Trust Tax

Description

Trust Taxes are taxes collected and held by businesses engaged in specific types of activity. These taxes are collected on behalf of the jurisdiction and remitted and reported on a defined periodic basis.

Examples are:

-

Lodging

-

Meal

-

Admissions

-

Daily rental

These taxes are known by various names depending on the state. Other common names are:

-

Trustee Tax (TT)

-

Tourist Development Tax (TDT)

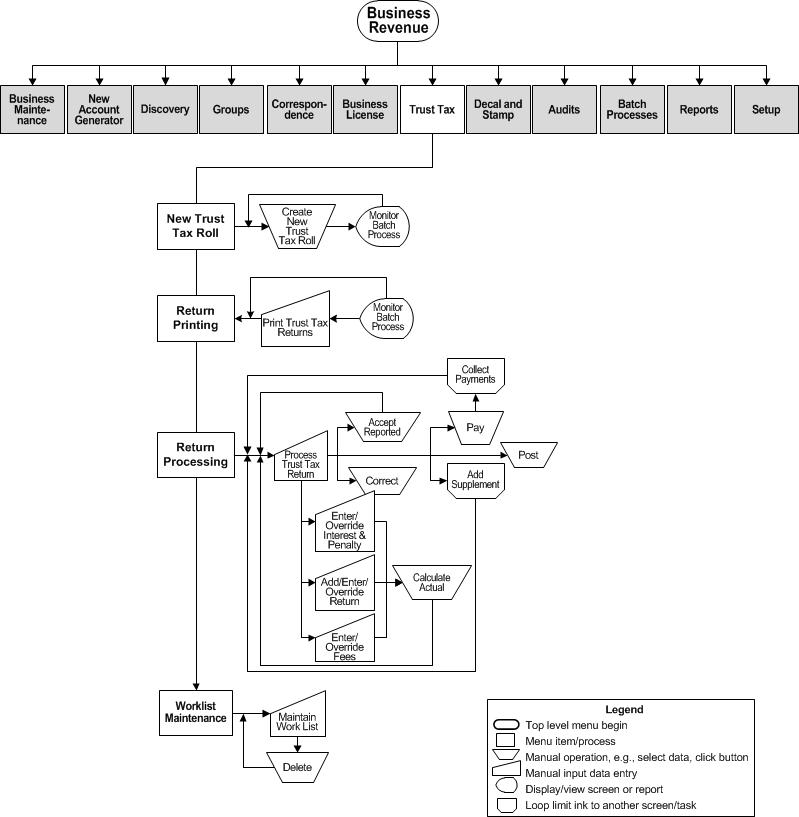

Use the Trust Tax task to:

-

Establish Trust Tax accounts

-

Print return notices

-

Process the periodic remittance returns

-

Maintain a worklist of trust taxes

![]() Jurisdiction

Specific Information

Jurisdiction

Specific Information

Steps

-

Create New Trust Tax Roll - Create a new trust tax roll for a new year from the previous year's data.

-

Print Trust Tax Return - Generate the returns within a tax year for a range of accounts and periods for one or more trust tax types.

-

Process Trust Tax Returns - Work with the trust tax return data for a trust tax account and period. The return data is entered, calculated, and posted to apply the period's charges to the account and create the trust tax bills.

-

Maintain Trust Tax Return Work List - Maintain a work list of trust tax returns that shows a list of tax bill numbers and tax year.

NOTE: When a Trust Tax bill is paid in full through the batch payment import, Accounts Receivable calls a Business Revenue Application Programming Interface (API) so that the Business Revenue module can update the Revenue Object Status from Filed to Paid on the Trust Tax Return.

Trust Tax Account Summary and History

You can also view a trust tax account summary and a history of trust tax corrections on the following screens:

-

View Trust Tax Account Summary (Business Revenue > Business Maintenance > Search for a Business > Maintain a Business > Maintain Business Location > Common Action: Trust Tax Accounts > View Trust Tax Account Summary). This screen shows all trust tax accounts for the business location, including balance, past due, and last pay date and amount.

-

View Trust Tax Return Correction History (Business Revenue > Business Maintenance > Search for a Business > Maintain a Business > Maintain Business Location > View Trust Tax Account Summary > Maintain Trust Tax Accounts > Process Trust Tax Returns > Common Action: View Correction History > View Trust Tax Return Correction History). This screen shows all trust tax return corrections such all non-value data associated with the trust tax (account number, etc.) as well as reported, actual, total, fee, interest/penalty, and total values.

Configuration, Prerequisites, and Setup

The Effective Date Type for Trust Tax Rate Calculation application setting defines whether to calculate trust tax rates by effective date or by tax year and period. To set this up:

-

Go to Configuration > Application Settings > Maintain Applications Settings.

-

Set the Effective Date.

-

Select the Filter by Module of Business Revenue.

-

Select the Effective Date Type for Trust Tax Rate Calculation application setting and set as applicable to your jurisdiction.

Refer also to the Business Revenue main module for any additional information about setup for business revenue and for trust tax.