Buyer Maintenance

Navigate:  Tax > Tax Sale > Property Sale > Buyer Maintenance

Tax > Tax Sale > Property Sale > Buyer Maintenance

Description

Use the Buyer Maintenance screen to enter and maintain information relating to Buyers and Buyer Groups for Tax Sale items.

Maintaining a Buyer

-

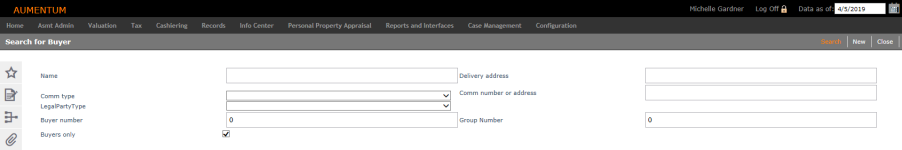

On the Search for Buyer screen, enter your search criteria and click Search.

NOTE: The Buyers only checkbox is automatically selected in order to avoid searches that may take a long time.

-

Enter the basic Buyer's information on the Buyer tab:

-

Buyer number or select to Auto assign number upon saving. The buyer number must be unique. If auto-assigning, leave the buyer number as 0.

-

Select the Safekeeping checkbox as needed. This is an indicator to determine whether the certificates are being held by the county (safekeeping = True) or if the certificates are held by Buyer (safekeeping = False).

-

Select the checkbox if the Buyer is Banned from bidding at Tax Sale.

-

Select the ACH Indicator checkbox if needed. True or False – set to true if the ACH Use Code in the import file is 1, otherwise false.

-

Enter a Vendor code. This code is used in the Tax Accounting Payment Export file. To export payments for Tax Accounting, go to Tax > Tax Accounting > Payment Export.

-

Select the Buyer type. The selections available vary, depending on your jurisdiction, and can include, for example, Individual, Agency, Group, Interested Party, Non-Profit, Agreement Sale Agency/Org, etc.

-

Enter a Temp number if necessary.

-

Select the Checked-In checkbox to indicate the Buyer is registered and actively bidding.

-

Review the Legal Party information. Legal party information is displayed from the setup in Aumentum Records Maintain Legal Party. Click Edit Party in the panel header to modify any of the information.

- The Edit Party button is not available if your user role does not have rights to the Records Non-Menu item Legal Party Maintenance.

-

Review the information in the Communication information. NOTE: If the Notify checkbox is selected, this buyer will receive the selected Notices via email to the Legal Party Email Address set up on the Maintain Legal Party screen in the Communication Information panel. Click Edit Party in the panel header to modify any of the information.

-

View any Buyer Agents which are associated with the buyer in view (Palm Beach, Florida only), if applicable. Buyer Agents include related legal parties with the relationship type of Buyer Agent. New agents can also be established by creating a new legal party.

-

Complete the following steps in the Withholding panel if a buyer is having funds withheld; the withholding is reported on the 1099. This is not required for all buyers.

-

Click Add to enter a withholding or click Edit in an existing withholding.

-

Select the type, such as IRS withholding or garnishment.

-

Select the calculation type, such as percentage or flat rate.

-

Enter the value of the percentage or flat rate. Use up to 2 decimals, if needed.

-

Click Apply to save the row of data within the Withholding panel.

-

Complete the following in the Redemption Interest panel.

-

Click Add to enter redemption interest overrides.

-

Enter a Year for the override.

-

Enter an Override Interest amount.

-

Select if you want to Apply Interest.

-

Enter an Override Withheld amount.

-

Select if you want to Apply Withholding.

-

Click Apply.

-

View/enter any alternate names on the Alt Names tab as needed. These are not used by all jurisdictions. When used, they are typically imported from the Buyer payment import file.

-

Additional cert name - the additional name to print along with the Buyer name on Certificate documents

-

Company Name of the person who registered on the internet. – informational

-

Tax return name of the entity responsible for paying taxes on interest

-

Business Name of the entity responsible to pay taxes on interest

-

Authorized agent

-

Vesting Type

-

Vesting Name(s)

-

Co-Owner Vesting Type

-

Co-Owner Vesting Name(s)

-

Add/Edit paddle numbers for each applicable tax sale on the Paddle Numbers.

-

Click Add to add a new paddle number. The Paddle Number pop-up window displays.

-

Select a Tax Sale for the paddle number.

-

Enter a Count of Paddle Numbers.

-

Click Apply. The pop-up window closes and the number of paddles you selected are added to the Buyer, starting with the next available paddle number.

