View Estimated Tax Roll Data

View Estimated Tax Roll Data

Description

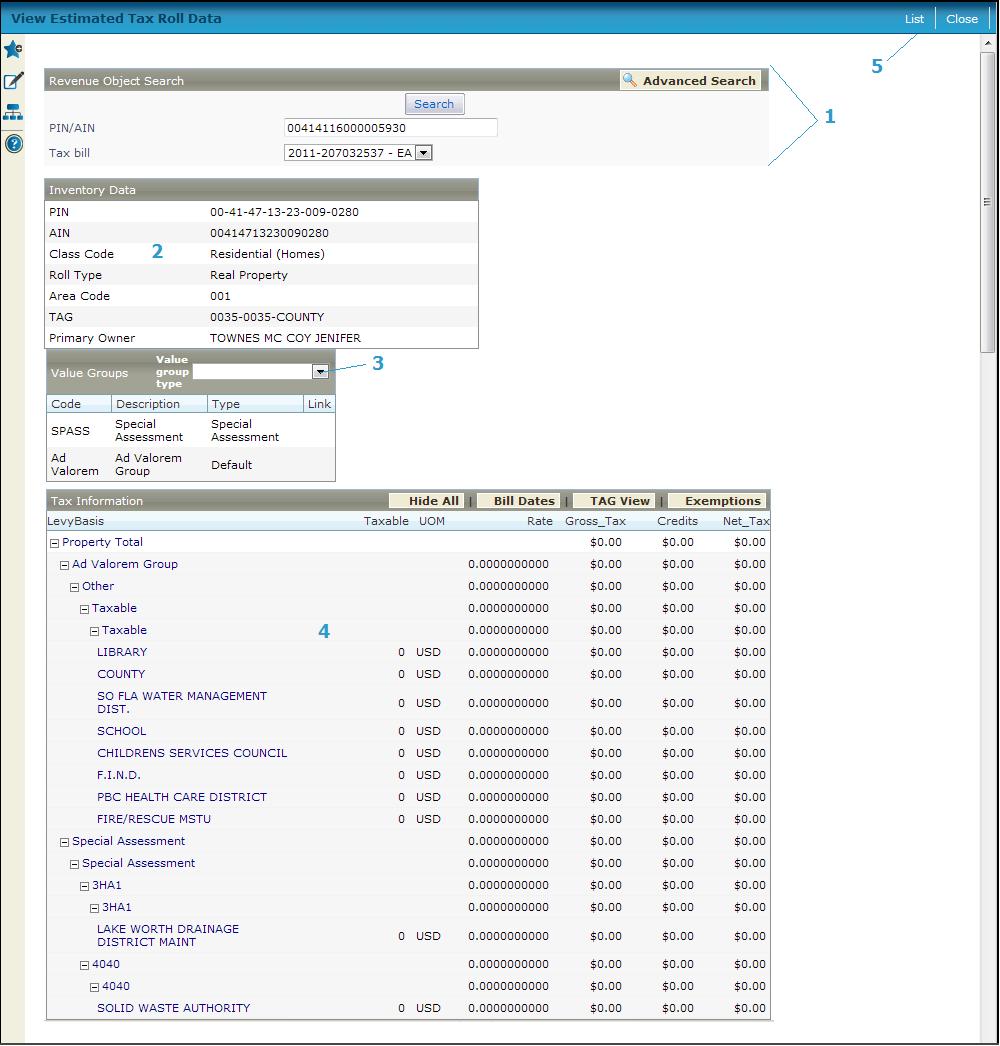

View the estimated billing tax roll data for a specific revenue object to verify that the data is correct before posting the estimated billing tax roll.

Steps

-

Enter a PIN or AIN and click Search to display the tax roll data for the revenue object,

OR

Click Advanced Search to use the Records Search for Revenue Object screen to find a revenue object using different criteria. Click Return to return to this screen. The revenue object data is displayed.

-

Review the Inventory Data, which displays property identification and ownership information.

-

Select a value group type in the Value Groups panel title bar to view the value groups of that type. All value groups are displayed if left blank.

NOTE: If a value group is part of a linked value group, the group PIN and the value group's sequence number within the linked value group are displayed in the Link column. -

Review the revenue object Tax Information, which includes the taxable value, rate, gross tax, any credit amount, and net tax (gross minus credit). The default view shows grand totals for the parcel and subtotals broken down by value group, value type, and tax authority.

NOTE: Click a + (plus) to expand the list to see more detail for an item; click - (minus) to close the expansion.- Click TAG View on the panel title bar to see the total charges for the tax authority group and subtotals broken down by tax authority, tax authority fund, and value type.

-

-

Click Exemptions to view the amount and tax savings for each exemption on the revenue object.

-

-

-

Click Parcel View to toggle back to the default view.

-

-

Click List to return to Maintain Estimated Tax Rolls.