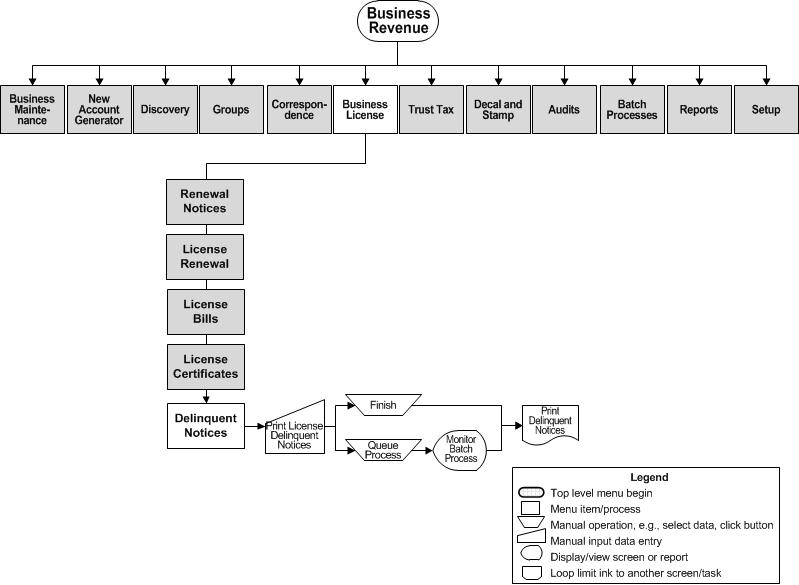

Delinquent Noticesfor Business Revenue

Description

NOTE: This task may not apply to your jurisdiction.

Use this task to print Business Tax/Tourist Revenue (BTR) notices and have the data as part of the extract file process. Generate both the report and file using this task.

Steps

-

Queue the notices on the Print License Delinquent Notices screen.

Setup and Prerequisites

Prerequisites and Setup

-

You can download and maintain the datasource for correspondence via Reports and Interfaces > Data Services.

-

Then manage the report setup and template via Reports and Interfaces > Correspondence > Report Setups.

-

Use the Manage Templates (Reports and Interfaces > Correspondence > Report Setups > Manage Templates) to select the existing associated datasource, or upload the datasource you maintained, and associate the report setup and template with the data service.

Configuration Menu

-

Application Settings

-

-

Maximum upload file size (Common) - This setting is also shared by Import Tax Bill Addresses for Mail Presort, Select Bills or Revenue Objects, Import Lender Revenue Objects in Billing, and A/R Batch Collection imports.

Note that this application setting needs to accurately show the IIS limit on import/export file size. Changing this application setting in Aumentum does not change the file size allowed in IIS. IIS must be changed first and then this application setting changed to correspond to IIS. Changing it in IIS requires a system administrator or appropriate Aumentum personnel.

-

-

NOTE: Do not change the following Correspondence application settings:

-

-

Delinquent

-

DelinquentAdditional

-

DelinquentWarrant

-

DelinquentRedemption

-

Delinquent Menu

-

Perform the steps to generate the correspondence via Tax > Delinquent > Correspondence > Notices.

Troubleshooting for Manage Correspondence Files

-

If Access denied or similar messages are displayed it usually means that the user under which Aumentum is running cannot create the correspondence folders. This user was specified when IIS was installed or when it was last configured.

-

-

For IIS 5.1 it is usually SYSTEM.

-

For IIS 6.0 it is usually ASP.NET.

-

For IIS running on a laptop or standalone machine it could also be the domain\username of the machine.

Use Internet Information Services and the DirectorySecurity tab of the website to determine this user. Please also consult with your Support Representative for assistance.

-

-

Also, ASP.NET is included as part of the machinename/Users group. So giving full access to machinename/Users will also work if the user is ASP.NET.

-

Once the user is determined, please give full rights to the Aumentum Reports folder to solve this issue.

-

Make sure that the Reports/Correspondence folder and all its subfolders do not have the Read-only attribute selected in its properties; If so, clear the Read-only checkbox.

Troubleshooting Notices

-

No subdivision prints on the notice when using DelinquentAdditional_Datasource.htm:

-

-

Two Delinquent module application settings must be set for subdivision information to show when using DelinquentAdditional_Datasource.htm for correspondence. These two application settings map where to get this information from the Records module:

Subdivsion Header Type

Subdivision Description Detail Type. -

Both must be filled in. If NOT set then no data will be displayed.

-

If the application settings are correctly set but no data is found, then 'Unknown Subdivision' will print instead of the subdivision name for those bills missing that data.

-

-

Net taxable value is not showing in the notice when using DelinquentAdditional_Datasource.htm.

-

-

Map the net taxable value in the ValueType table. This is done through Levy Management > Setup > Value Type Mapping. If this is not mapped, then net taxable value will not show in the Delinquent Additional Datasource.

-

-

Error when printing notice: "Could not find file <templatename>.doc

-

-

When uploading the correspondence file make certain it is uploaded to the correct matching process. For example, if you create a Word template using DelinquentAdditional_DataSource.htm, then upload the template to the DelinquentAdditionalProcess.

-

-

Owner as of delinquent date does not print on notices.

-

-

If no owner prints in the notices, then step 1 (below) was probably not completed properly.

-

-

Set up the delinquent date in the Functional Calendar before performing the tax roll processing (which creates the dates needed for Correspondence.)

-

Select "Owner as of delinquent date" in the Defendant Information dropdown field of Create a Delinquent Notice.

-

-

To test for correct setup of the delinquent date, run this query. It must return a valid value. If it returns no value, then set up the delinquent date as specified in step 1 above.

select max(bd.datevalue) from taxbilldates_v bd where taxbillid = x and bd.eventtype = 152501

-

Valuable Vocabulary