Groups

Description

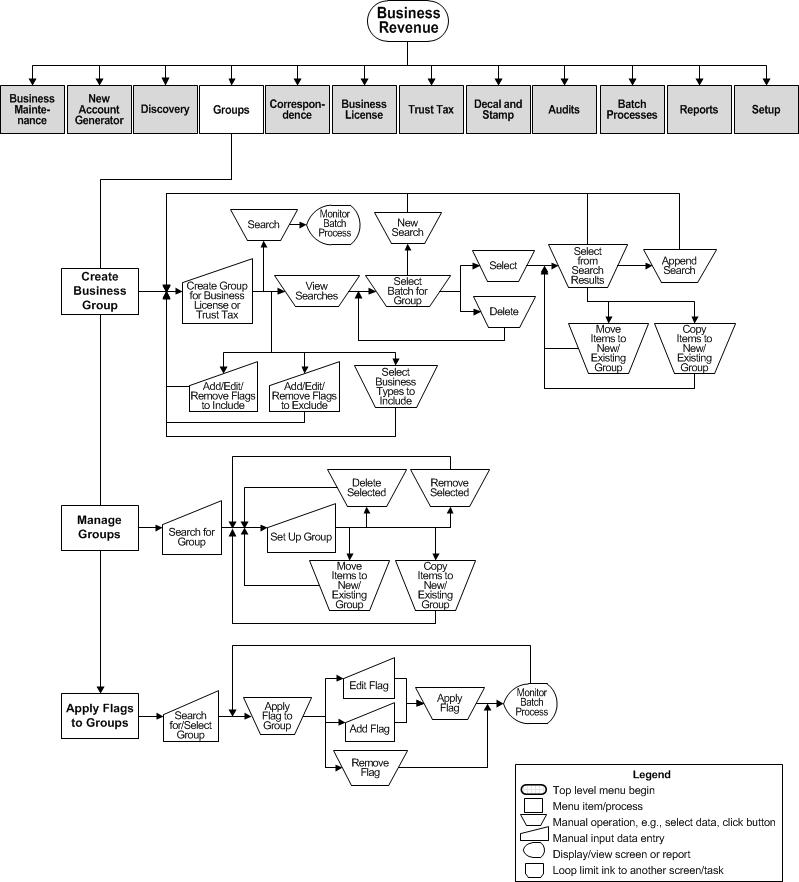

Create and manage groups of accounts for Business License or Trust Tax processing. A group is convenient method of selecting similar accounts when applying flags or reporting.

Steps

-

-

Create Groups for audits, business account master, license, license bill, and for trust tax accounts, returns, and return bills on the Create a Group screen..

-

Move/copy/add items from/to a new or existing group on the Set Up Group screen.

-

Move/copy items to/from delinquent groups - Find the group with Search for Group, then continue to Manage Delinquent Groups screen.

-

-

-

-

Set Up Group - Add items to a new group. Move or copy items to a new or existing group.

-

-

-

Manage Groups - Search for the Group and work with an existing group to add or remove group members.

-

Apply Flag to Group - Search for the Group and then create and apply the flag(s) to the group.

Dependencies, Prerequisites, and Setup

See the Business Revenue topic for Business Revenue setup information

Data Services and Correspondence for Business Groups

NOTE: Multiple data services can optionally be associated to a business revenue group for the purpose of generating correspondence. To set this up:

-

Create a minimum of two Data Services for the business revenue group.

NOTE: Make note of the Data Service names/code you create for the next steps. -

Add a Correspondence Report for each Data Services you have created via Reports and Interfaces > Correspondence > Setup > Report Setups.

-

Go to Configuration > Systypes > Select or Add a Systype. For each of Data Service you created, the system creates a systype under the Data Service Code systype category. Find the two Data Services you created using the Code and Description.

-

Select each systype, respectively, to navigate to the Edit a Systype screen.

-

Click Add in the Additional Information panel and select BRGroupTypes from the Descripton dropdown and select the BrGroupType from the Value dropdown for the service you created. Repeat this for both systypes.

NOTE: The Value type for both systypes should be the same. -

Click Save and Close.

-

Create the Business Group via Business Revenue > Groups > Create a Business Group for the same Business Group type you created for the data services and correspondence.

-

if you create a correspondence for the Trust Tax Return Bill, you should have assigned the same value to the Data Service systype, then create a Business Group for Trust Tax Return Bill.

-

To generate the correspondence, go to Business Revenue > Correspondence.

-

Select the Business Group you created.

-

Select the Report Setup correspondence you created for the group.

-

Click Print Correspondence to submit the correspondence to the Outbound Document Queue.