Levy Rate Maintenance

Levy Rate Maintenance

Navigate: Tax > Levy Management > Tax Rate Calculation > Levy Maintenance

Description

The Aumentum Levy Maintenance tool empowers users with a user-friendly configuration interface, facilitating the seamless management of diverse tax-related settings. This comprehensive documentation is specifically tailored to guide users through the process of configuring tax-related settings, with a particular focus on District Levies within the state of Washington.

The central objective of this configuration process is to equip the Levy Comptroller with the tools necessary to efficiently process data entry for District Levies. Simultaneously, it establishes a crucial mechanism for associating these District Levies with the respective Tax Authorities. This feature plays a pivotal role due to the substantial volume of data handled by the Levy Comptroller's office in the State of Washington.

Leveraging the tax rate calculation programs, users can accurately determine the levies requested by tax authorities and compute the corresponding rates based on the input values provided by the Levy Value Builds

-

Levy Maintenance - Maintain the requested and actual levies which will be used to calculate tax rates.

-

Tax Rates - Import - Allows importing, processing, and posting of tax rates.

Jurisdiction Specific Information

Steps to Create, Edit, Delete and Export District Levies, TCA Levies, Levy Limits and Equalization Factors

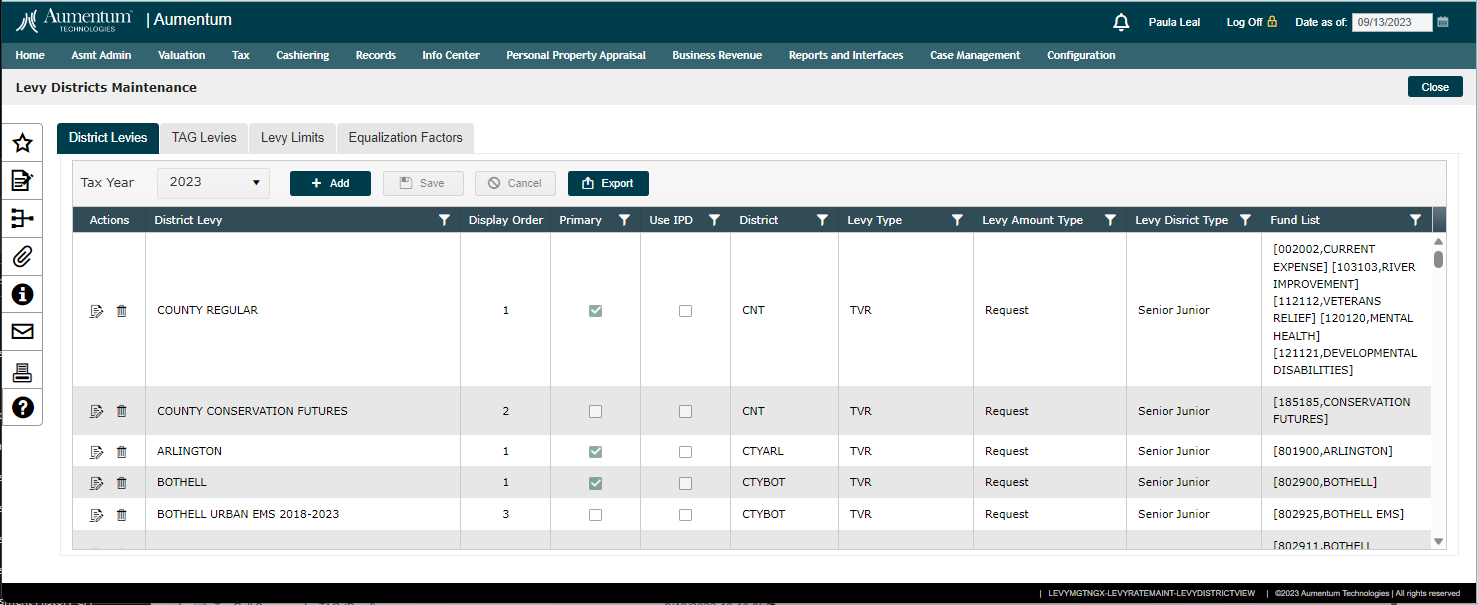

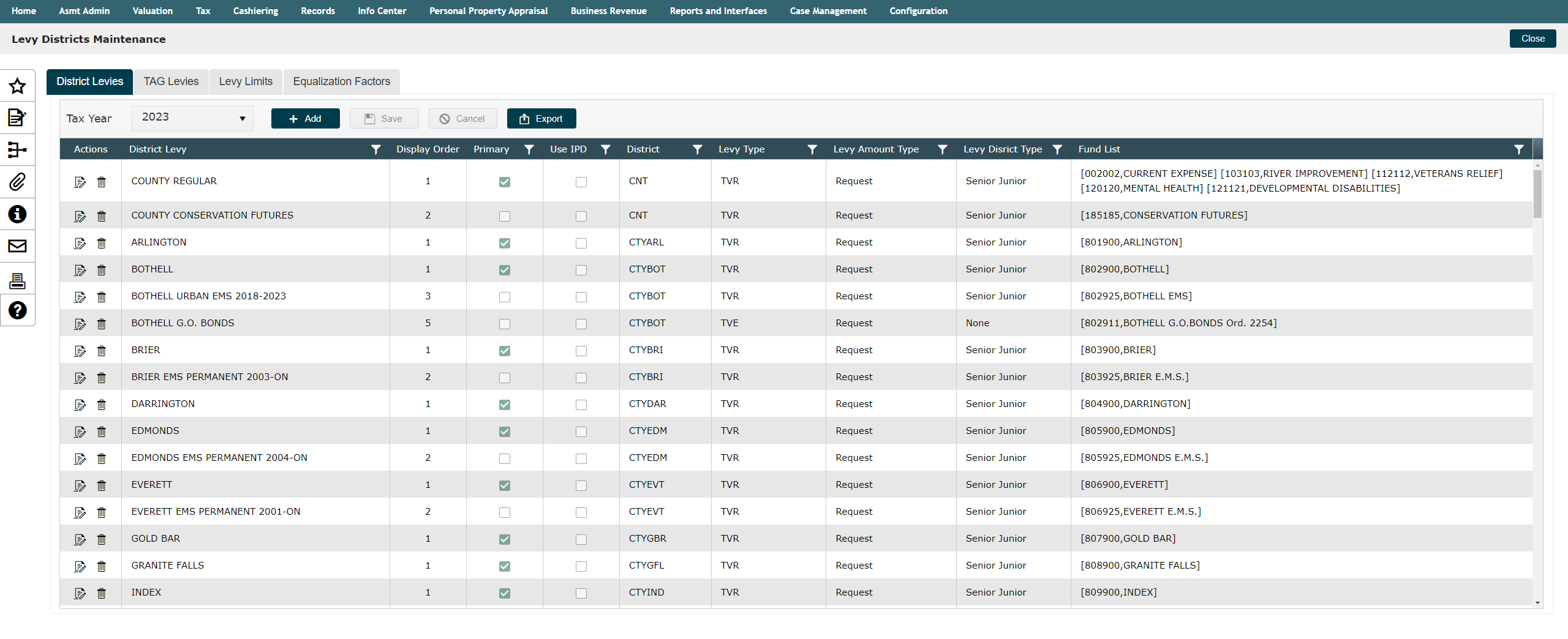

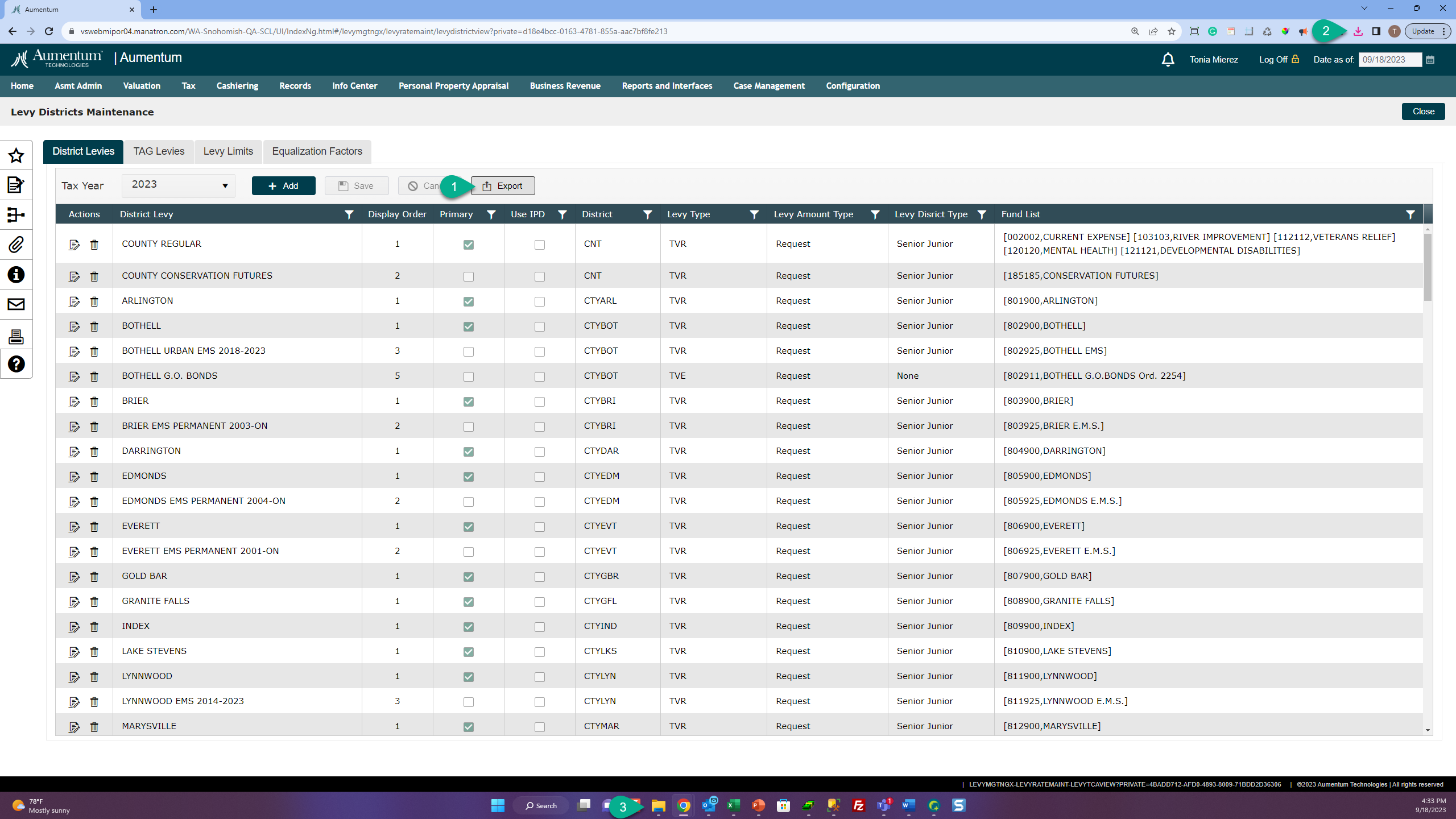

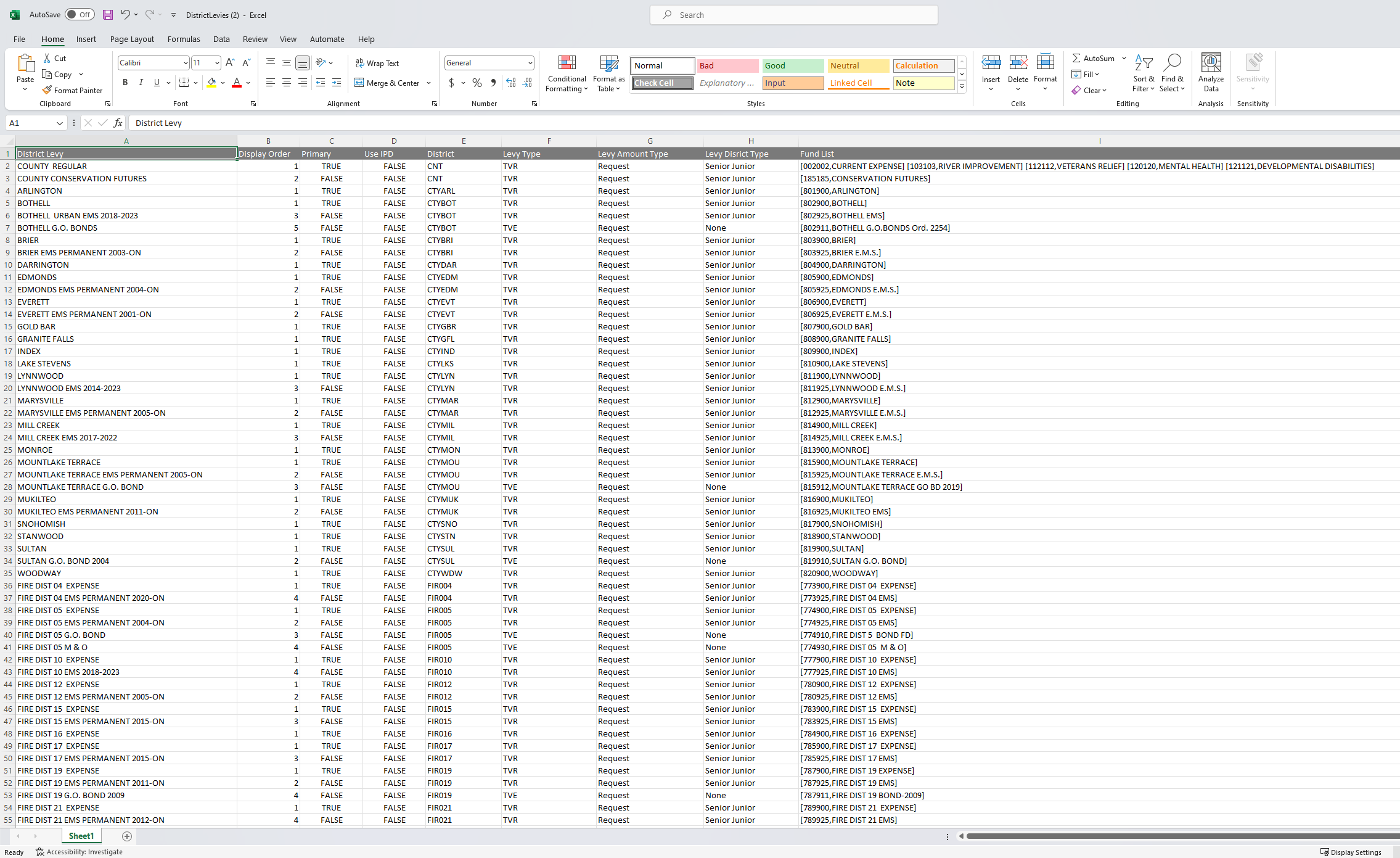

Navigate to Tax > Levy Management > Tax Rate Calculation > Levy Rate Maintenance > District Levies

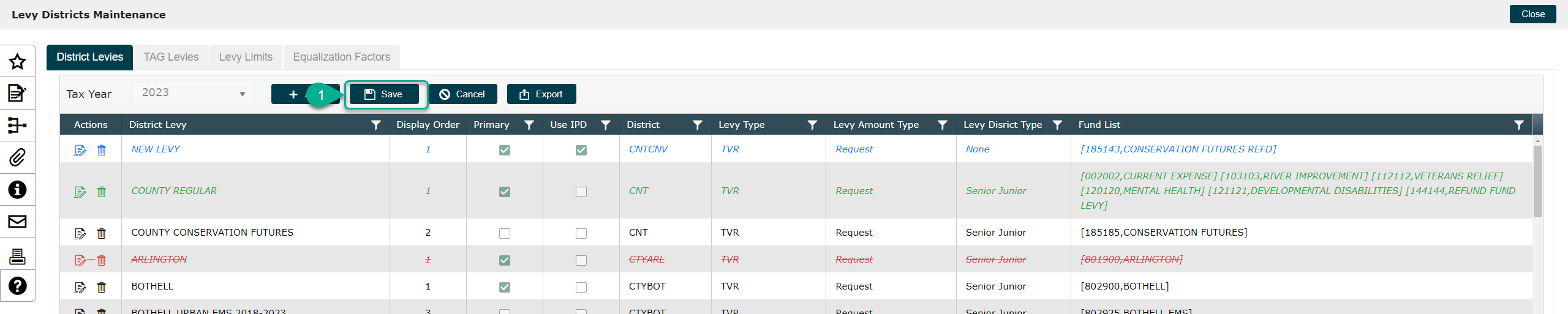

Save

For any of the action items described below, to commit changes you must click the [SAVE] button.

For any of the action items described below, to commit changes you must click the [SAVE] button.