-

Enter or Edit the group information on the Group tab. Enter the Group Number, if the Buyer is of type Group. Buyer type is set up.

-

Enter the Registered Sales information for the Buyer.

-

Select the checkbox if the Buyer is Approved for Public Nuisance on the Registered Sales tab.

-

Add the Tax Sales the Buyer is register for. The Buyer Registration pop-up window displays. Select a Tax Sale to register the Buyer for and click Finish. The pop-up window closes and the Tax Sale is added to the list of registered sales.

-

Select the checkbox for each Tax Sale you want to pay the registration fee for and click Pay Registration at the top of the screen. You advance to the Collect Payments screen, where you can pay the Buyer Registration fee. After you cashier the payment, you return to this screen and the Paid checkbox is selected.

-

Click the Surplus Info tab.

-

Go to Configuration > Systypes > Select or Add a Systype, select theSystypeof Buyer Deposits, set anEffective date, and add the systype name of your choice (example, Buyer Deposits).

-

Next, go to Tax > Accounts Receivable > Advance Surplus Mappings > Map Advance Surplus and map the new systype you created to the Buyer Deposit surplus subcode.

-

Set the following application settings as applicable:

-

Buyer Deposit Surplus SubCode = Buyer Deposit (or the systype you created)

-

Require Buyer Deposit = Required

-

Is Minimum Buyer Deposit amount required during tax sale? = true

-

Is Minimum Buyer Deposit a dollar amount or a percentage? = Percentage

-

Minimum Buyer Deposit Amount = [Insert an amount]

-

Buyer Deposit – Percentage withheld for unsettled bid, - The percentage value, if applicable to your jurisdiction

-

Buyer Deposit – Surplus SubCode for refund amount– The surplus subcode to use for any buyer deposit amount withheld in the event of an unsettled bid, if applicable to your jurisdiction

-

Buyer Deposit – Surplus SubCode for withheld amount for unsettled amount- The surplus subcode to use for any buyer deposit amount withheld in the event of an unsettled bid, if applicable to your jurisdiction

-

Click the ACH Information tab.

-

Select the Prenotification to indicate a Prenotification has been sent.

-

Enter the Prenotification Sent Date.

-

Select the ACH Bank account to display the associated bank information.

-

Click Pay Registration to navigate to the Cashiering Collect Payments screen to pay the registration fee setup for the sale.

-

Click Save to save the withholding information and buyer information. A Buyer number is created and displayed if you selected to Auto assign number.

NOTE: Depending on your jurisdiction, the Tax Sale > Property Sale Require ID number with adding Buyersdetermines whether a buyer ID is required when creating new buyers. Set to True to require a number or to False to accept a new buyer with defining a number.

IMPORTANT: The legal party must have a social security number or a federal id number before you can save the withholding information. Click Edit Party and look at the Identification Numbers panel of Maintain Legal Party.

Or, if the Buyer is not a Group buyer type, you can select to Associate with a Group Number.

NOTE: The Pay Registration button does not display on this screen until after you have saved the Buyer. Also, the Buyer Registration Fee is a Tax Sale Setting. This setting must be set before you can charge the registration fee to a buyer.

NOTE: This tab displays only when the following conditions and prerequisites are met:

NOTE: This tab may not apply to your jurisdiction.

NOTE: To be able to pay registration, secured and unsecured tax sales should exist, and the miscellaneous source for buyer registration must be configured for both collection types in Property Sale Setting. When navigating to the Collect Payments screen, two bills are displayed.

NOTE: The role of buyer is attached to the legal party when you successfully save.

Adding a Buyer

- Click New in the Command item bar.

- On the Add New Legal Party screen, make a selection from the Legal party type drop-down list.

- Optionally, make a selection from the Legal party sub-type drop-down list to further describe the legal party.

- Optionally, make a selection from the Functional role drop-down list, which identifies residency and citizenship for individual legal parties or type of organization.

- Select the Confidential checkbox if the legal party is confidential. This field only displays for users who have the required security rights to view and edit confidential legal parties. A confidential status is typically used for legal parties who cannot have public records, such as judges.

- First – up to 32 characters

- Middle – up to 32 characters

- Last – up to 64 characters; required

- Display name – A fictitious name that displays on the Aumentum screens, such as Info Center and Records. It is defined in the Legal Party Name field.

- Actual name – The actual, real name of the legal party. It is defined in the Actual Name field and is stored encrypted in the database.

- Make a selection from the Name prefix drop-down list.

