Print Trust Tax Detail Report

Navigate:Business Revenue > Reports > SRS Trust Tax Reports > Print Trust Tax Return

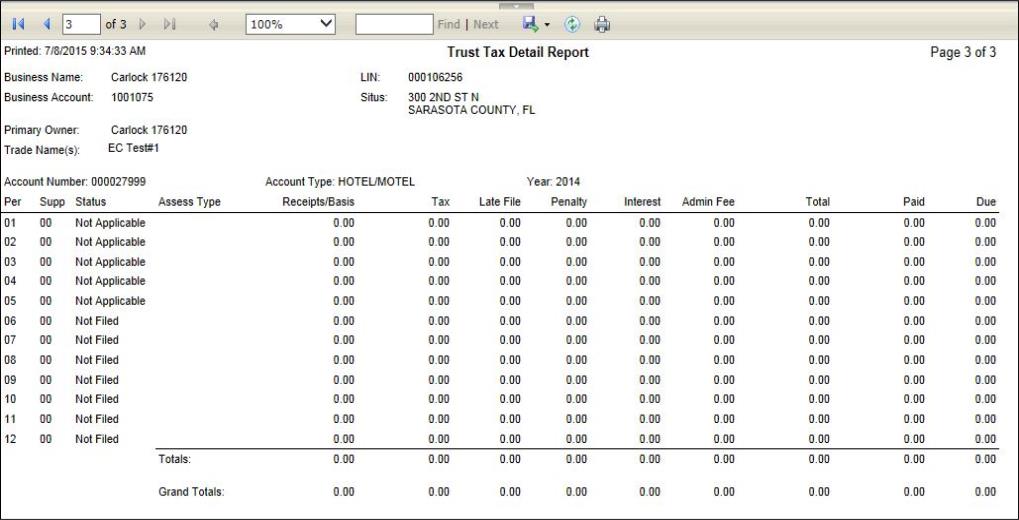

Description

This is a report of details for each period including tax, interest/penalty, fees, paid, and due. The amounts included in the report are based on the posting results of either reported or actual as defined on the Process Trust Tax Returns screen.

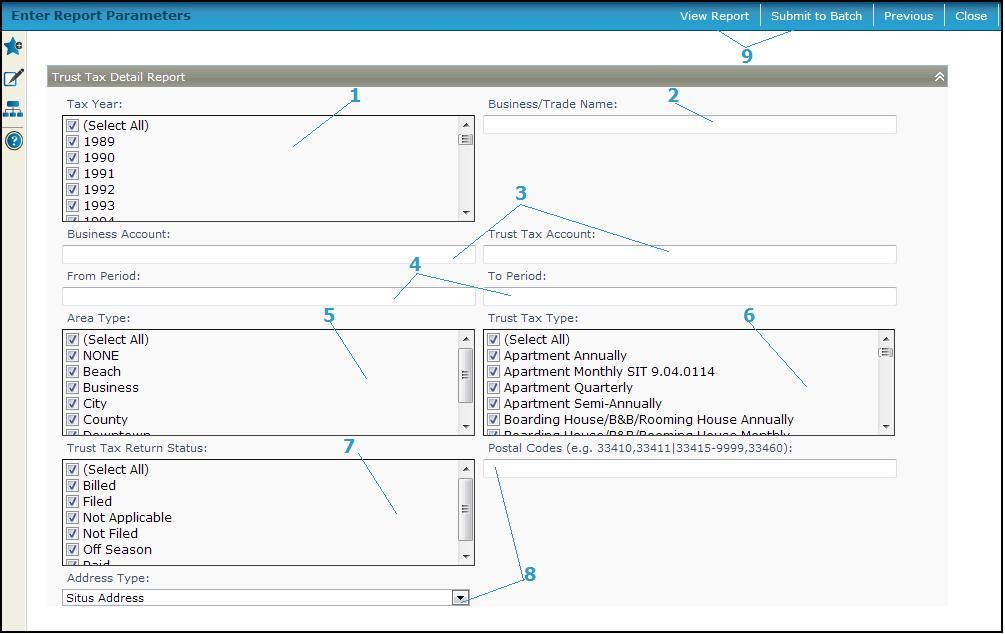

NOTE: You must minimally select a Tax Year to generate the report. All are selected by default.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Steps

-

Select the appropriate Tax Year from the list of all tax years.

-

Report on a single Business/Trade Name by typing the correct name.

-

Enter a BusinessAccount number or a Trust Tax Account number to report on a single business.

-

Define a From Period and a To Period.

-

Select one or more Area Type.

-

Select one or more Trust Tax Type for the report.

-

Select one or more Trust Tax Return Status for the report, such as billed, filed, paid.

-

Select the Address type, either Situs Address (default) or Mailing Address, to filter the postal code, and enter the Postal Code to generate a report of accounts by postal code. Various formats and mixes are accepted for the postal code, for example:

-

32828

-

32828, 32829, and 32830

-

32828-1024

-

32828-1024, 32828-1025, and 32828-1026

-

32828-1024, 32828-1025, and 32828-1026

-

32828, 32829, between 32830 and 32845,32850

-

32828-1024, between 32828-1025 and 32828-1045, and 32828-1026

-

Click View Report to generate the report in a separate browser window, or click Submit to Batch to open the Monitor Batch Processes screen on which you can view the progress of the report. When completed, click the report in the grid to open the View Batch Process Details screen, and click the report to open it. Click Close to close the batch screens

-

Click Previous to return to the list of SRS Trust Tax Reports.

-

Click Close to end the task.