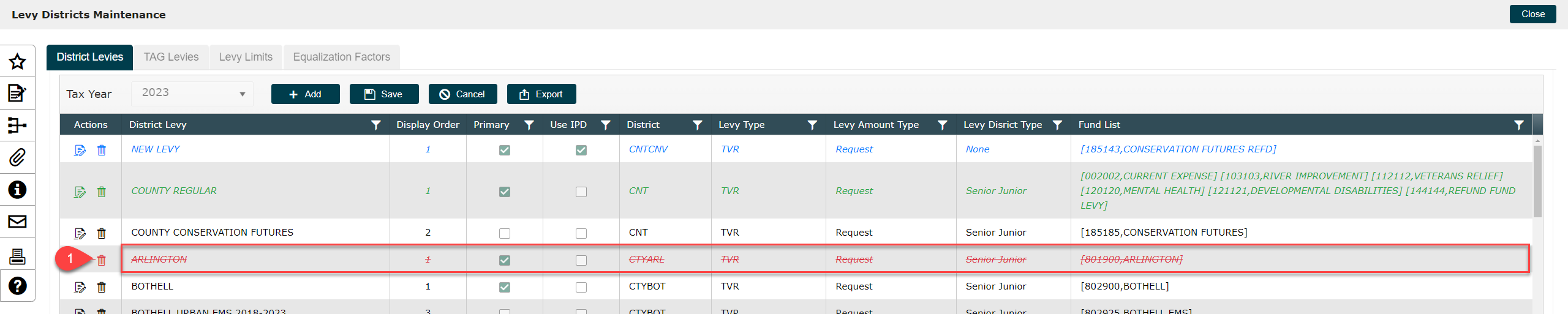

Color coding for seamless visual cues:

In the snippet above we have illustrated the new Aumentum color coding that define actions that are being taken on records.

Blue - indicates records are being added to the grid and are New).

Green - indicates records are being edited (changed).

Red - indicates records are being deleted. Aumentum Levy holds the records inline until the Save action is clicked.

