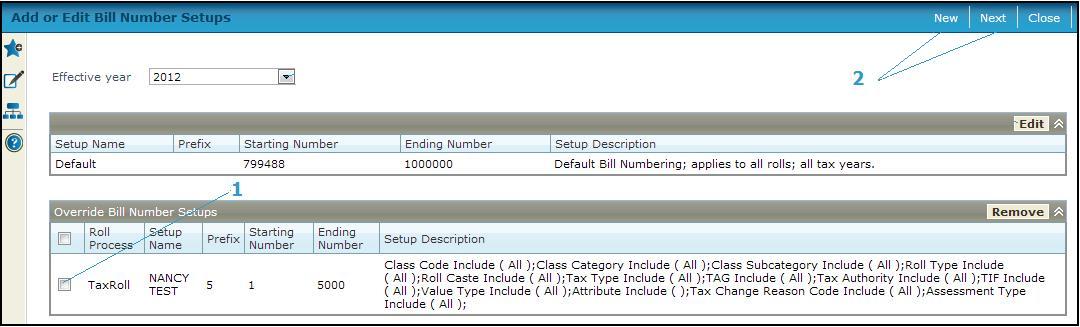

Add or Edit Bill Number Setups

Add or Edit Bill Number Setups

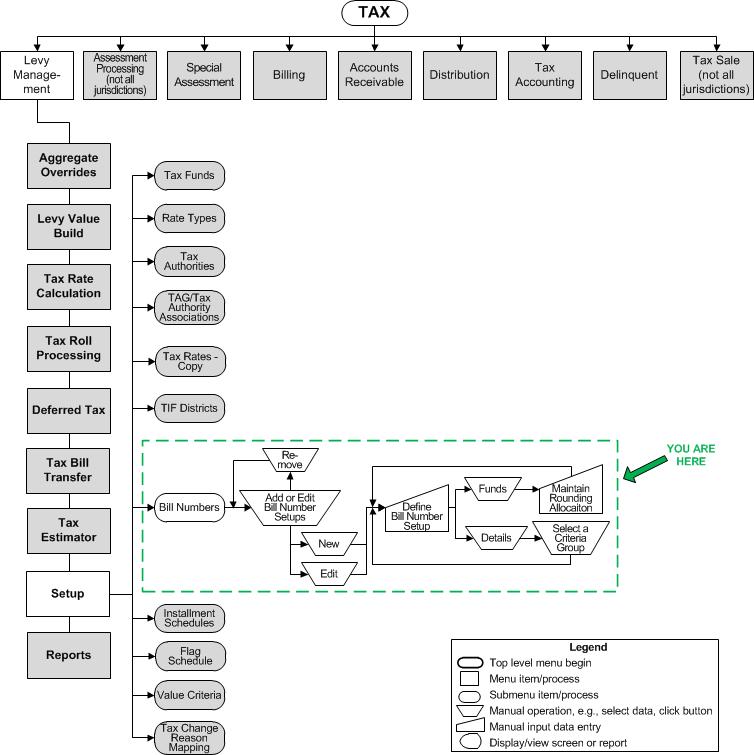

![]() Navigation Flowchart - Roll-Based Assessment

Navigation Flowchart - Roll-Based Assessment

![]() Navigation Flowchart - Event-Based Assessment

Navigation Flowchart - Event-Based Assessment

Description

The existing bill number setups are listed. One default setup is provided; you can edit only certain attributes of the default. You can create any number of override setups for use with revenue objects meeting certain user-defined criteria.

The default bill number is comprised of an optional text prefix, then a sequential number. The bill number length controls the final length of the numerical portion of the number. The number is left padded with zeroes to make the number of digits match the number specified in the bill number length field. After that, the prefix is prepended to the string.

![]()

![]() For example, a prefix of blank, a bill number length of 6, and a bill number of 250 would generate a bill number of 000250. A prefix of ABC, a bill number length of 6, and a bill number of 250 would generate a bill number of ABC000250.

For example, a prefix of blank, a bill number length of 6, and a bill number of 250 would generate a bill number of 000250. A prefix of ABC, a bill number length of 6, and a bill number of 250 would generate a bill number of ABC000250.

SETUP: See Levy Management, Levy Management Setup, and Bill Numbers for any applicable prerequisites, dependencies and setup information for this task.

Steps for Defining a Bill Number Setup by Value Criteria Group

NOTE: When rounding on exempt parcels with special assessments, to avoid creating LNTC tax on exempt parcels, you can define a Bill Number Setup by Value Criteria Group. To do this:

-

Go to Tax > Levy Management > Setup > Value Criteria > Add or Edit Value Criteria Groups.

-

Click Add to set up a new Value Criteria.

-

Enter a Value criteria group name and click Add.

NOTE: Make sure the Required value type criteria checkbox is selected. -

Select the Value type roTMV - RO TMV Total and click Update and Save.

-

Go to Tax > Levy Management > Setup > Bill Numbers > Add or Edit Bill Number Setups.

-

Select the applicable Effective year. Click Edit for the Default setup to navigate to the Define Bill Number setup screen.

-

Change the Ending number to 50000000 and click Save, then click List.

-

Click New on the Add or Edit Bill Number Setups screen. Verify you have selected the correct Tax year and click OK.

-

Enter a Setup name and Description.

-

Enter a Starting number of 50000001 and an Ending number of 99999999.

IMPORTANT: Bill Number Schedules cannot have overlapping Bill Number Ranges. Optional Bill Number ranges could be 1 - 50000000 for the Default schedule, and 50000001 - 99999999 for the new bill number setup.

IMPORTANT: Bill Number Schedules cannot have overlapping Bill Number Ranges. Optional Bill Number ranges could be 1 - 50000000 for the Default schedule, and 50000001 - 99999999 for the new bill number setup.

-

Select the Value type criteria group you created.

-

Select to round to the Nearest Dollar.

-

Select the criteria group to use.

-

Click the Common Action Criteria Group Setup to create a new group.

-

Verify the Roll Process is Tax Roll Processing and the Apply Rounding To Specials checkbox is unselected.

-

Click Save.

Steps for Default Setup

The default bill number setup is not tax-year specific.

-

Select the Effective year or accept the current year default.

-

Click Edit in the Default Setup grid to change the settings for the default setup on the Define Bill Number Setup screen.

OR

Click New to create a new bill number setup on the Define Bill Number Setup screen.

Steps for Override Setups

-

Select one or more existing setups from the Override Bill Number Setups grid.

-

Click Next to access the Define Bill Number Setup screen,

OR

Click New to add a new override setup on the Define Bill Number Setup screen.

-

-

Click Close to end the task.

-