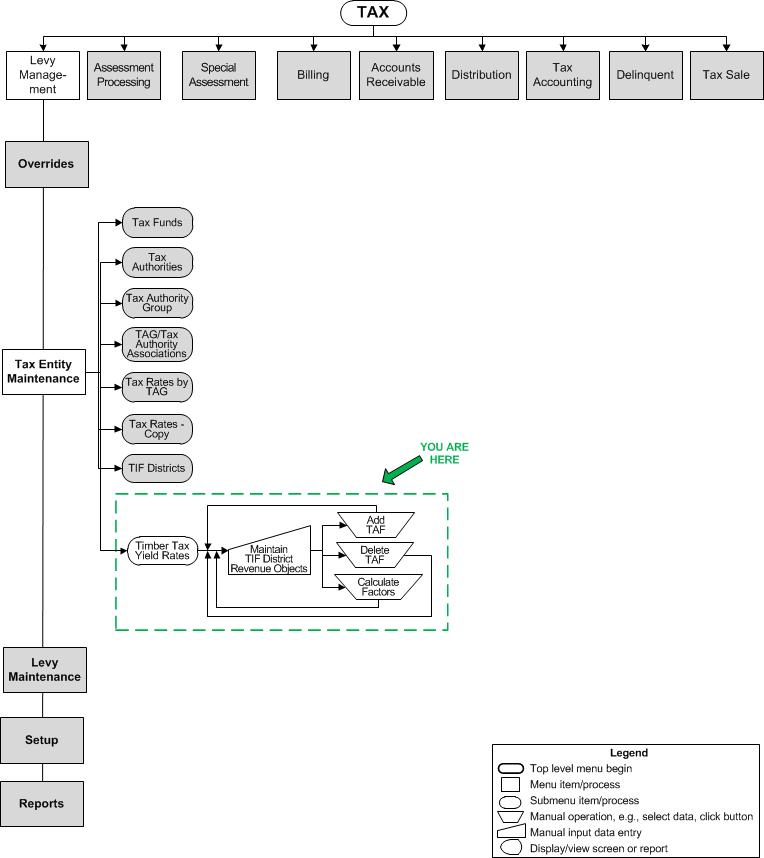

Maintain Timber Tax Yield Rates

Maintain Timber Tax Yield Rates

Description

NOTE: This task may not apply to your jurisdiction.

Any changes to the BOE Change Notice that affect a TRA or district associated with the Timber Yield Tax generate an alert. This screen is used to maintain timber tax yield rates.

When a TAG-TAF relationship related to the Timber Tax matrix is removed, the TAG-TAF item is moved to the workflow queue for review and action. Alerts are generated on this screen when a:

-

TAG or TAF has been removed that is associated with a Timber Tax.

-

TAF that is associated with a Timber Tax is moved from its associated TAG to a new or different TAG.

An apportionment factor generation process produces and publishes the certified Timber Yield Tax apportionment factors to Aumentum Distribution. A Timber Yield Tax Apportionment Factor group was created for this process.

SETUP: See Levy Management, Levy Management Setup, and Timber Tax Yield Rates for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Accept the current date default or select the Tax Year.

-

Click Add TAF to expand the panel to include a TAF dropdown field.

-

Select the TAF from the dropdown.

-

Click Delete TAF to remove the TAF.

-

-

Click Apply.

-

Once a TAF is selected, an arrow becomes available to the left of the panel. Click the arrow.

-

Click Add TAG to expand the TAG panel.

-

Select the TAG from the dropdown.

-

Click Change TAG to change it and select a different TAG.

-

Click Delete TAG to remove it.

-

-

Define the Rate if not already defined or if changing it.

-

Click Copy Rate to copy the rate to another TAG.

-

Click Edit Rate to edit the rate.

-

-

Click Apply.

-

Click Calculate Factors (right panel) to perform a calculation of the defined factors and display the results in the Calculate Factors panel.

-

Click Save.

-

Click Close to end the task.

-

Common Actions

None.