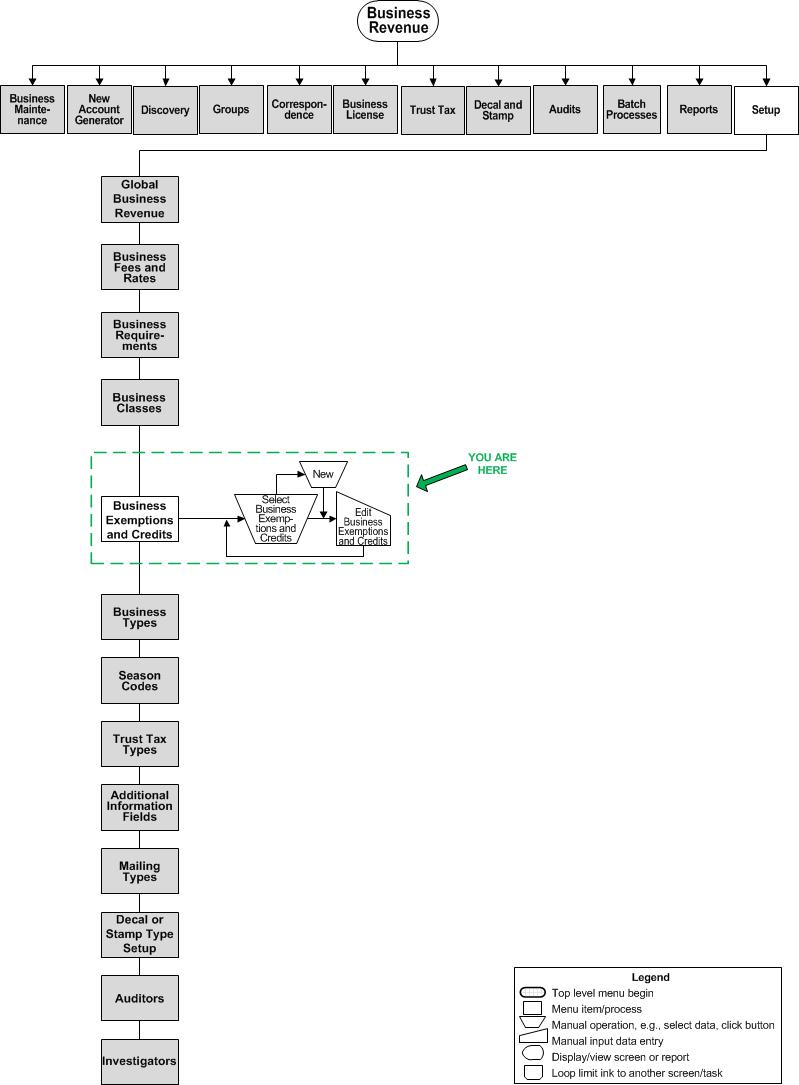

Business Exemptions and Credits Setup

Description

Certain states have business exemptions and credits that are applied to the assessed value of a business. When issuing a business license, these exemptions/credits are applied to the tax bill. Examples are:

-

(Palm Beach) Senior Deferral, a 100% tax exemption for a senior citizen who opens a business

-

(CVB) Gas Credit

NOTE: Exemption amounts apply to the assessed value, not to the tax. It is not possible to have more exemptions than the assessed value. If there are more exemptions than the assessed value, the tax caps at zero.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Setup

-

Set up business fees and rates.

-

Search for Rules and Rates.

-

Select either Business License Exemption or Business License Credit from the dropdown list, depending on which you want to set up and search for any existing ones to maintain.

-

If the exemption or credit does not exist, set up a new one on the Maintain Rules and Rates screen.

-

Set up the business requirements on the Set Up Business Requirements screen.

-

Add any new requirements for the exemption/credit if none exist.

-

Set up the business exemptions and credits.

-

Select the exemption or credit on the Select Business Exemptions and Credits screen to edit on the Edit Business Exemption/Credit screen.

-

If none exist, create a new one and define details on the Edit Business Exemption/Credit screen.

Note: When setting up a new exemption or credit, select the earliest year available or the earliest year that the exemption or credit was implemented so that it rolls forward to each subsequent year. The amount of exemption/credit can be edited each year as necessary.

-

Set up the business type.

-

On the Set Up Business Type screen, select the exemption or credit to associate it to the business type, and select any other fees, requirements, and taxes, as applicable.

Issue the License with Exemptions/Credits

Issue the license from the Maintain Business License screen.

-

Select the business type to automatically display any defined exemptions/credits.

-

Optionally, add any additional exemptions/credits before posting and printing the bill.