Estimated Tax Roll Processing

Estimated Tax Roll Processing

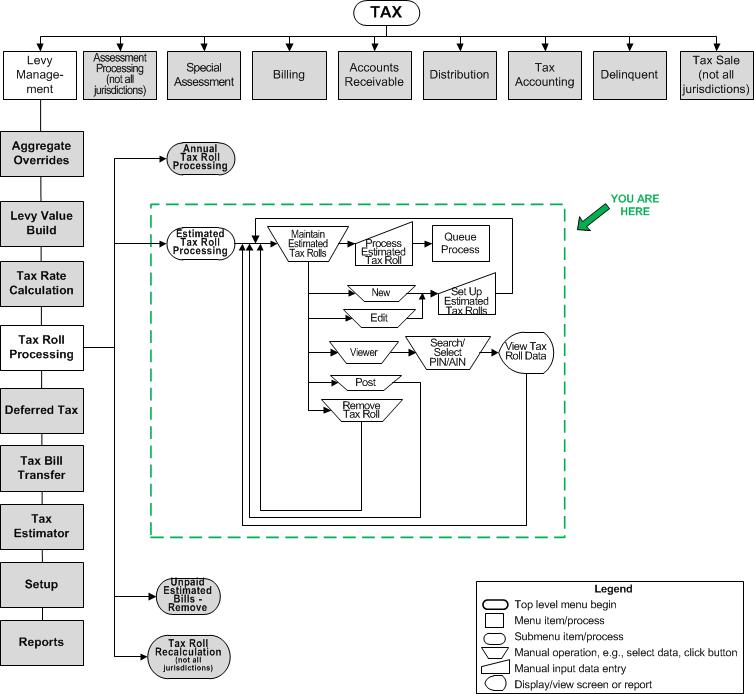

Navigation Flowchart

Navigation Flowchart

Description

Use this task to create a tax roll for estimated installment bills. The batch process component of this task identifies estimated bills that were not paid between the first and second installment and indicates whether a property is on an installment plan, thus triggering a correction that zeroes the tax bill. This tax roll processing reconciles the annual tax bills to estimated installment bills.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Tasks include:

When the estimated billing annual tax Roll process is run, it creates annual tax bills, and:

-

Calculates the annual charges.

-

Creates annual tax bills for those properties that do not have an Installment modifier attached. These bills have the following attributes, if for example, you :

-

Roll Caste = Annual

-

Tax Type = Real, Personal, Mobile Home, Motor Vehicle

-

Revenue Source = Property

-

Charges calculated from the taxable values times the tax rates

-

Installments = 1

-

Zeroes all estimated tax bills and processes as follows for those with an installment modifier:

|

Description of Estimated Bill |

Roll Caste |

Tax Type |

Calculation |

Installments Created |

|

Unpaid |

Annual |

Installment Billing |

Charges calculated from the taxable values times the tax rates |

1 |

|

Paid and the annual bill is greater than the estimated bill |

Annual |

Installment Billing |

Charges calculated from the taxable values times the tax rates |

4 (The additional installments contain the difference in tax between the estimated and annual bills) |

|

Paid and the annual bill is less than the estimated bill |

Annual |

Installment Billing |

Charges calculated from the taxable values times the tax rates |

2 |

-

Upon posting, notifies A/R to reapply payments from the estimated bills to the new annual bills.

NOTE: Flag schedules are assigned by effective year and can be used to override bill number setup. This is a similar schedule to the installment or the bill number schedule. It is used to apply flags to tax bills during estimated tax roll processing. Although it is typically only used for estimated billing, in can also be applied to Annual Tax Roll Processing. To define the flag schedule, go to Levy > Setup > Flag Schedule > Define Flag Schedule.