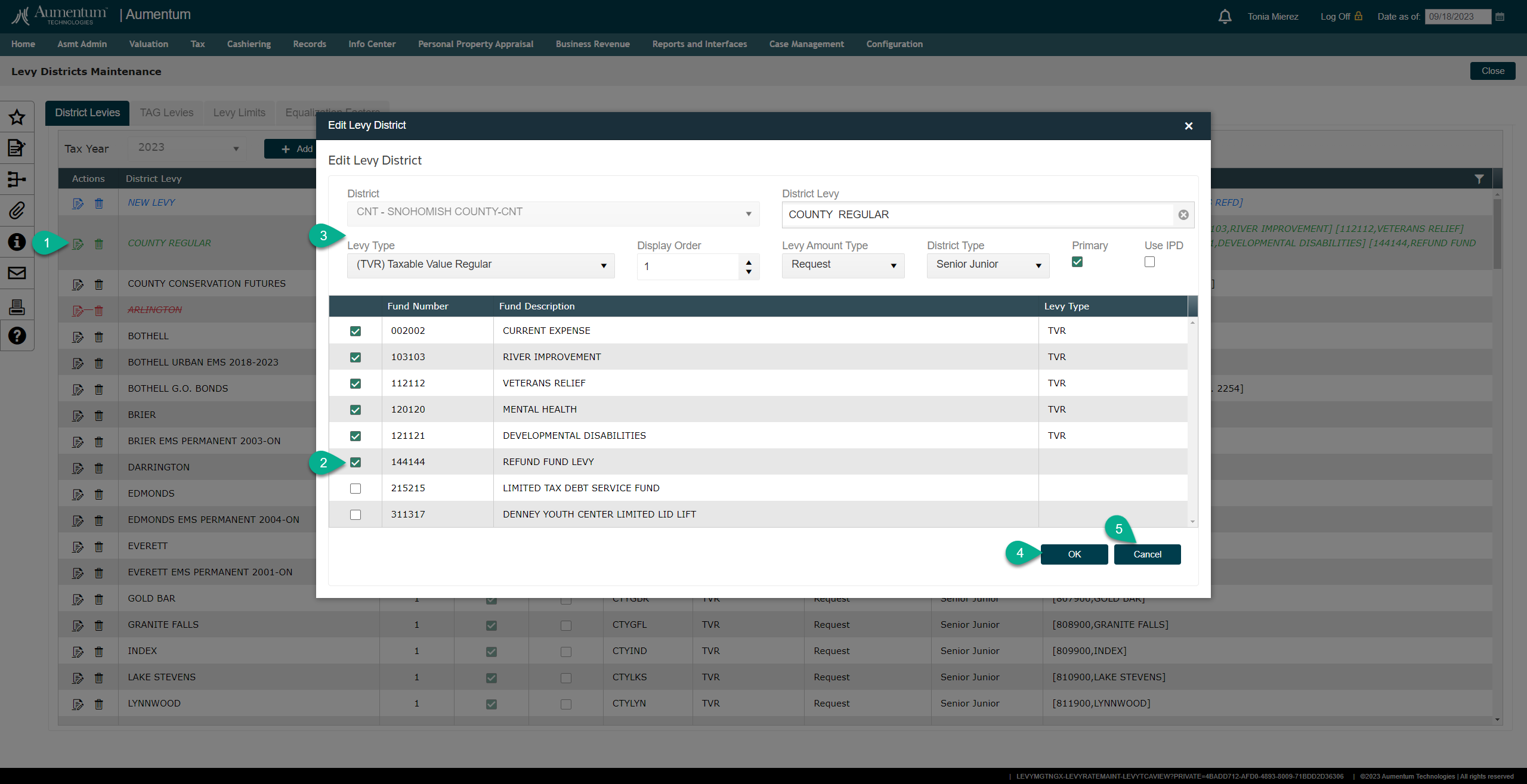

Edit

-

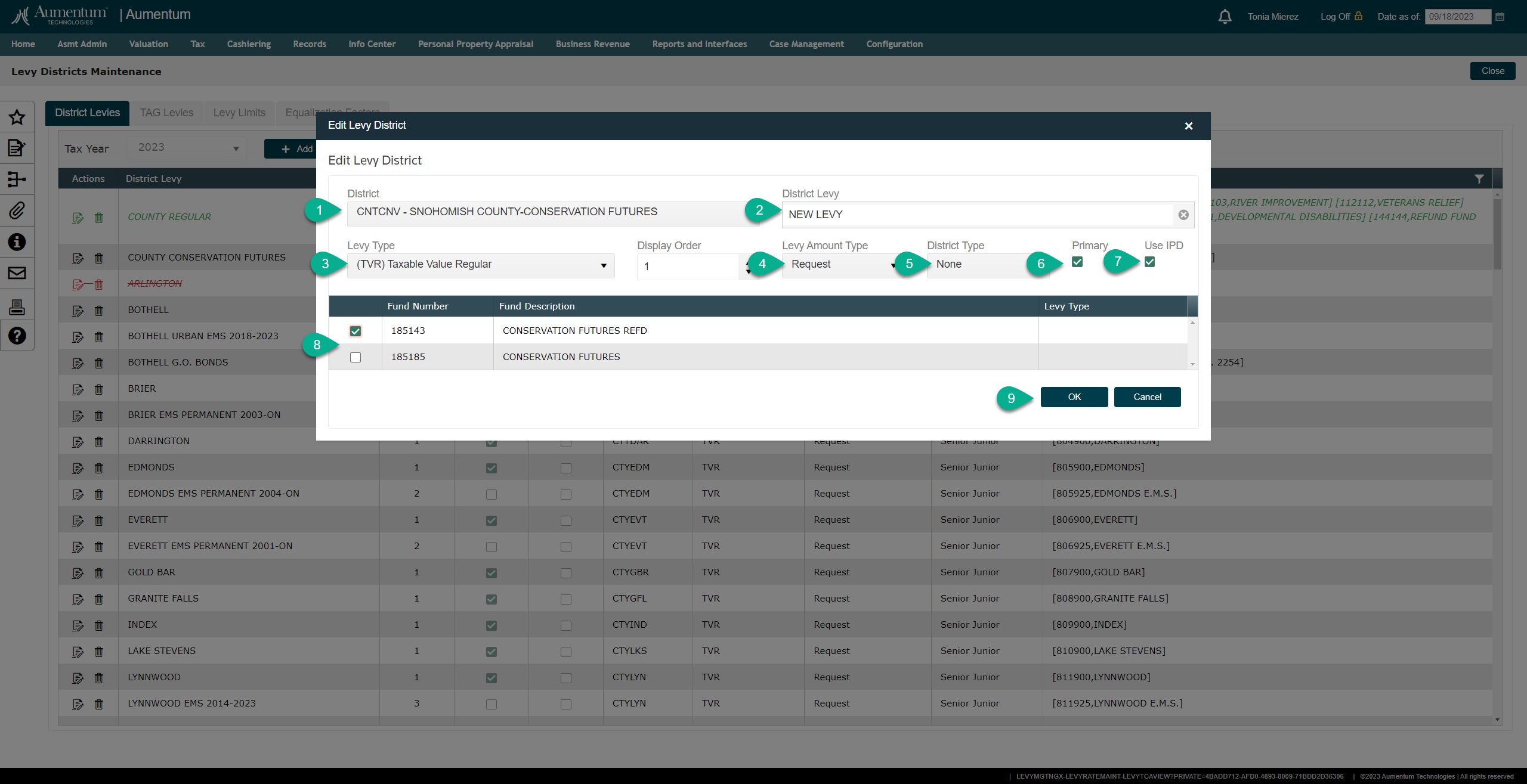

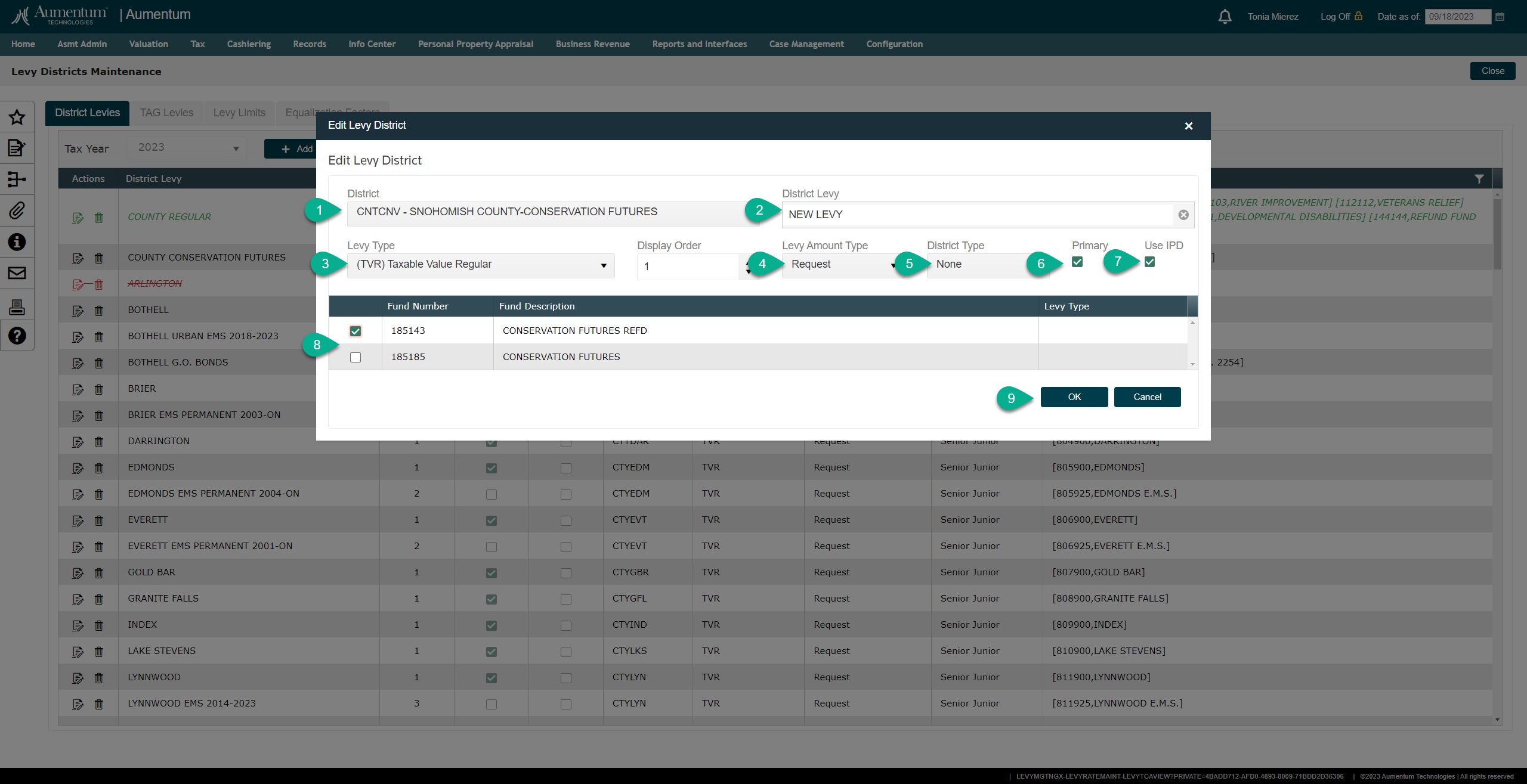

Click the [EDIT] icon of the District Levy record you want to edit.

-

In the modal select a new or remove and existing Fund

-

There are a few parameter selections that can also be edited. (District Levy Name, Levy Type, Display Order, Levy Amount Type, District Type, Primary, Use IPD).

-

When all desired changes are made click [OK] to commit the changes

If you wish to refresh or cancel edits, click [CANCEL] to remove changes and close the modal

Delete

1. Click the trash can icon to delete any record

Add

-

1. Select District

-

Enter New District Levy Name

-

Select Levy Type

-

Select Levy Amount Type

-

Select District Type

-

If Primary check this box

-

If this Levy District uses IPD for calculations, check this box.

(Optional - The display order can be determined here to define the order of the District Levy within the TAG (TCA)).

-

Click the [EXPORT] button

-

Navigate to the "Downloads Folder" to obtain the file

-

If your network doesn't have the configuration to display the download in the browser, navigate to Window

-

Explorer > Downloads, the file name will default to DistrictLevies.xlsx

Note: TAG (Tax Authority Group) in Aumentum is equivalent to the TCA (Tax Code Area in Washington State.

