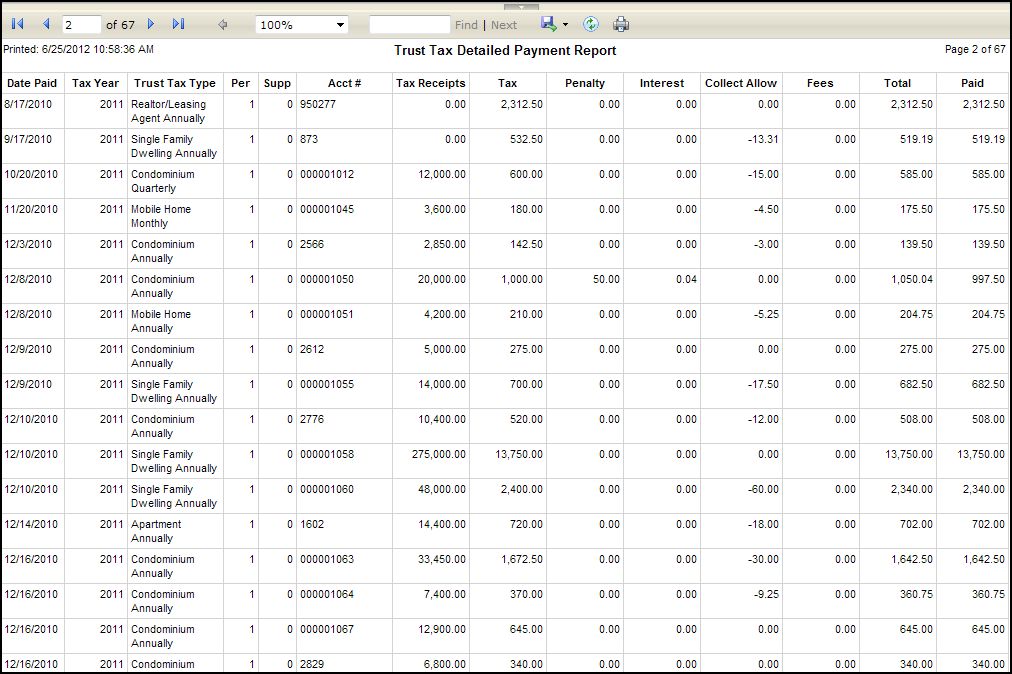

Trust Tax Detailed Payment Report

Navigate:Business Revenue > Reports > SRS Trust Tax Reports

Description

NOTE: This report may not apply to your jurisdiction.

Generate a report on Trust Tax (TDT) collections by year/period within a given time frame. Reporting includes:

-

Date paid

-

Tax year

-

Trust tax type

-

TDT period to which payment was applied,

-

Supplemental number to which payment was applied, if applicable

-

Account number

-

Amount of taxable receipts, calculated tax, penalty/interest, sum of fees, if any, amount of collection allowance, and sum of total of tax through fees on the return

-

Amount paid towards the filed return on the date from Accounts Receivable when it was collected in Cashiering.

Steps

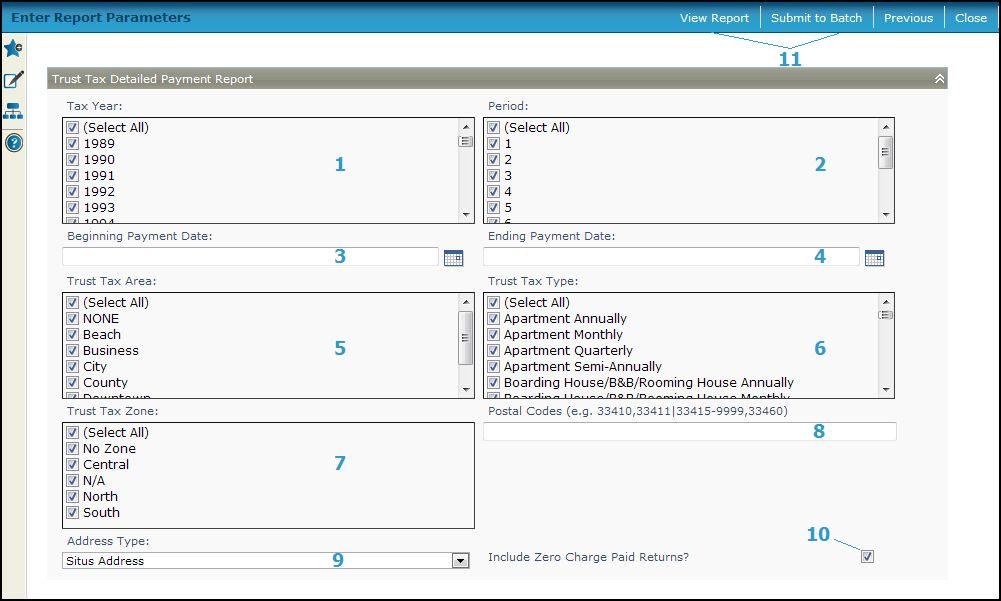

-

Select the Tax year(s).

-

Select the Period.

-

Enter the Beginning Payment Date.

-

Enter the Ending Payment Date.

-

Select the Trust Tax Area.

-

Select the Trust Tax Type.

-

Select the Trust Tax Zone.

-

Enter the Postal Codes.

-

Select the Address Type.

-

Check the Include Zero Charge Paid Returns? checkbox to include in the report any returns with a zero charge.

-

Click View Report to generate the report in a separate browser window, or click Submit to Batch to open the Monitor Batch Processes screen on which you can view the progress of the report. When completed, click the report in the grid to open the View Batch Process Details screen, and click the report to open it. Click Close to close the batch screens and return to this screen.

-

Click Close to end the task.

-

Report Samples

![]() Trust Tax Detailed Payment Report

Trust Tax Detailed Payment Report

Common Actions

None.