Auctioneer Report

Navigate:  Tax > Tax Sale > Lien / Certificate Sale > Reports > SRS Tax Sale Reports > Auctioneer Report > Enter Report Parameters

Tax > Tax Sale > Lien / Certificate Sale > Reports > SRS Tax Sale Reports > Auctioneer Report > Enter Report Parameters

OR

Tax > Tax Sale > Property Sale > Reports > SRS Property Sale Reports > Auctioneer Report > Enter Report Parameters

Description

This report contains the fields that someone would need to conduct a tax sale if they did not have connectivity to the Aumentum system. The county may choose to use this report as the primary resource to conduct the sale or they may use it as a backup in case connectivity to the system is lost. This report may be run repeatedly before the sale to reflect any changes (changes in amounts owed or reporting on those items where the taxes have been paid).

Typically this report is printed before a Tax Sale starts.

Steps

-

Select the Tax sale you want to print the report for.

-

Select an Item choice. Choose from All items, Items participating, and Items not participating.

-

Click View Report to generate the report and display it on the screen.

OR

Click Submit to Batch if this report contains a large amount of data. You advance to the Monitor Batch Processes screen.

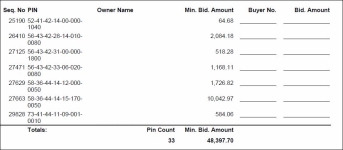

Report Sample

Tips

The Amount due in this report does not include fees setup as attached to the Levy Tax Bill in Tax Sale Settings or any fees applied via the Delinquent Fee Application task that are currently due but were calculated after the Final Advertising List was printed.

The Amount due for the Tax Bills is not updated for Tax Sale Items. The Amount due is calculated at the time the Tax Bills are added to a Tax Sale from the Final Advertising List. If you want to include penalty and interest in the Amount due, use a forecasted date when creating the Final Advertising List and adding bills to the Tax Sale.