Levy Maintenance

Levy Maintenance

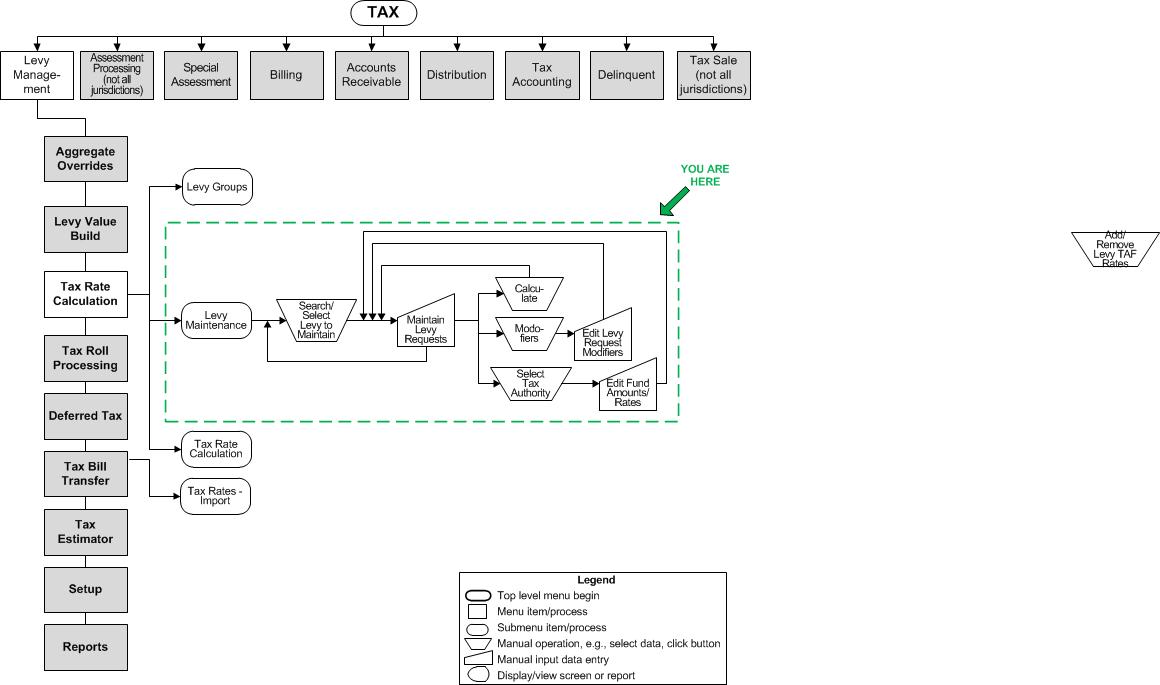

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

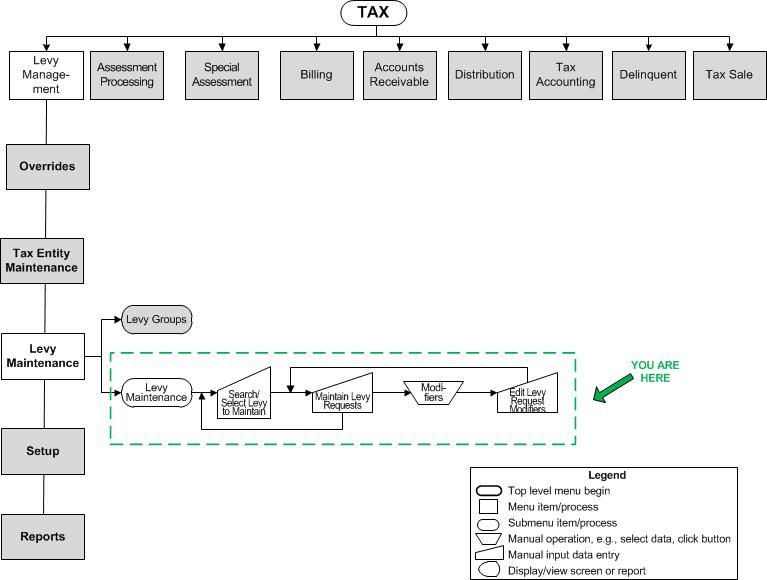

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Maintain the requested and actual levies which will be used to calculate tax rates.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Steps

-

Review the list of levies by tax year on the Select Levy to Maintain screen.

-

Enter requests amounts by tax authority fund on the Maintain Levy Requests screen.

-

Enter modifiers to change initial levy request amounts on the Edit Levy Request Modifiers screen.

Valuable Vocabulary

Valuable Vocabulary

Related Topics

Prerequisites

Levy Management

-

Levy Setup - The types of levies that will be used for levy requests must be defined.

-

Tax Authorities - Set up tax authorities and their associated funds prior to entering levy request amounts.

Configuration

-

Systype Maintenance - Set up any Levy Reason Code systypes you will need to track levies.

Other Sources

-

Receive the levy request amounts from the tax authorities.

Dependencies

Levies must be set up before Tax Rate Calculation.