Print Trust Tax Returns

Description

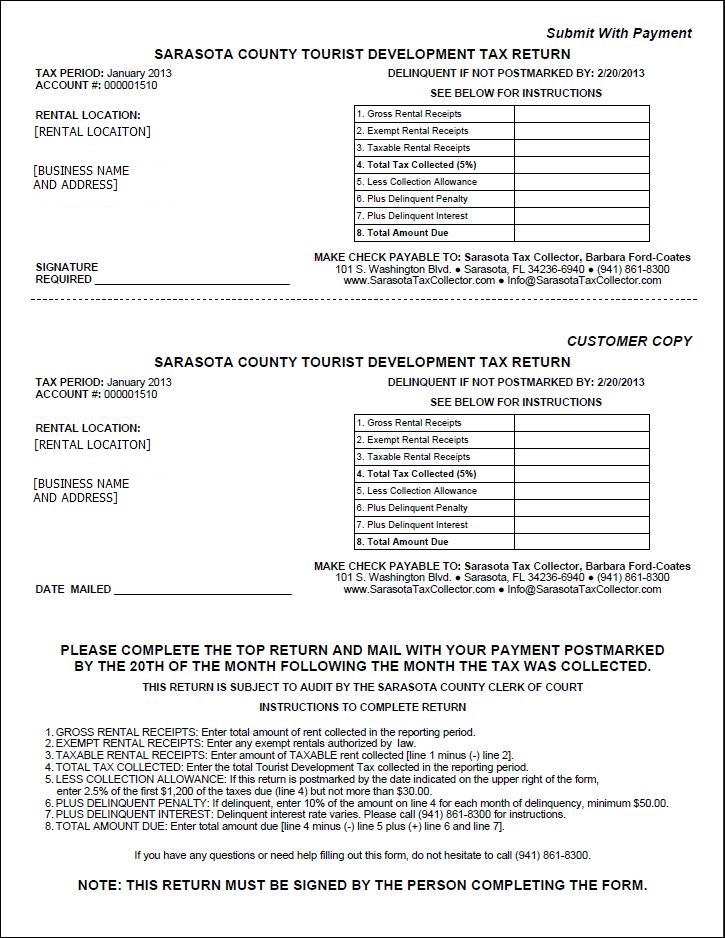

Print the trust tax returns for a tax year. You can select one or more tax types for a range of accounts and periods.

IMPORTANT: You can either export data or choose to print the return. If printing the return, you can control the number of additional blank returns you print based on the Business Revenue application setting Number of Blank Trust Tax Returns to Generate. To set this up:

-

Go to Configuration > Application Settings > Maintain Application Settings.

-

Select the setting type of Effective Date and the filter by module of Business Revenue.

-

Click Edit on the Number of Blank Trust Tax Returns to Generate application setting and enter the number of trust tax returns you want to print in addition to the regular printed return. The additional blank return prints after the regular return.

