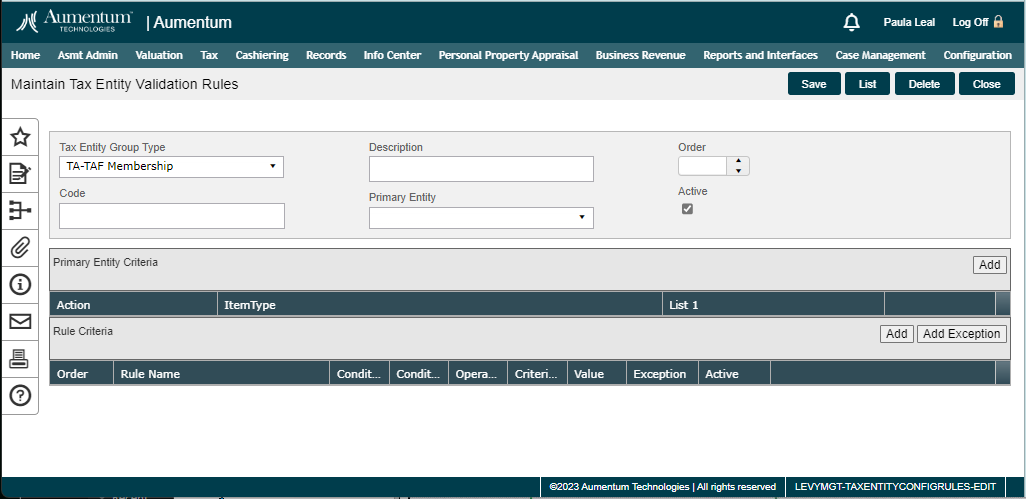

Tax Entity Validation Rules

Tax Entity Validation Rules

Navigate: Tax > Levy Management > Setup > Tax Entity Validation Rules

Description

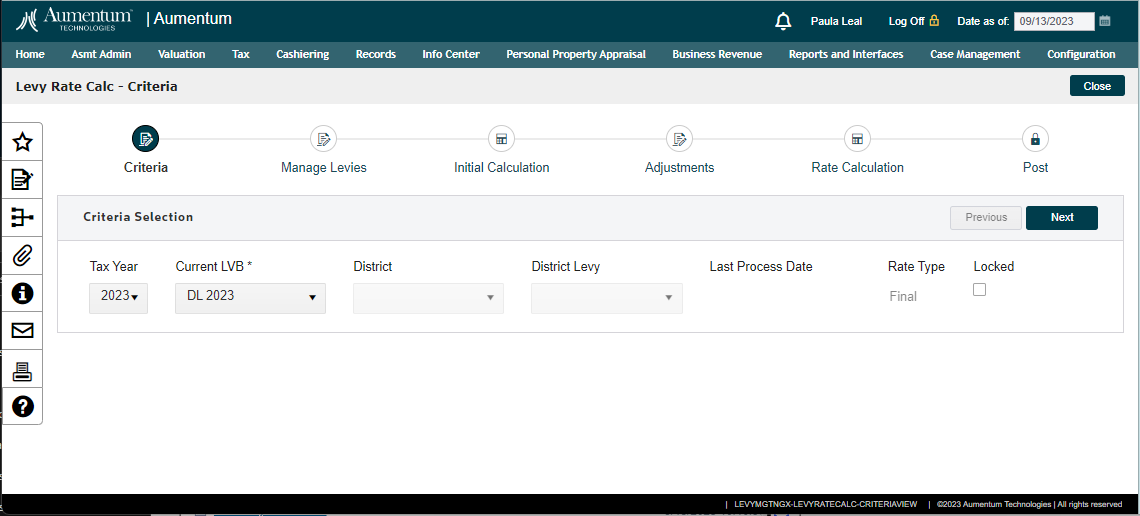

Select the assessment rolls to use to create a levy value build.

SETUP: See Levy Management, Levy Management Setup, and Levy Value Build for any applicable prerequisites, dependencies and setup information for this task.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Steps

-

Select the Tax year for the levy build.

-

Enter or edit the levy value description.

-

Select the checkbox if you are creating Sample levy values. You can run a sample value build via Tax Roll Processing but you cannot post it to Accounts Receivable.

-

Select the Assessment year from which to take assessment roll data. The assessment rolls for the selected year are displayed in the Available Assessment Rolls grid.

Only assessment rolls with locked levels are available. The rolls displayed also depend on whether the sample levy value box is checked. -

Select the Build type to keep track of which values will be built.

-

Select the checkbox of each assessment roll to include in the value build. If a roll has multiple available levels, select the Level to use from the list.

NOTE: The same assessment roll level cannot be used on more than one active levy value build. -

Click Save to save the changes and return to the Maintain Levy Value Builds screen. From there you can select to process the levy values and access the Process Levy Value Build screen.

-

Click Cancel to discard your changes and return to the Maintain Levy Value Builds screen.

-