Aggregate Overrides

Aggregate Overrides

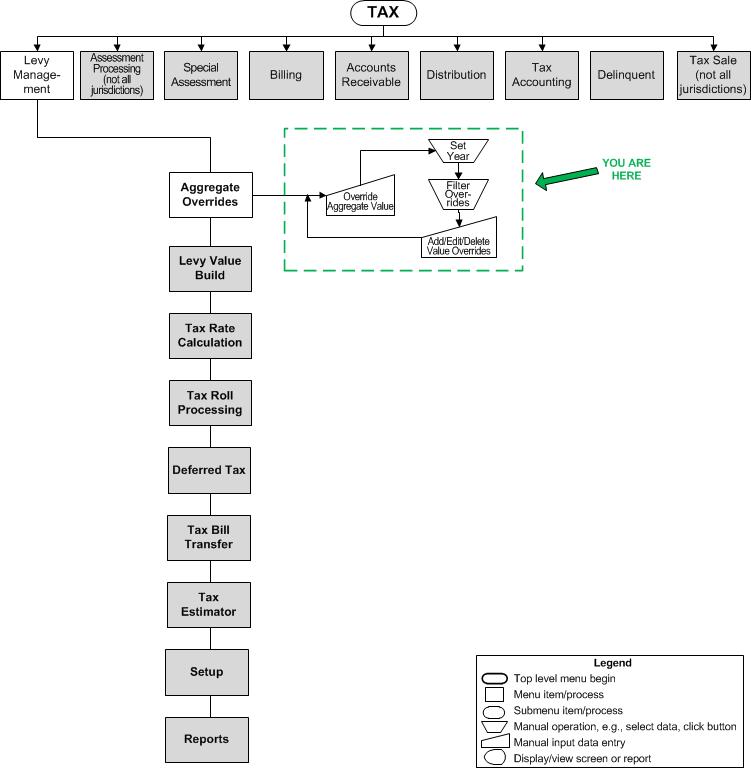

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

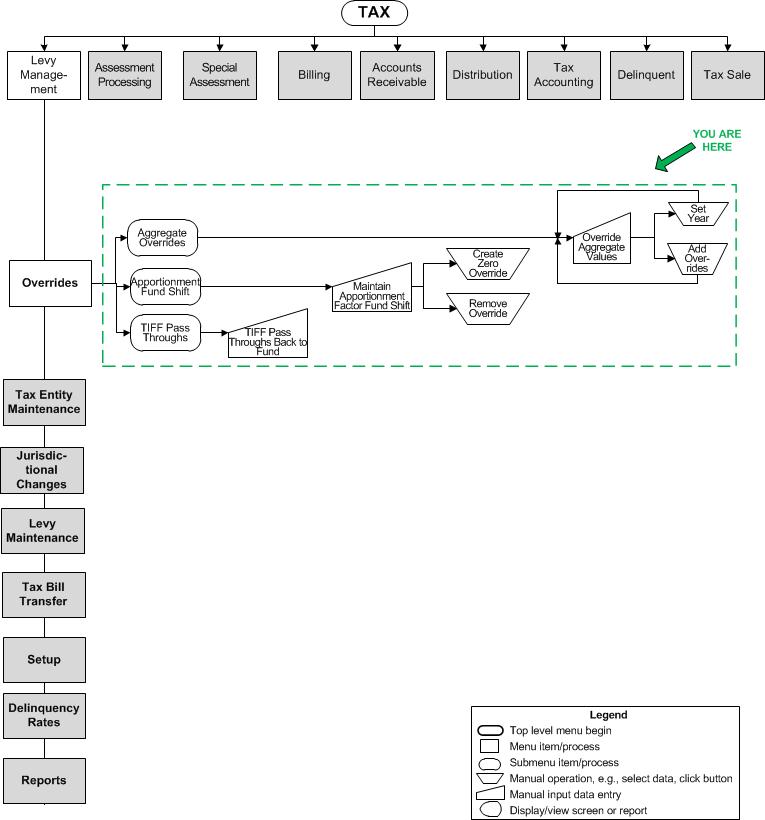

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

Maintain aggregate value data, such as state aid tax from adjoining county governments for use in various calculation processes, including secondary tax calculation.

Steps

-

Enter aggregate value overrides on the Override Aggregate Values screen.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Prerequisites

Levy Management

-

Tax Authorities, TIF Districts - Set up the tax authorities and TIF districts you need to add aggregate values to.

Assessment Administration

-

Value Types - Set up the value types for aggregate values.

Records

-

Tax Authority Groups - Set up the tax authority groups you need to add aggregate values to.

Other Sources

-

Receive the aggregate values from the adjoining county governments.