![]() Jurisdiction

Specific Information

Jurisdiction

Specific Information

Steps

-

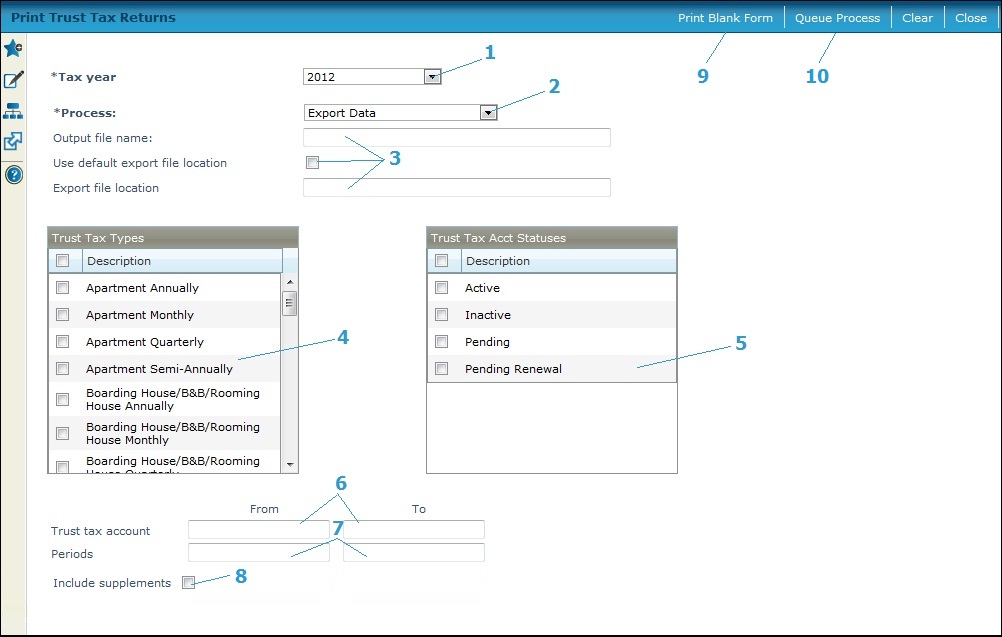

Select the Tax year.

-

Select the Process, either:

-

Print Report

-

Export Data

-

If you selected Export Data:

-

Enter the Output file name.

NOTE: The file is set up via Configuration > File Input/Output > Input/Output File Configuration > Manage Input/Output Configuration. Click Edit on Export TDT Return to navigate to the Manage Input/Output file Details screen to set up the file details as applicable to your jurisdiction. -

Check the Use default export file location to use the default location.

-

Define the Export file location if checking the checkbox.

-

-

Check the checkboxes for the Trust Tax Typesto include.

-

Select theTrust Tax Acct Statusesto include. Any types or status checkboxes left unchecked are not included.

-

Enter the beginning and ending Trust Tax Account numbers to print in the From and To fields.

NOTE: For a single account, enter the number in the From field. Leave both fields blank for all account numbers. -

Enter the Periods for the returns, with the beginning period, or single period, in the From field and the ending period in the To field. Leave both fields blank for all periods.

-

Check the Include Supplementals checkbox to include supplementals in the report.

-

Click the Print Blank Form button to print a blank form for just one trust tax account only.

NOTE: This button may not be available in your jurisdiction. -

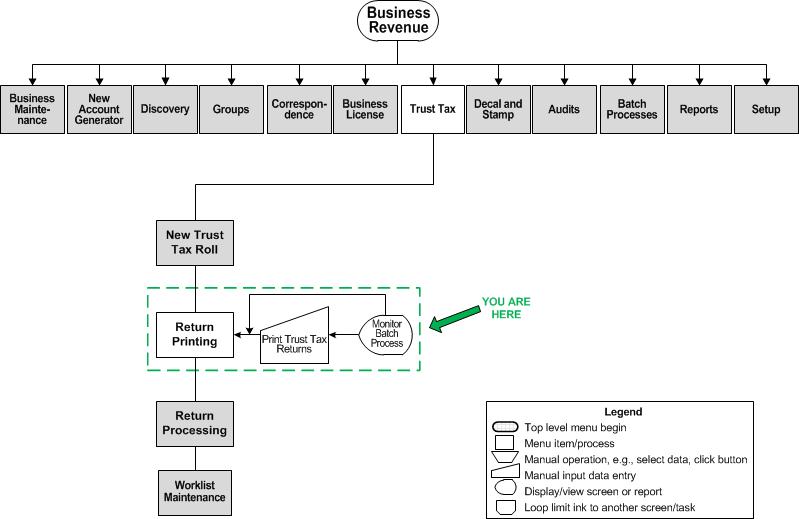

Click Queue Process to initiate the batch process to generate the returns. The Monitor Batch Processes screen displays, from where you can view batch process details.

When the process is complete, a PDF file of the returns is available from the View Batch Process Details screen. After viewing the forms, you can send them to a printer. In addition, an error log showing any returns that failed due to missing information is also generated as part of the process. The log report includes run date, trust tax account number(s), return period, and reason, for example, return period does not exists.-

Click Clear to remove all selections.

-

Click Close to exit the task

-

Common Actions

Tax Detail - Opens the Info Center > Business > Business Detail Information screen for the selected account(s).