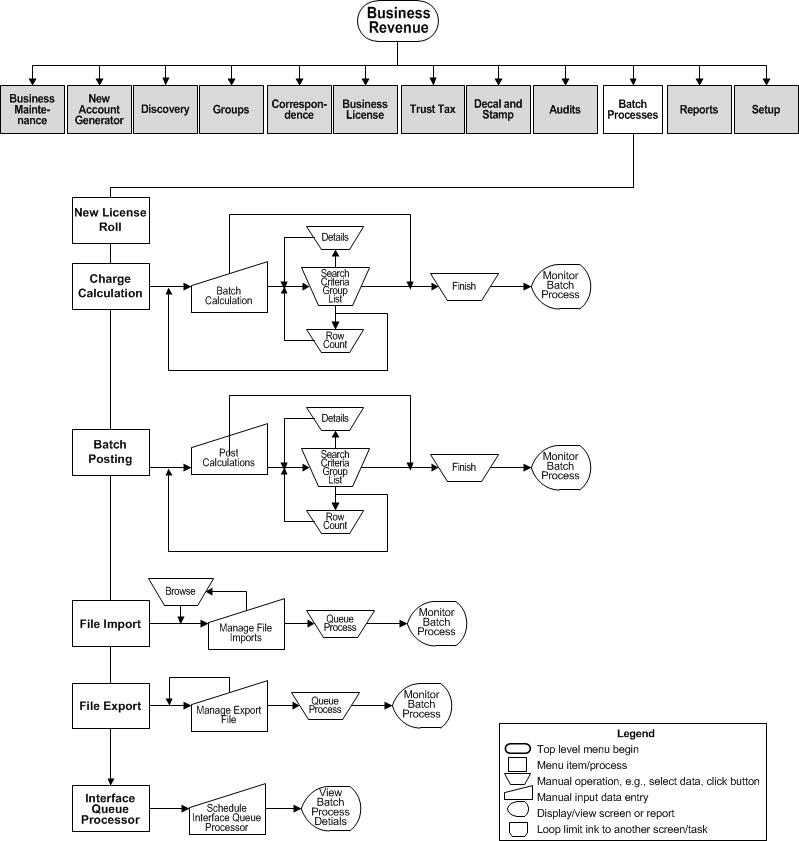

Batch Processes for Business Revenue

NOTE: This task may not apply to your jurisdiction.

Description

Use batch processes to manage file imports and exports, to schedule and process imports, and to calculate and post batch charges.

Processes

-

New License Roll, which is used to create a new business license roll. This is an annual process that creates a new cadastre (roll) for a new year.

-

Charge Calculation, which is used to calculate batch process charges.

-

Fee Application - batch apply selected fees to business revenue accounts

-

Batch Posting, which is used to batch post accounts after processing charge calculations.

-

Fee Application, which is used to batch apply fees to business accounts.

-

File Imports by selecting the import file and file layout and defining a batch name.

-

File Exports by defining the start/end dates, file layout, export file name and location, and batch name.

-

Interface Queue Processor, which is used to schedule processing of imported files (such as Rise 1 and Rise 2 files). Any files with discrepant data are sent to the Discovery queue where the file data can be updated on the Manage Discovery Worklist screen.

Prerequisites

Set up the file layout for import/export via Configuration > File Input/Output > Manage Input/Output File Configuration. Then go to Business Revenue > Setup > Global Business Revenue > Set Up Global Business Revenue and set up default names and locations, except for the Interface Queue Processor, which does not require the global setup.

To set up the new roll for charge calculations and for batch posting, go to Configuration > Criteria Groups > Set Up Criteria Groups. Select Business Tax Receipt Batch Criteria as the criteria process code. Enter a criteria group description. In the Criteria panel, select Include, select Custom Criteria, click Add, and click Save.