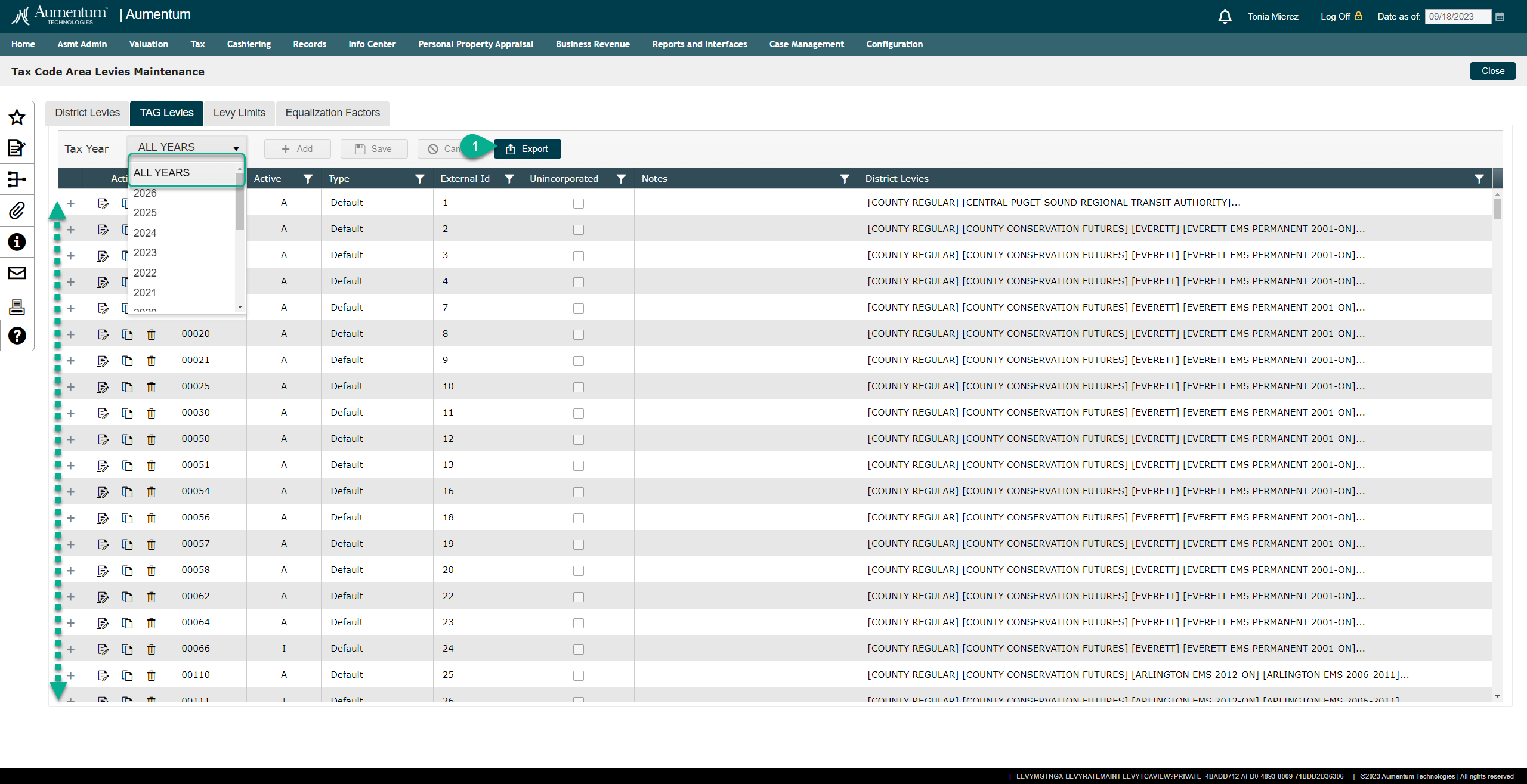

Navigate to Tax > Levy Management > Tax Rate Calculation > Levy Rate Maintenance > TAG Levies

1. Click the Tax Year drop-down and select ALL YEARS

2. Click [EXPORT]

Note* When the page is in ALL YEARS mode, the individual years are not editable, navigate back to an individual tax year to edit a TAG Levy.

Funds

Navigate to Tax > Levy Management > Setup > Tax Funds

Tax Authority (District)

This configuration is essential for performing Aumentum Calculations and deals with Tax Authority (District) associations (Groups).

Equalization Factor

Navigate to Tax > Levy Management >Tax Rate Calculation > Levy Maintenance > Equalization Factor

Levy Limits

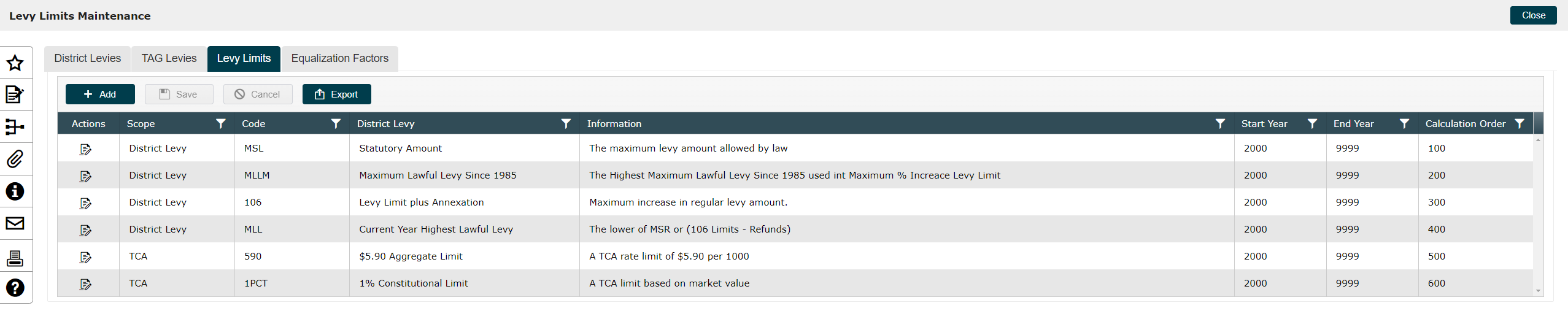

Navigate to Tax > Levy Management > Tax Rate Calculation > Levy Maintenance > Levy Limits

Tips

Tips

Each rate calculation event is a unique combination of tax year, rate type, and levy. Although you can run multiple calculations on the same combination, only one rate calculation event can be posted.

Valuable Vocabulary

Valuable Vocabulary

TCA (TAG in Aumentum)> Tax Code Areas | A TCA is a geographical area in which local entities such as a city, county, school, or fire district may assess taxes to sustain its operations. These combined taxing districts make up a TCA. In a county as large and diverse a Snohomish, there are hundreds of TCAs. TCA summaries can be reviewed as part of the assessor's Annual Report for Taxes. View the various taxing districts.

Taxing District (Tax Authority in Aumentum)> "Taxing district" means the state and any county, city, town, port district, school district, road district, metropolitan park district, regional transit authority, water-sewer district, or other municipal corporation, having the power or legal authority to impose burdens upon property within the district on an ad valorem basis, for the purpose of obtaining revenue for public purposes, as distinguished from municipal corporations authorized to impose burdens, or for which burdens may be imposed for public purposes, on property in proportion to the increase in benefits received.

Levy Type:

TVE (taxable value excess): For excess levies.

TVR (taxable value regular): For regular levies except for

State levies.TVS (taxable value State): For State

School 1 levy.TVS2 (taxable value State 2): For State School 2 levy.

District Levy (New Level in Aumentum)>

A term used to describe the sub district level of a county district where the levy rates are to be extended for purposes of calculation and charge extensions.

Levy Limit (Regular Levy Limitations)>  Other Levy Limits may be applicable based on taxing district and populationo https://dor.wa.gov/education/industry-guides/ballot-measure-requirements/part-1-voted-regular-levies-levy-limit-levy-lid-lifts-and-general-obligation-bonds-port-districts/levy-limit

Other Levy Limits may be applicable based on taxing district and populationo https://dor.wa.gov/education/industry-guides/ballot-measure-requirements/part-1-voted-regular-levies-levy-limit-levy-lid-lifts-and-general-obligation-bonds-port-districts/levy-limit

Statutory Rate Limit

The regular levy of each taxing district cannot exceed a certain rate, which is determined by statute and relates to the type of district based on Chapter 4 of the Property Tax Levies –

Operations Manual from the WADOR.

For example, the levy for the county current expense fund cannot exceed $1.80.

