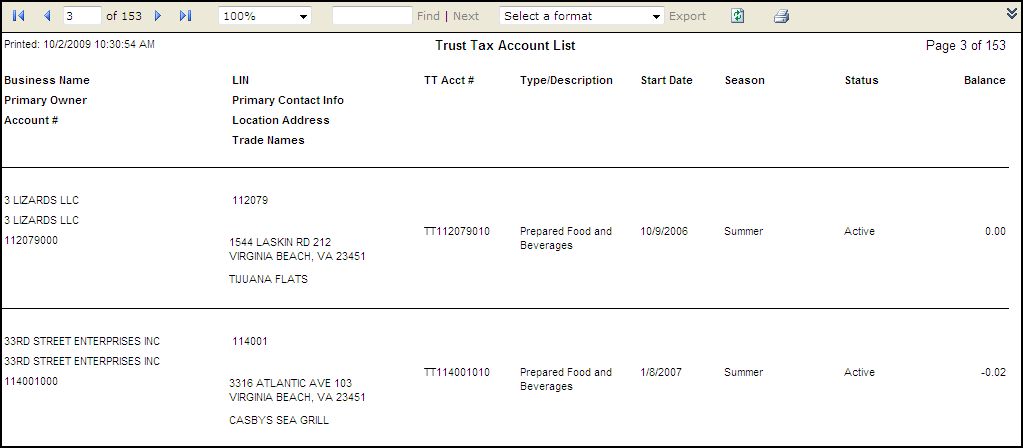

Trust Tax Account List

Navigate:Business Revenue > Reports > SRS Trust Tax Reports > Trust Tax Account List

Description

This SRS report for Trust Tax shows the trust tax accounts with their statuses and balances.

Steps

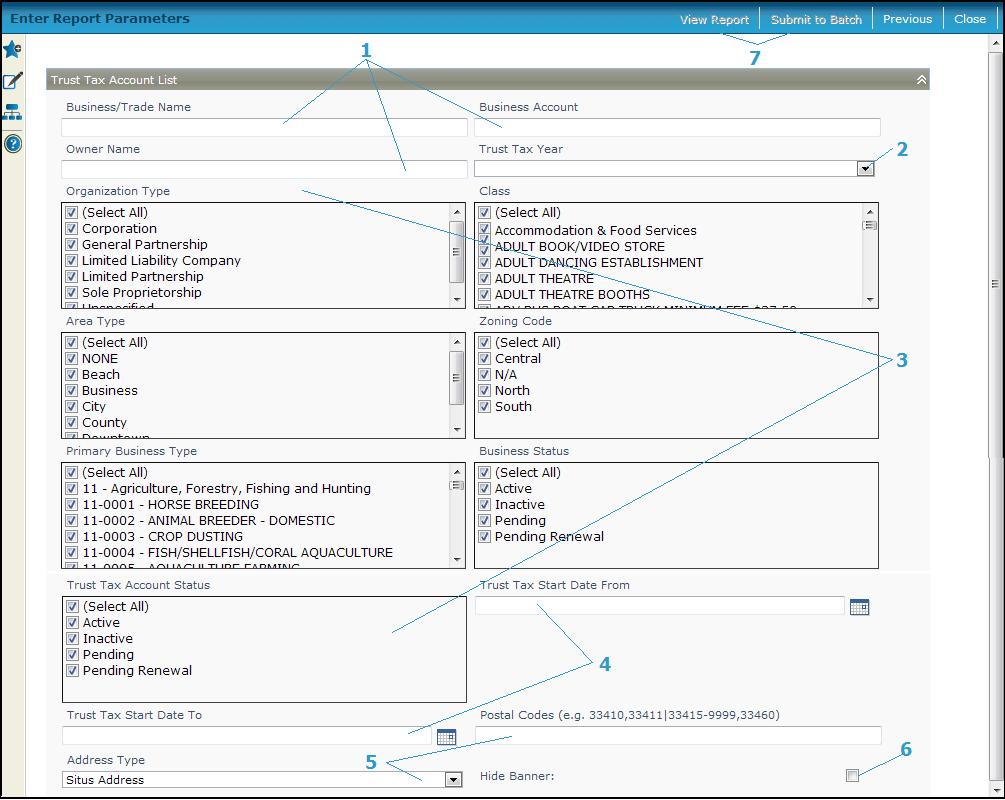

You must minimally select a Trust Tax Year to generate the report. All other parameters are optional.

-

Enter a Business/Trade Name, Owner Name, and/or Business Account Number to report on a single business. Leave blank to report on multiple businesses.

-

Select a Trust Tax Year.

-

Select an Organization Type, Class, Area Type, Primary Business Type, Business Status, and/or Trust Tax Account Status to report on business licenses matching all selections.

-

Enter a Trust Tax Start Date From date and a Trust Tax Start DateTo date or select the dates from the date picker.

-

Select the Address type, either Situs Address (default) or Mailing Address, to filter the postal code, and enter the Postal Code to generate a report of accounts by postal code. Various formats and mixes are accepted for the postal code, for example:

-

32828

-

32828, 32829, and 32830

-

32828-1024

-

32828-1024, 32828-1025, and 32828-1026

-

32828-1024, 32828-1025, and 32828-1026

-

32828, 32829, between 32830 and 32845,32850

-

32828-1024, between 32828-1025 and 32828-1045, and 32828-1026

-

Check the Hide Banner checkbox to hide the parameter banner information from the report cover page.

-

Click View Report to generate the report in a separate browser window, or click Submit to Batch to open the Monitor Batch Processes screen on which you can view the progress of the report. When completed, click the report in the grid to open the View Batch Process Details screen, and click the report to open it. Click Close to close the batch screens.

-

-

Click Previous to return to the list of SRS Trust Tax Reports.

-

Click Close to end the task.

-