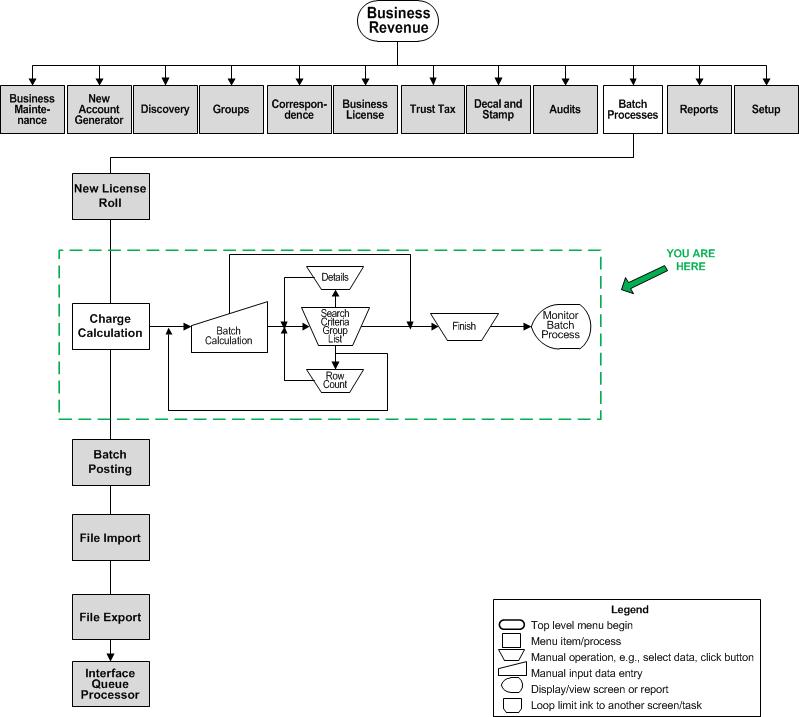

Charge Calculation

Description

Set up the batch process for the business tax certified roll for the purpose of calculating batch process charges.

IMPORTANT: Batch Calculation processes only calculate the licenses that are not posted.

Steps

-

Define the selection method on the Batch Calculation screen.

-

Define the tax year, select the criteria group, and do a row count on the Search Criteria Group List screen.

-

Define calculate options and schedule on the Batch Calculation screen.

-

Submit the batch, which opens the Monitor Batch Processes screen on which you can select and view the Confirmation Detail Report to view processing statistics.

Prerequisites

To set up the new roll for charge calculations, go to Configuration > Criteria Groups > Set Up Criteria Groups. Select Business Tax Receipt Batch Criteria as the criteria process code. Enter a criteria group description. In the Criteria panel, select Include, select Custom Criteria, click Add, and click Save.