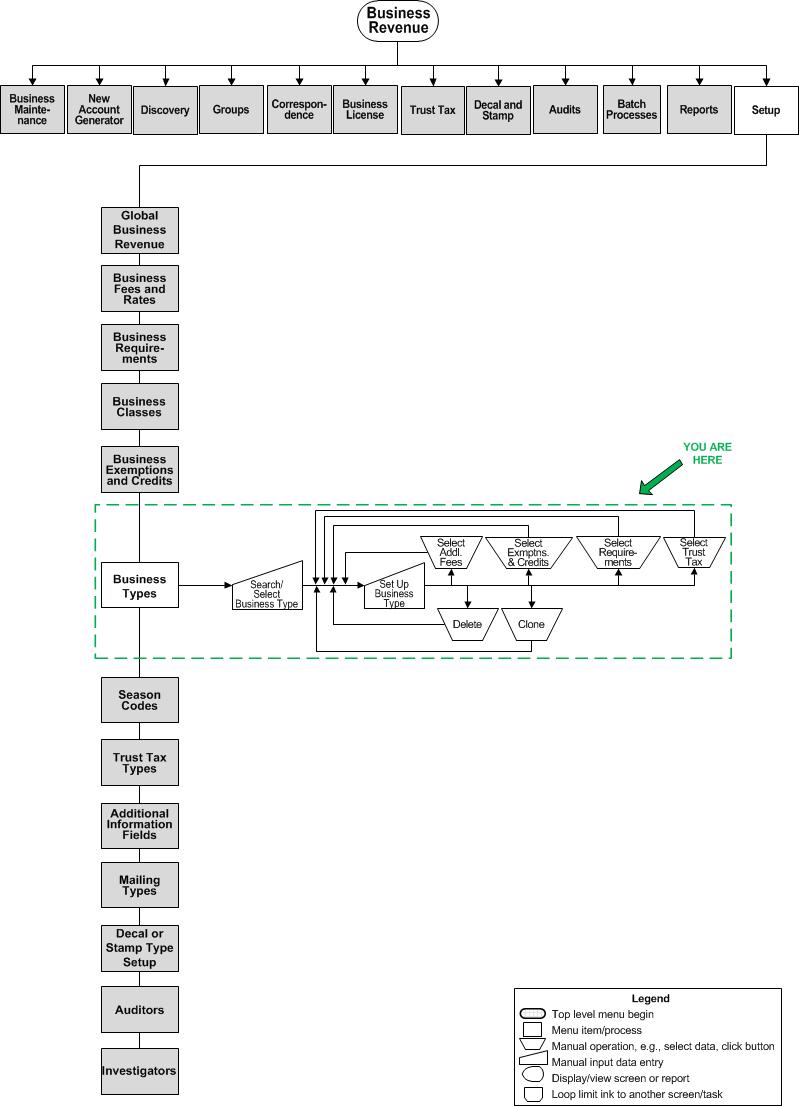

Business Types

Description

Set up the business type codes; currently the business type codes use the NAICS or SIC codes. Business types are contained within business classes to classify the type business activity, license, or trust tax.

Business types are defined during setup after rates and fees and proration schedules, are associated with a business class, and are assigned other requirements and characteristics.

You can decide whether to use NAICS (North American Industry Classification System) codes (or SIC), depending on the set up in Configuration's Application Settings. When using NAICS or SIC, the codes are pre-loaded for you during system setup.

NOTE: You can also manage the NAICS code

in the Property Information panel of the Maintain

PPA Accounts screen if our jurisdiction has the Personal Property

Appraisal module.

IMPORTANT: The NAICS

code is applied at the tax year level, not the account level, even though

you can define it on the Maintain

PPA Accounts screen.

Steps

-

Search for Business Type - Find the NAICS or SIC code to use.

-

Set Up Business Type - Assign to the NAICS or SIC code the rate, proration, related codes, and requirements.