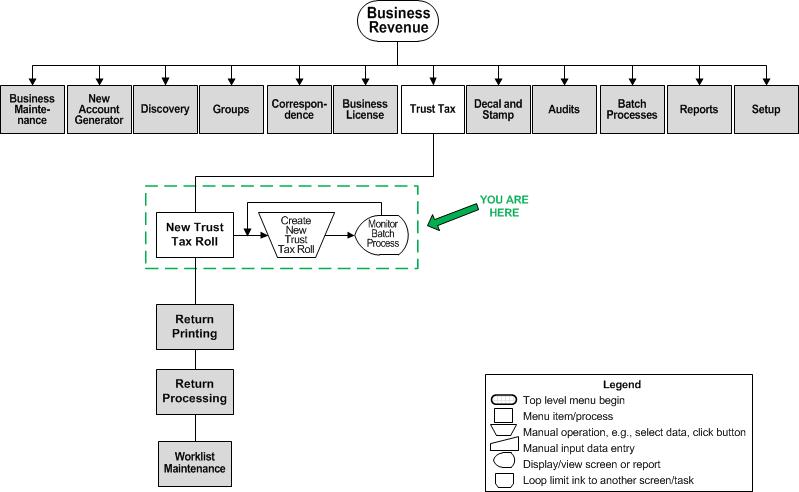

Create New Trust Tax Roll

Description

Create a new trust tax roll for a new year from the previous year's data. When the batch process runs, records for each period in the year are created for the new year roll from the existing trust tax returns. A status of not filed is automatically assigned to the new returns, and the assessment type is blank.

SETUP: See Trust Tax, Business Revenue and Business Setup for any applicable prerequisites, dependencies and setup information for this task.

![]() Jurisdiction

Specific Information

Jurisdiction

Specific Information

Steps

-

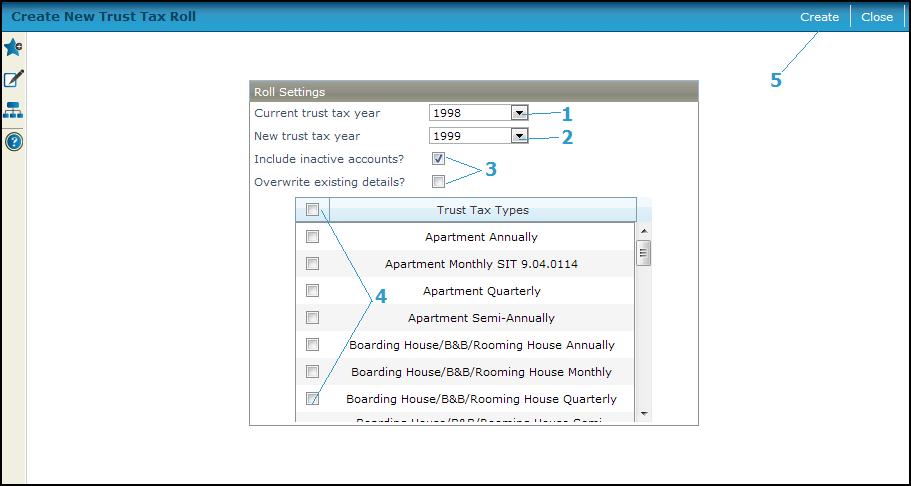

Select the Current trust tax year. The default is the current license year.

-

Select the New trust tax year. Default is the current year plus one.

-

Choose either, both, or neither of the items to include or overwrite.

-

Include inactive accounts - when selected, inactive and active trust accounts are included in the roll.

-

Overwrite existing details - when selected, the past year details are overwritten for the new year.

IMPORTANT: A non-menu security item controls this checkbox: A warning message is displayed when security rights are not appropriately set for this non-menu security option when attempting to overwrite existing details. To configure this, go to Configuration > Security and User Maintenance > Roles. Click the Non-Menu Items button and select BusRev to modify security for, and set the security rights for AccessOverwriteOnTrustTaxRoll by selecting it, checking the applicable Rights checkboxes, and clicking Save.

-

-

Select the Trust tax types to include in the roll.

-

Click Create to initiate the batch process and create the trust tax roll, which displays the Monitor Batch Processes screen.

-

Click Close to end the task.

-