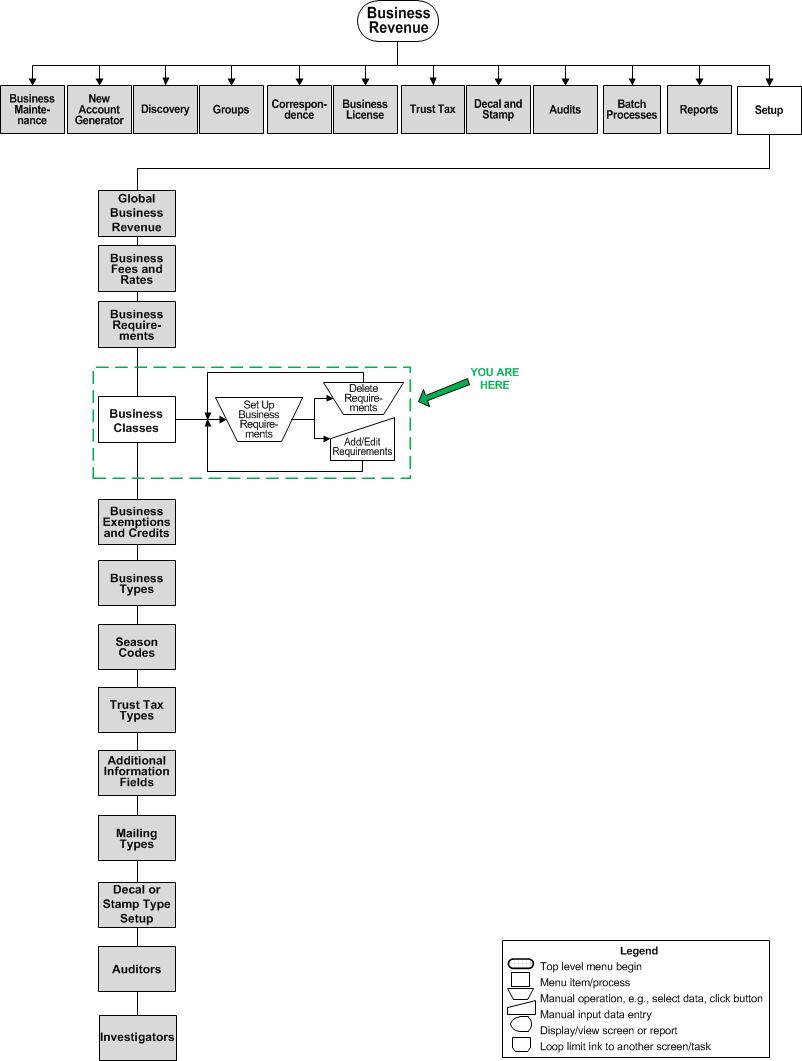

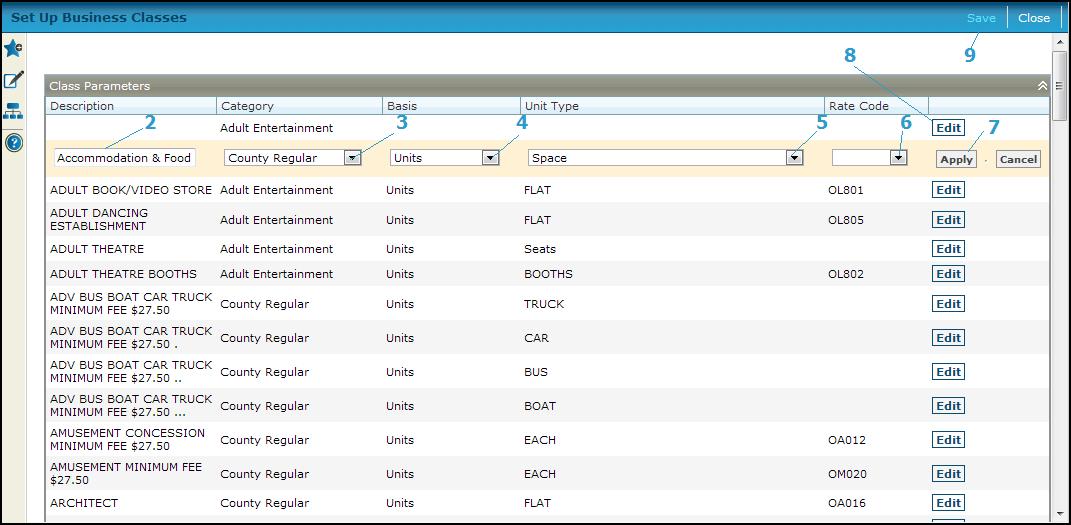

Set Up Business Classes

Description

Set up the business classes for organization and reporting. This is the highest level of organization of the business. Some examples of business classes are retail, wholesale, service, or internet. Then within each class, businesses are identified with more detail by the business type.

The class codes are assigned values for basis, unit type, and rate that serve as the default values for a business type associated with the class.

SETUP: See Business Revenue and Business Setup for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

Click Add in the Class Parameters panel title bar to add a new class code, or click EDIT in a grid row to edit an existing class code.

-

Enter a unique Description for the business class.

-

Select the Basis for the class, such as gross receipts or units, and select the Unit type for the class, if the basis is unit.

-

Select the Rate code for the class. The rate code is associated with the type; it is optional here. When used, it becomes the default rate code for the type when the class is selected. Repeat these steps for additional classes

IMPORTANT: When editing an existing business class, do not change the rate code without understanding the effects of the action. Please check with your Support Representative.

-

-

Click Apply to finalize the class.

-

Click Cancel to discard any changes to the class..

-

-

-

Click Delete to remove a class from the grid. NOTE: You cannot delete a class that has business types assigned to it.

-

-

Click Save to save the classes.

-

Click Close to end the task.

-

Tips

The following items need to be defined before setting up business types:

-

-

Rate codes

-

Basis types (systype)

-

Unit types (systype)

-

No entry is required in the basis, unit type, or rate code fields.

Valuable Vocabulary