Deferred Tax Rollback Billing

Deferred Tax Rollback Billing

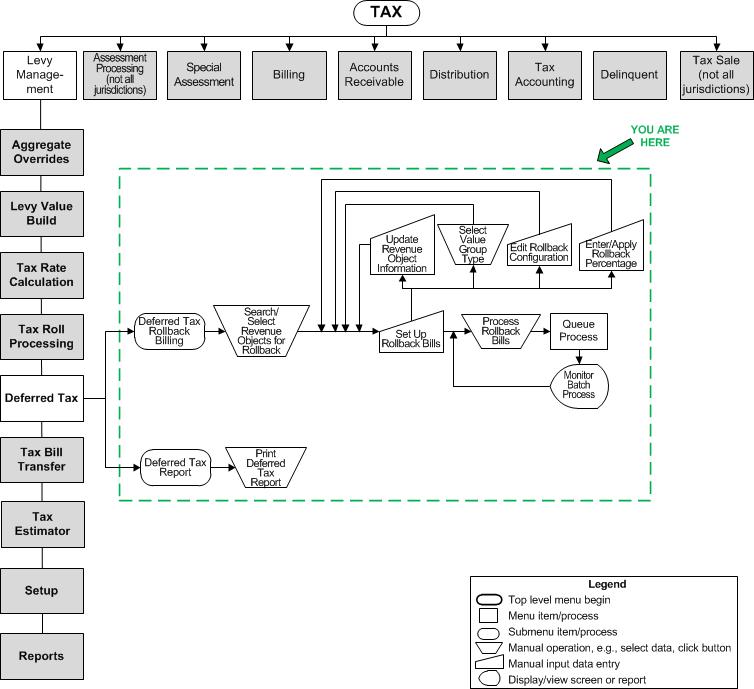

Navigation Flowchart

Navigation Flowchart

Description

Levy Management has the ability to track deferred taxes using value types.

-

Deferred Tax Rollback Billing - Create rollback bills from a portion of deferred value using tax rates from any tax year. This process calculates the rollback taxes based on the rate information you provide, creates the bill data, and optionally prints the bills.

-

Deferred Tax Report - Print a report listing deferred value, rollback value, and rollback tax.

Steps

Create rollback bills from a portion of deferred value or previously calculated deferred taxes using tax rates from any tax year. This process calculates the rollback taxes based on the rate information you provide, creates the bill data, and optionally prints the bills.

-

Select the revenue objects for whom deferred inventory (value or taxes) are being rolled back on Select Revenue Objects for Rollback. If there is no deferred balance for the selected revenue objects, you can also enter it on this screen.

-

Configure the information needed to calculate the rollback bills on Set Up Rollback Bills.

-

Schedule and submit the rollback billing process on Process Rollback Bills.

Prerequisites

Configuration Menu

-

Roll related deferred rollback bills into one parent bill - Set to True (checked) if you want to combine multiple years of deferred rollback bill data for the same taxpayer into a single parent bill (Virginia only).

-

Defer taxes if true, defer values if false - Set to True to determine deferred taxes from the difference in taxes calculated on taxable value before and after excluding deferred values. Default value is False.