Search for TIF Districts

Search for TIF Districts

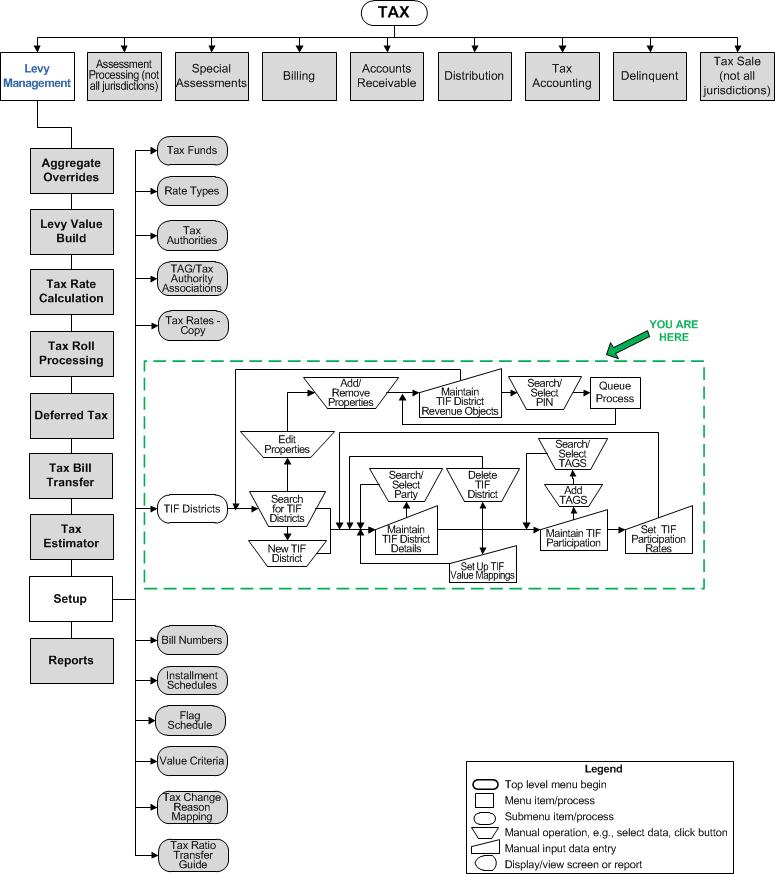

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

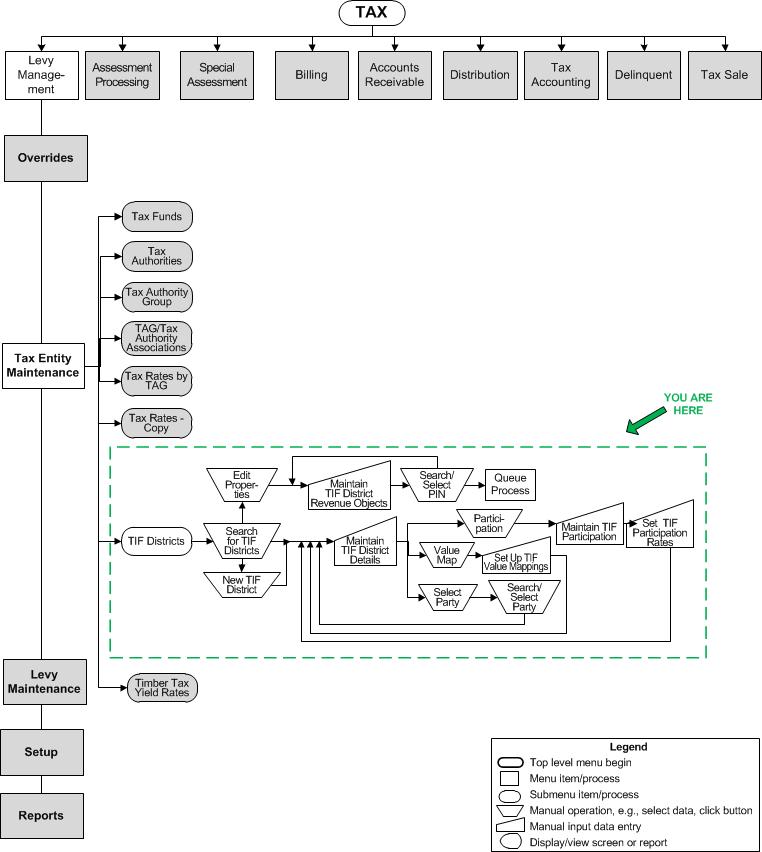

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Search for TIF districts to edit or to maintain the revenue objects associated with them.

SETUP: See Levy Management and Levy Management Setup for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Enter search criteria to limit the list of TIF districts, if necessary.

-

The Tax year of the TIF information you want to view

-

All or part of the TIF Code or Description

-

The TIF Category and/or Type.

-

-

Click Search to display the TIF districts matching the criteria.

-

Click Notes on any TIF district to view or create notes on the Maintain Notes screen.

-

Select one or more TIF districts from the list.

-

Click Next to view and edit it on the Maintain TIF District Details screen,

OR

Click New to add a new TIF district on the Maintain TIF District Details screen,

OR

Select one TIF district and click Edit Properties to attach individual revenue objects or entire TAGs to the TIF district on the Maintain TIF District Revenue Objects screen.

-

-

Click Clear to clear the screen for a new search.

-

Click Close to end the task.

-

Valuable Vocabulary

Valuable Vocabulary