Set Up Estimated Tax Rolls

Set Up Estimated Tax Rolls

Description

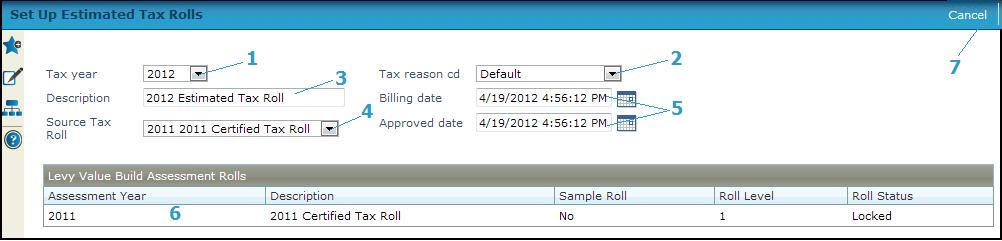

Set up a new estimated billing tax roll or maintain an existing one. Specify the tax year, reason code, description rates, source tax roll and dates to use in the estimated tax billing tax roll processing.

![]() Jurisdiction Specific Information Beach

Jurisdiction Specific Information Beach

Steps

-

Select the Tax year for which you are creating the estimated billing tax roll. This determines the available levy value builds and the year bills are created.

-

Enter the tax rollDescription if you are creating a new tax roll.

-

Select the reason code from the Reason Cd dropdown list.

-

Select the Source Tax Roll.

NOTE: You must have set up a tax roll first for a source tax roll to display in the list, and the tax roll must be open. -

Enter the Billing date and the Approved date for this tax roll or accept the current date default.

-

Select the Levy value build from the list. The Assessment rolls and levels used to produce the value build are displayed.

-

Click Finish to save the tax roll and return to Maintain Estimated Tax Rolls.

-

Click Cancel to return to the Maintain Estimated Tax Rolls screen without saving changes.

-

Tips

Tips

Preliminary, proposed, and estimated billing rolls can be used to create various reports and notices, such as for Truth in Taxation or Florida TRIM notices. You cannot create tax bills from these tax rolls.

After a tax roll has been posted, you can only view its settings; you cannot make any changes.

Common Actions

None.