Select Revenue Objects for Rollback

Select Revenue Objects for Rollback

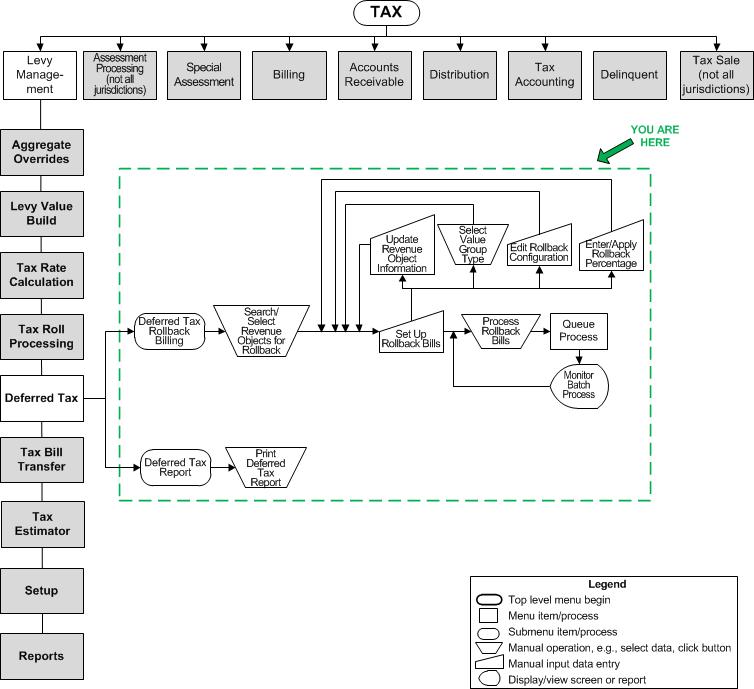

Navigation Flowchart

Navigation Flowchart

Description

Select the revenue objects for whom deferred taxes are being rolled back and billed.

SETUP: See Levy Management, Levy Management Setup, and Deferred Tax Rollback Billing for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Enter a revenue object PIN or AIN and click Add to add it to the list.

OR

Click Search to use the Records Search for Revenue Object screen to find revenue objects using different criteria. When you select the revenue objects from the search results, they will be returned here. -

Click Enter Deferrals to open the Edit Deferred Inventory popup.

-

Accept the current date default or enter a date.

-

Click Update Information whenever you change any selections.

-

Select a Value group type to enter deferred amounts for (real or personal property, special assessments, business revenue).

NOTE: You can limit the value groups displayed by selecting the Value group type from the list in the panel title bar. -

Click Add in the Deferred Inventory panel.

-

Accept the current Tax Year or enter it.

-

Select the Rate Value Type.

-

Enter the Total Deferred.

-

Click Remove to remove a revenue object from the list.

-

-

Click Next to go to Set Up Rollback Bills.

-

Click Close to end the task.

-