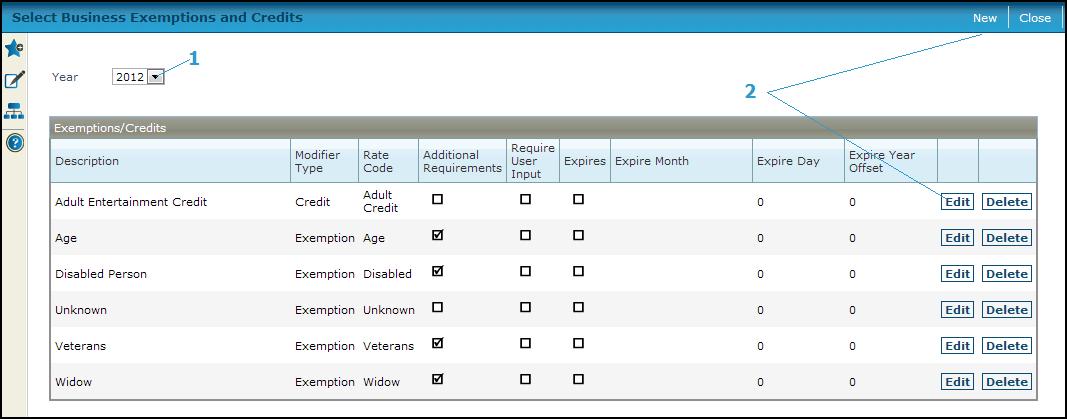

Select Business Exemptions and Credits

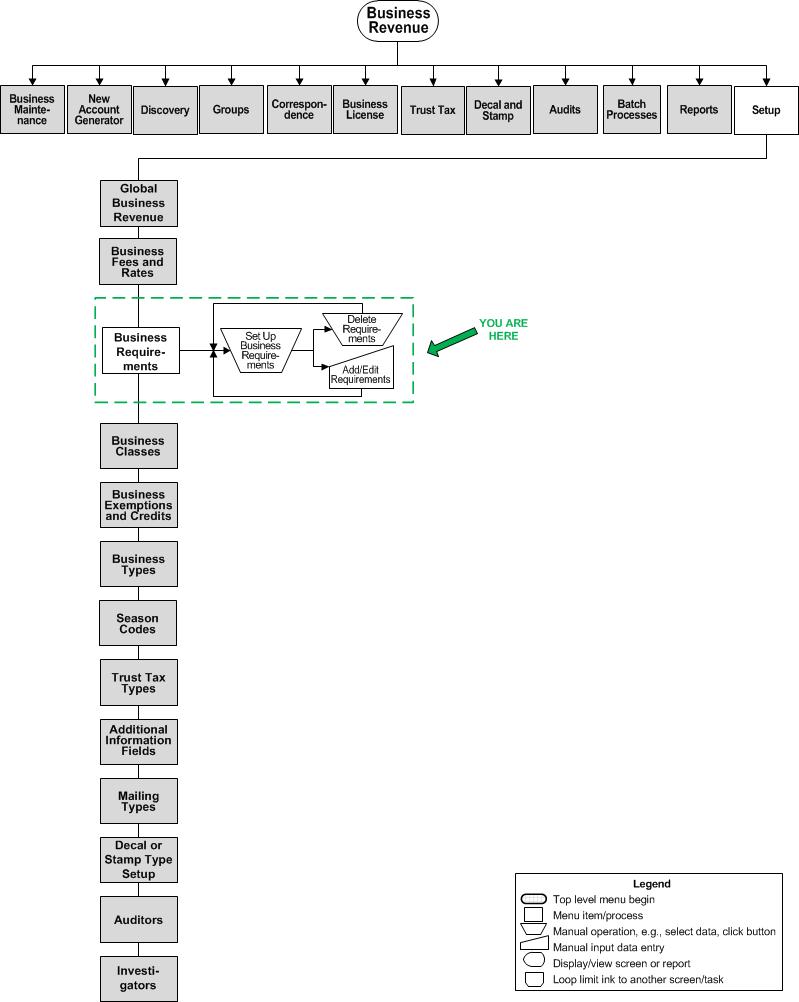

Navigate:Business Revenue > Business Setup > Business Exemptions and Credits > Select Business Exemptions and Credits

Description

Set up business exemptions and credits specific to your jurisdiction.

SETUP: See Business Revenue and Business Setup for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Select the Year from the dropdown list.

NOTE: When setting up a new exemption or credit, select the earliest year available or the earliest year that the exemption or credit was implemented so that it rolls forward to each subsequent year. The amount of exemption/credit can be edited each year as necessary.

NOTE: Before setting up a new exemption/credit:-

Set up rules and rates for exemptions and credits on the Maintain Rules and Rates screen.

-

Set up any business requirements for exemptions and credits on the Set Up Business Requirements screen.

-

-

Click Edit in the existing exemption or credit in the Exemptions/Credits grid to edit an exemption or credit.

OR

Click the New button to create a new exemption or credit. The Edit Business Exemption/Credit screen is displayed.

-

-

Click Delete to delete an exemption or credit

-

Click Close to end the task.

-