Sale Item Corrections

Navigate:  Tax > Tax Sale > Property Sale > Sale Item Corrections

Tax > Tax Sale > Property Sale > Sale Item Corrections

Description

Use this task to process corrections to property sale items. Cancel or void Tax Sale Certificates for Tax Sale Bills. Only sold certificates that are not redeemed and not Tax Deed Applications (TDA) are available for this process.

Steps

-

On the Search for Tax Sale Items screen, enter your search criteria and click Search.

- In the Search Results panel, select the checkbox for one or more items in the grid and click Next.

- On the Cancel or Void Tax Sale Items screen, select the Apply flag checkbox to select a flag to apply during the batch process.

- In the Selected Flags panel, click Add.

- Make a selection from the Flag type and Flag value drop-down lists.

- Enter or select the Tickler date and Start date.

- Make a selection from the Privacy drop-down list.

- Click Apply.

-

Make a selection from the Correction type drop-down list.

-

Make a selection from the Reason drop-down list. Reason is a user-defined systype. Info Center's Tax Sale Information screen displays the Reason after running the cancel/void/write-off process.

-

Click Fees in the Command Item bar open the Select Fees to Remove with Void screen to remove fees.

-

Click Process to open the Monitor Batch Processes screen.

Report Samples

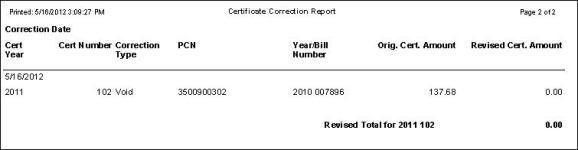

Certificate Correction Report

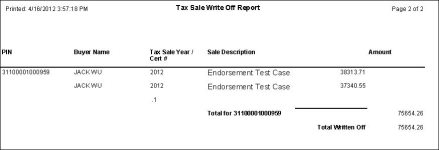

Tax Sale Write Off Report

Common Actions

Cancel Teeter Loss

Cancel Teeter Loss

- On the Cancel Buyer Payments with Teeter Loss screen, enter the receipt year and receipt number, then select a PIN.

- Click Process in the Command Item bar.

- On the View Batch Process Details screen, you can check the status of the process.

Tips

'Reason' is a user-defined Systype. Click Configuration > Systypes > Select or Add a Systype. Enter the earliest date you want to use Reasons. Select the Systype category 'Tax Sale Change Reason'. Create Reasons as needed.

The Tax Sale Participation flag is automatically removed if the tax sale item is removed from the Tax Sale (is no longer Participating).

You cannot void or cancel a tax sale bill when there are payments made against it.

Void writes off the tax sale bill and removes the tax sale payments from the levy tax bill. The payments removed are those as of the effective pay date of the tax sale item. An Accounts Receivable refund process can be used to refund the amount to the buyer.

Cancel writes off the tax sale bill only. The surplus is on the tax sale bill and is for the buyer.

Agency Certificates can be corrected this process. When canceling an Agency certificate, the charges on the Levy tax bill (Tax, fees, penalty) are written off, the Correction type of the tax sale item is set to 'Cancel' in Tax Sale Maintenance, and the Tax Sale Participation flag is inactivated for the tax sale item. When voiding an Agency certificate, the Correction type of the tax sale item is set to 'Void' in Tax Sale Maintenance and the Tax Sale Participation flag is inactivated for the tax sale item.

Be sure to set up the Functional Calendar via Configuration > Localization > Functional Calendar. Select the Tax Sale Calendar and set the Limitation Date event for the various certificates.

Calendar Periods must be set up in Tax Sale Settings for all types of sales and certificates.

Info Center's Tax Sale Information screen displays the Reason after running the cancel/void/write-off process.