Tax Estimator

Tax Estimator

Navigate: Tax > Levy Management > Tax Estimator

Tax > Levy Management > Tax Estimator

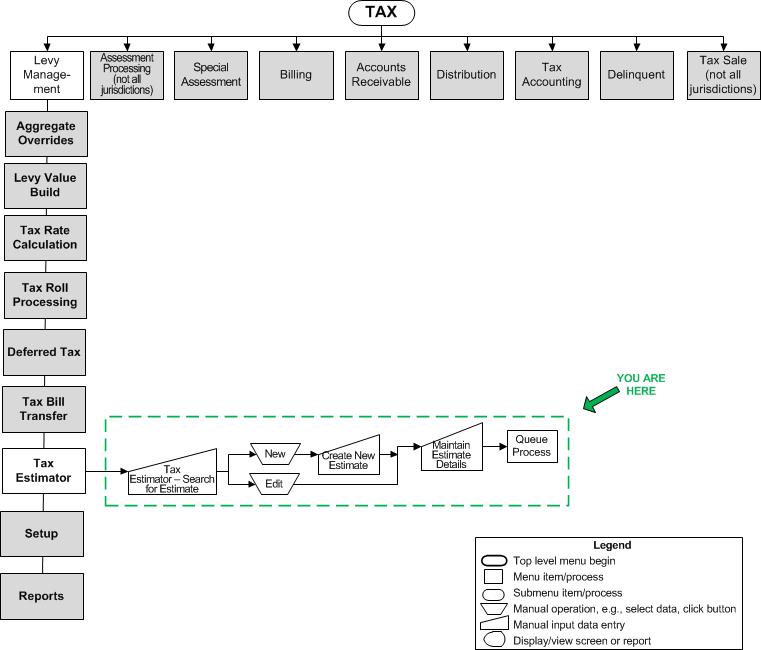

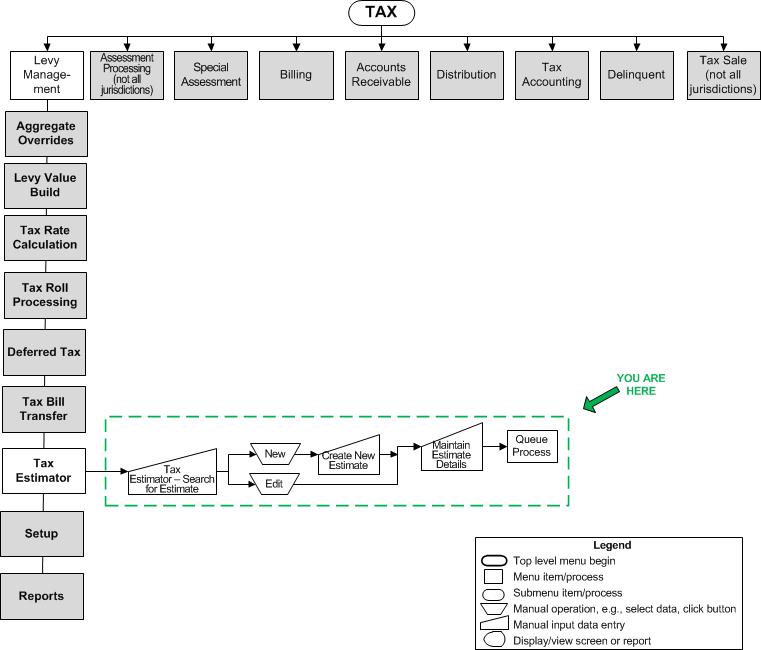

Navigation Flowchart

Navigation Flowchart

Here is a flowchart of Levy > Tax Estimator. Obvious actions, such as Previous and Close, are not included in the flowchart. The Common Action links are included only if necessary for task completion.

Description

NOTE: This task may not apply to your jurisdiction.

This task provides a process to bill for the portion of the property being split, prorated over the remaining months in the current tax year. Use this task for a property split due to eminent domain and the need to collect an estimated tax bill for the split portion prior to the annual roll being available from the property appraiser.

The charge is collected as surplus. Since it is not to be disbursed, it is only held in surplus to pay next year’s actual charges.

Because these advance billings occur after the lien date, they are always prorated for the remainder of the assessment year. To accomplish this, the current appraised values are used to calculate assessed and taxable values, which are then prorated for the remainder of the year.

Taxes are extended against the prorated values using the most recent tax rates for the TAG, and the estimated taxes are printed on a tax bill form. The taxpayer is required to pay the estimated tax, but the tax is not entered as receivable in A/R because the tax roll has not yet been prepared. Instead the amounts are collected and attached to the property and escrowed.

Jurisdiction Specific Information

Jurisdiction Specific Information

PTOC

- The ability to compute prorated values and estimated taxes with the results available to print on a tax bill form is available. To accommodate this, Levy now executes the following additional processes:

-

Calculates the estimated taxable values based on the data entered.

-

Calculates the estimated tax amounts based on the data entered.

-

Optionally create a miscellaneous charge in Accounts Receivable for collection.

-

Prints the tax bill.

-

Payments are collected into surplus and then after taxes are calculated in the subsequent year processing to be applied against the calculated taxes.

-

Fees for Manufactured Home (Authentication Fee and CTD) are applied against the levy bill before the estimation. Flags are added to the properties so that they can be used for later processing to potentially abate (or refund) taxes for the next year after the advances are applied to estimated taxes.

-

If the Assessor has the new valuation and levy, then it is calculated on that. If it is early in the year, and the current year’s valuation and levy is unknown, the prior year’s valuation and levy (as directed by statute) are used.

-

To accommodate this, four new estimation types (system-define systypes) were created for the Estimation Types dropdown field on the Create New Estimate screen (Tax > Levy Management > Tax Estimator > Tax Estimator - Search for an Estimate > Create New Estimate): 1.) Manufactured Home (destruction or relocation); 2.) Government Acquis/Change, 3.) Change to Taxable (exempt), and 4.) Personal Property Trust Fund (sale, relocation or closure of assets). In addition, new UDFs have been created for each of these four types and are available on the Data Entry tab of the Maintain Estimate Details screen (Tax > Levy Management > Tax Estimator > Tax Estimator - Search for an Estimate > Create New Estimate > Maintain Estimate Details).

-

Setup: Only the description, display order, and whether the systype is selectable for the four new estimation types can be changed via Configuration > Systypes > Select or Add a Systype. Set the effective date and select the systype category of Estimation Type. Click on any of the four estimation types to navigate to the Edit a Systype screen on which you can maintain the Description, Display order, and the Selectable checkbox.

-

The Maintain Estimate Details screen, which is the final screen in this process, includes a UDF field called Authentication Fee on the Data Entry tab. Define the data for the Full Assessed Value field and the Authentication Fee, and click the Calculate button. Once complete the Calculation tab shows the Estimation Net Tax Amount. The Prorated Taxes on the Data Entry tab match the Estimation Net Tax Amount. Also, a Print MH Authorization Form checkbox and the existing Print Estimated Bill checkbox enable printing of the form and the estimated bill when checked. Click the View Report button (top of screen) to generate the reports.

Steps

-

Search for an existing estimate.

-

Create a new estimate.

-

Maintain details for an existing or new estimate.

Tax Estimator

Tax Estimator![]() Jurisdiction Specific Information

Jurisdiction Specific Information