Tax Bill Transfer

Tax Bill Transfer

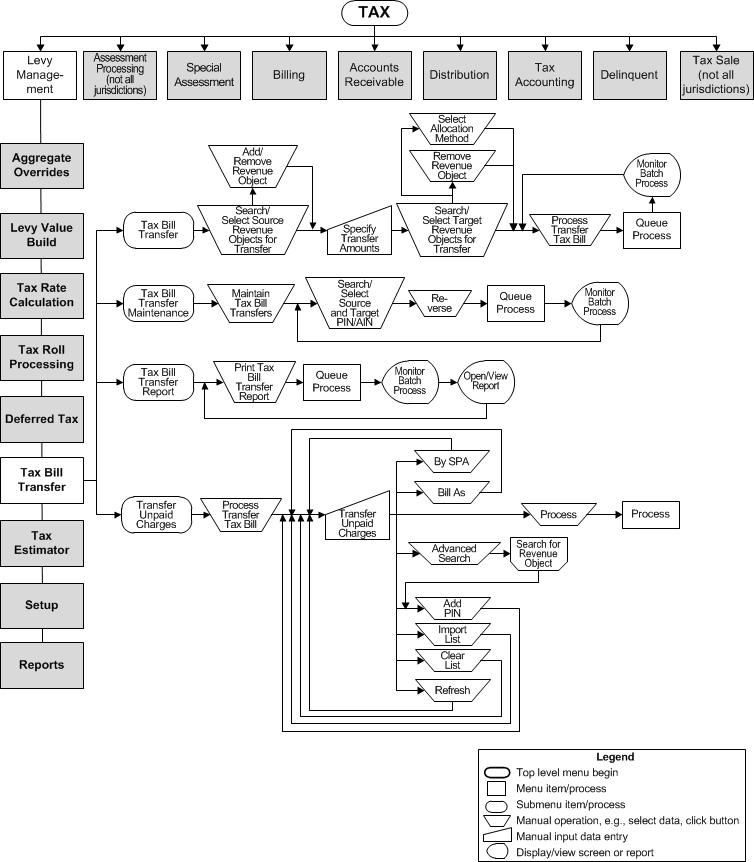

Navigation Flowchart

Navigation Flowchart

Description

NOTE: This functionality may not be available in your jurisdiction.

-

Tax Bill Transfer - On occasion you may need to transfer unpaid tax charges from one revenue object to another, to move charges for a revenue object from one tax year to another, or to split charges among multiple bills. You have the option of preserving the original charge structure (distribution between tax authority funds), or of reallocating the charges using the tax authority fund rates for a different tax authority group (TAG) or tax year.

You can also divide bills of undivided interests into multiple bills based on ownership in a property. The multiple bill divide can be based on either a percentage of the bill or a flat amount.

NOTE: For dividing bills, a WSAPI interface provides an indicator that the bill is to be split according to beneficial interest shares. This may not apply to your jurisdiction. Contact your (Undefined variable: Variables.SupportRep) for details.

-

If a modifier (exemption) exists that does not have one or more specific legal parties defined for the PIN, the modifier is split among all bills, both original and new, based on the ownership percentage for each bill. For example, if a bill for 100,000 has a 50,000 exemption, but the exemption is not linked to a specific legal party, the 50,000 exemption applies to the calculation of both bills as shown here:

Legal Party

Gross Value

Exemptions

Ownership %

John Smith

100,000

50,000

50%

Jason Bourne

100,000

50,000

50%

-

If a modifier (exemption) exists that is linked to one or more specific legal parties for this PIN, the modifier follows the legal party and is included as part of the calculation for that owner’s bill. For example, if a bill for 100,000 has a 7,000 exemption linked to John Smith and the bill is subsequently split between John Smith and Jason Bourne, the 7,000 modifier follows John Smith and his bill as shown here:

Legal Party

Gross Value

Exemptions

Ownership %

John Smith

100,000

7,000

50%

Jason Bourne

100,000

50%

-

If a modifier (exemption) exists that is linked to multiple legal parties for this PIN, the modifier follows the legal parties and is included as part of the calculation for those bills. For example, if a bill for 100,000 has a 7,000 exemption linked to John Smith and Martha Smith, but Jason Bourne does not have a modifier linked, the 7,000 modifier follow John Smith & Martha Smith and their bill(s) as shown here:

Legal Party

Gross Value

Exemptions

Ownership %

John Smith

100,000

7,000

40%

Martha Smith

100,000

7,000

40%

Jason Bourne

100,000

20%

-

Tax Bill Transfer Maintenance - Search for existing tax bill transfers to reverse.

-

Tax Bill Transfer Report - Print a report of tax bill transfers for certain dates or tax years.

-

Transfer Unpaid Charges - Transfer any unpaid tax charges for the transferred tax bill.

NOTE: When using this task and when searching/selecting revenue objects that have bills in tax sale, Levy prohibits adding the revenue object and a message indicating to use the Tax Sale Certificate Split Workflow displays on the Maintain Tax Bill Transfers screen.

![]() Jurisdiction

Specific Information

Jurisdiction

Specific Information

Use this task for the following scenarios:

|

|

Source Revenue Objects |

Target Revenue Objects |

Notes |

|

A real property split results in the parent property being retired. When the parent property's tax bills become delinquent, they are proportionally split and transferred to the child properties. |

Parent property |

Child properties |

Transfer delinquent or deferred charges |

|

Tax bill estimation for pre-payment of future taxes. A new bill is created for a revenue object based on current or any prior year property values, deferred values, taxes or deferred taxes. |

Any |

Same as source |

Target tax year: Next year |

|

Delinquent personal property taxes are reassigned to a related real property. |

Personal property |

Related real property |

Charge structure from either source or target revenue object may be used |

|

Delinquent tax bills are transferred to the current tax year, and the charges are reallocated over the current year rate structure. |

Any |

Same as source |

Target tax year: Current year |

Steps for Tax Bill Transfer

-

Select the revenue objects from which to transfer unpaid charges to another revenue object or tax year on Select Source Revenue Objects for Transfer.

-

Use the Revenue Object Search, if necessary.

-

-

Select the charges amounts on the revenue objects that you wish to transfer on Specify Transfer Amounts.

-

Select the revenue objects you are transferring the charges to on Select Target Revenue Objects for Transfer.

-

Select the target tax year and charge allocation rule to use for the transfer, as well as the bills to print on Process Tax Bill Transfer.

-

Maintain tax bill transfers via the Maintain Tax Bill Transfers screen.

-

Transfer any unpaid charges using the Transfer Unpaid Charges screen.

Configuration

Set up a Criteria Group for the Transfer Unpaid Charges task via Configuration > Criteria Groups > Set Up Criteria Groups. Select Transfer Unpaid Charges as the Criteria process code. Set up the criteria group as applicable to your jurisdiction.

Additional setup may include the following for the Transfer Unpaid Charges screen, depending on your selections on that screen:

-

Special Assessments via Tax > Special Assessments > Special Assessment Maintenance.

-

Revenue Object Lists via Records > Other Revenue Object Maintenance

-

Criteria Groups via Configuration > Criteria Groups with a process type of 'Transfer Unpaid Charges.

-

Flags via Configuration > Flag Setup.

Tips

Tips

In order to process tax bill transfers, you must associate the Tax Bill

Transfer systype in the Financial Management Processes category with the

Correction systype from the Surplus Sub Code category.

To reverse a transfer, use Maintain Tax Bill Transfers.

You cannot transfer unpaid penalty and interest charges.