Reverse Refund

Navigate:  Tax > Accounts Receivable > Manage Payments > Reverse Refund

Tax > Accounts Receivable > Manage Payments > Reverse Refund

Description

This screen displays refunds matching the search criteria specified on the Search for Payments/Surplus screen. Use the Reverse Refund screens to reverse a refund existing in the system but that has not yet been paid to the customer.

NOTE: You can also reverse a refund after it has been exported in Tax Accounting.

Steps

-

On the Search for Payments/Surplus screen, enter search criteria in one or more fields and click Search.

-

On the Select Funds to Reverse screen, the Business date field defaults to the current date. You can change this date if necessary.

-

Make a selection from the Reversal reason drop-down list (required).

-

In the Search Results panel, select the checkbox for each of the refunds you want to reverse.

NOTE: Select the checkbox in the panel's header row to select all refunds.

-

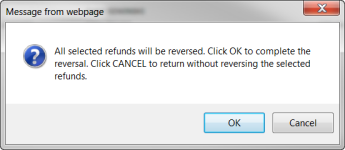

Click Reverse in the Command Item bar. A message prompt displays.

-

Click OK on the confirmation message to continue with the reversal. The message Reverse Refunds information was saved successfully is displayed when the process is complete and the refunds are removed from the panel.

-

Click Cancel to close the message without reversing the refund.

-

Click Restart to return to the Search for Payments/Surplus screen.

-

Click Close to end the task.

Prerequisites

Configuration Menu

- Click Configuration > Systypes.

- On the Select Systypes screen, start typing Refund Reversal Reason Codes in the Systype Category drop-down list to select it.

- See Systypes to learn more about adding and editing items in the grid.