$5.90 Limit

The aggregate regular levy rate of certain local senior and junior taxing districts (not including the state, port districts, public utility districts, emergency medical levies, affordable housing districts, and conservation futures, county ferry districts, criminal justice, regional transit authority, transit levies and park & rec levies) cannot exceed $5.90. RCW 84.52.043

1% Constitutional Limit

o Washington's State Constitution limits the regular combined property tax to 1% of its true and fair market value (not including port districts and public utility districts). RCW 84.52.050

1% Levy Limit (Initiative 747)

Initiative 747 (I-747), which was approved by voters in 2001, changed the amount a taxing district may levy. The regular property tax levy of a taxing district is limited to 101% of the highest levy since 1985, plus amounts attributable to new construction, increases in state assessed property and annexations to the district. Prior to I-747, the limit was 106% per Referendum 47. Please note that the initiative does not affect assessed values; it limits the amount a district may levy.

School District Enrichment levy (Excess Levy | TVE)>Local school funding in excess of basic education. Levy the lesser of District Certified Amount, or Maximum Statutory Limit $2.50 or Per Pupil Limit + refund.

Fund>Aumentum calculates the Levy Rates at the District Levy Level due to limitations within the law for Regular levies. Then the rates will be distributed to Funds for Washington State.

Funds are charging level accounts in Aumentum.

The configuration must include the association of Funds to District Levies for proper “fund charging” allocations.

The Treasurer takes ownership of creating the Funds for Snohomish.

The Assessor does not “manage” the funds that are associated with the Levies; however, the Levy Comptroller will communicate directly with the Treasurer when a new fund is created and will define the cross-reference of the District Levy to the Funds that are associated.

The Levy module will calculate the Levy Rates and distribute the rates to the funds prior to extending charges.

The Treasurer receives the payments and distributes the funds to the accounts of the appropriate taxing districts

Earmarked Funds

Earmarked funds are generally levies created for very specific purposes or services. They may be from within a district’s regular levy like the City Accident Fund, or they may be a small, standalone levy for raising money to buy conservation property. In general, a district will devote the funds raised to the specific purpose to which it dedicated the funds for, not for the day-to-day operation of districts.

Transfer of Funds between DistrictsRCW 39.67.020

Diversion of Road Funds

During the budget-setting process, the county legislative authority may divert funds obtained by the general road levy for current expense account purposes. The funds must be placed in a separate and identifiable account within the county current expense fund. Diverting road funds does not affect the levy limit or the levy rate for the county general levy or road levy because funds are diverted after the levies have been set. Because the county general levy is not adding the amount of the diversion to its levy, the funds from the diversion can be used only for services provided in the unincorporated area of the county.

RCW 36.82.040 General tax levy for road fund -- Exceptions. RCW 36.33.220 County Road property tax revenues, expenditure for services authorized Local school funding in excess of basic education.

Levy the lesser of District Certified Amount, or Maximum Statutory Limit $2.50 or Per Pupil Limit + refund.

Equalization Factor > Equalization factor types allow for the adjustment of assessed property values based on various variables, including specific property characteristics. For instance, in County X, property characteristics such as neighborhood and size are tracked in property accounts. In 2004, residents in a particular neighborhood successfully appealed their property values, claiming that they were over-appraised by 10%. To address this, the County could create an equalization factor type for that specific neighborhood and generate an equalization factor record for the 2004 tax year, setting the value to 0.90. The value rule would then be modified to incorporate this factor into the calculation, resulting in a more accurate assessment of the property values.

Implicit Price Deflators (IPD)

-

A Levy Limit

-

IPD is for the limit factor (% increase up to 1% for the highest lawful levy)

-

Implicit price deflator, a measure of inflation used in the calculation of levy limits

-

-

Real & Personal Property Tax Ratios

-

Real and Personal Property ratios are for the 1% Constitutional Limit.

-

A variety of situations can cause the 1 percent limit to be exceeded.

-

-

The county's indicated ratio results show the personal property ratio is higher than the real property ratio by several points. The personal property ratio controls the limit because it is higher. The real property, by its volume, causes the state school levies to go up. When a real or personal property ratio is low, the assessor must raise the state levy to generate the same amount of money had the assessment ratios been at 100 percent.

Levy Basis Value >A taxable value, in aggregate, of all the properties against which a levy is to be applied.

Initial Tax Rate >The raw charge per unit of the Levy Basis Value required to produce the levy. This is computed by dividing the Levy Basis Value into the Requested Levy amount.

Intermediate Tax Rate >The rate obtained by dividing the Levy Basis Value into the Adjusted Levy amount.

Rate Modifier >A value that reduces or increases the Intermediate Tax Rate. The rate my be increased or decreased because of statutory rate limits and external revenue sources (see also Levy Modifier), or because services are not provided in certain areas that fall within the taxing authority's purview.

Final Levy Rate >The rate obtained by applying Rate Modifiers to the Intermediate Tax Rate. Levy Rate = (Taxing Authority's Budget) / (Taxable Value in the Taxing Authority's Jurisdiction)

Related Topics

Rate Calculation by Tax Authority Group Report

Rate Calculation by Tax Authority Report

Prerequisites

Levy Management

-

Levy Maintenance must be completed for the year prior to tax rate calculation.

-

Levy Value Build - A levy value build is required for tax rate calculation.

-

Funds - Fund configuration is required to complete association to the appropriate Levy District.

-

Tax Authorities - Tax Authorities (Districts) configuration is required to complete associations to District Levies and TAG Levies.

-

TAGs - Tax Code Area configuration is required to complete associations to District Levies and TAG Levies. For Washington State, the TAG configuration will solely be managed in the TAG Levies page of Levy Maintenance.

The variance tolerance must be defined for tax rate calculation on the Maintain Levy Request screen.

-

Go to Configuration > Application Settings > Maintain Application Settings.

-

Select the setting type of Effective Date and the filter by module of Tax Levy Management.

-

Click Edit on the Tax Rate Variance Tolerance application setting and set the tolerance as applicable.

-