authority.

-

TIF Summaries by Fund Report - Generate a report that shows TIF summaries by fund. This report replaces the legacy 429-10-002 RDA Summaries report.

-

TIF TAF Increment By Base Type Report - (California only) Generate a report that shows tax increment funding and tax authority funding increment by base type.

-

TIF Tax Roll Detail by PIN Report - (may not apply to your jurisdiction) This report breaks down the TIF inventory information, summary of charges and values and amount by PIN.

-

TIF Tax Roll Detail by Value Group - (may not apply to your jurisdiction) This report breaks down the TIF inventory information, summary of charges and values and amounts by value type and for each value group on the revenue object.

-

TIF Tax Roll Differences by Tax Authority Report - Generate a report that shows TIF distribution for each TIF project, the taxing unit, the fund, levy, and the amount distributed as a refund to the project sponsor.

-

TIF Tax Roll Summary by Tax Authority - This report breaks the TIF tax roll data down by the tax authority.

-

TIF Tax Roll Summary by Tax Authority Group - This report breaks the TIF tax roll data down by the tax authority group.

-

Top X Taxpayers - Lists the taxpayers with the highest tax charges for the year. You enter the number of taxpayers to include.

-

Top X Taxpayers by Tax Authority Report - Lists the top X taxpayers grouped by Tax Authority. The top (x) taxpayers for each authority are shown on the report.

-

Unitary Excess Allocation Factors - Shows excess allocations and includes prior year net AB8 tax revenue, prior year VLF swap, prior year revenue plus prior year VLF swap, prior year revenue for all funds, and the excess allocation for all funds.

-

Unpaid Personal Property Abstract Report - (Kansas only) Generate a report that shows a listing of personal property for which taxes are unpaid.

-

Unpaid Real Property Abstract Report - (Kansas only) Generate a report that shows a listing of real property for which taxes are unpaid

-

Value and Tax by Authority, Fund and TAG Report - Generate a report that shows the fund, tax rate, TAG, assessed value, tax amount, and total tax for by selected year for the defined tax authorities.

Other Levy Reports

Reports available to most jurisdictions that are not SRS reports but are available via Tax > Levy > Reports include:

-

TRA - TAF Discrepancies Report - Generated automatically as part of the Levy Tax Roll Processing task when selecting the process of TRA/TAF Edit Check Validations, this report is available on the File tab of the Build Roll Process screen.

Levy Abstract Reports

Configure and run a variety of tax abstract reports. Abstract reports are specific to your jurisdiction.

![]() Jurisdiction

Specific Information

Jurisdiction

Specific Information

Steps

To produce an SRS report:

-

Select a report from the list. The report criteria are displayed on the Enter Report Parameters screen.

-

Enter/select the report criteria.

-

Click View Report to generate the report and display it in a new window. See SQL Server Reporting Services for options for viewing and exporting the report.

OR

Click Submit to Batch to send the report through batch processing if the report is large or the criteria you have selected are complicated. This prevents the report from timing out. The Monitor Batch Processes screen displays.

Related Topics

Set Up Tax Authority Fund Rates

Prerequisites

Levy Management

-

Reports will not display data if it has not been set up or processed for the selected year.

-

TIF Districts - User-defined information must be entered through TIF district setup, after the fields have been defined under Configuration, for the data to be available for TIF reports.

-

Process Tax Roll - TIF excess charges must have been calculated for the TAGs and authorities being reported on for the TIF Excess report.

Configuration Menu

-

Role Maintenance - Grant users access to the Levy Management Reports task and the related views and subtasks so that they can access these reports.

-

Application Settings

SQL Reporting Services’ Report Server URL

SQL Reporting Services’ Report Root Directory -

User-Defined Fields Maintenance - The user-defined fields must be set up for the Levy Management module and the Tax Increment Financing object type before the data will be available to print on TIF reports.

Other Sources

-

If you plan to be accessing any SQL Server Reporting Services reports outside of Aumentum, establish access to it for the appropriate users.