- Enter the First name (max 32 characters), the Middle name (max 32 characters), and the Last name (max 64 characters), and make a selection from the Name suffix drop-down list. This name is used as the display name for the Aumentum screens.

- Enter or select the Date of birth or date of establishment.

- Enter or select the Date of death or date of dissolution, if applicable.

- Click Next in the Command Item bar.

- If the name you entered is the same or similar to another legal party name, the Similar or Matching Names Found screen is displayed so that you can verify whether this is a new record or whether it is a duplicate record.

- On the Add Mailing Address screen, make a selection from the Address type drop-down list.

-

Optionally, Enter a name in the Attention line field.

-

Edit the Recipient, if necessary. This defaults to the legal party name, but can be changed.

-

Enter an additional address , if necessary.

-

Enter the street number and directional information as applicable.

-

Enter the Secondary address unit type, such as an apartment or P.O. Box.

-

Enter the Address unit identifier, such as the apartment or suite number.

-

If Foreign is selected as the Address Type, enter the Last Line (optional) and select the Country.

-

Enter the Postal code, which is the zip code in the United States. The city and state may automatically populate based on the postal code you enter.

-

Click Next. If the address is found as a true address, the Confirm Mailing Address screen is displayed.

- If the address that you entered could not be found, you can accept, reject, cancel or go back to the previous screen.

- Click Cancel to cancel the task and return to Maintain Legal Party.

Click here for more information about selecting this option.

Click here for more information about selecting this option.

When selected, enter the information in the additional Actual Name fields is displayed at the bottom of the screen.

NOTE: Two names are stored for confidential legal parties:

Regardless of a security level, confidential legal parties do not display in Aumentum search results when the actual name is used as the search criteria. Users must know and use the confidential party's display (fictitious) name as the search criteria when searching by name.

When a legal party is confidential and a user has security rights to view confidential legal party data, Information Center displays a stop sign next to the name as a warning. If the user does not have the required security, the stop sign does not display. In either case, note that the confidential legal party's display name appears, not their actual name.

NOTE: If a legal party has a Date of Death, the party only displays in search results when the Return field on the Records Search for Legal Party screen is set to All. When Return is set to Active Only, legal parties with a Date of Death do not display, regardless of the effective search date. If the effective search date is earlier than the Date of Death, the legal party does not display in the search results when Active Only is selected.

NOTE: APO, DPO, or FPO must be chosen when selecting Military Overseas for an address type. APO refers to the Army/Air Force post offices. DPO refers to Diplomatic Post Office. FPO refers to the fleet post offices (ships and Navy personnel). The Military domestic address type uses the same format as standard.

When APO, DPO, or FPO are selected, the remaining fields vary, depending on the selection.

NOTE: If General Delivery is selected as the Address Type, the Street name field is populated with General Delivery, and only the Postal Code, City, and State are required from that point on.

NOTE: The Zip Code Lookup for Non-Group1 application setting must be set to True and Group1 Validate Mailing Addresses must be set to False. In addition, the Aumentum PostalCdLookup table must contain your desired list of zip code, city, and state combinations (including vanity city names). Aumentum contains a script that contains city and state combinations from the USPS. If necessary, you can update this script to include all vanity names that are appropriate to your jurisdiction. Aumentum Records will fill the city and state fields using the data in the PostalCdLookup table based on the postal code you enter.

Important information for the Postal Code method

Important information for the Postal Code method

Content and functionality for the lookup of United States Postal Service Zip Codes is included within the Aumentum Records module. By using this content and functionality, you expressly assume all liability and risk of loss associated with its use. There is no warranty or representation as to quality or correctness of the data contained within the Zip Code lookup content and functionality. This content and functionality is not included as part of its maintenance and support coverage. You can make updates or modifications to this Content and Functionality, but any such changes will be solely at your expense and risk.

NOTE: For either of the above postal code lookup methods (Group1 and USPS), if there are different variations of the city name for a given zip code (for example, vanity names), a drop-down list is available so that you can select the city name you want to use for this address.

NOTE: Adding or confirming a mailing address when creating a new legal party is not mandatory. If bypassing this, you return to the Maintain Legal Party screen.

Dependencies, Prerequisites, and Setup

Configuration Module

-

The Tax Sale > Property Sale application setting Require ID number with adding Buyers determines whether a buyer ID is required when creating new buyers. To set this up:

-

Click Tax > Tax Sale > Property Sale > Property Sale Settings > Maintain Property Sale Settings.

-

Selecting the Setting Type of Effective Date and the Filter By module of Tax Sale.

-

Click Edit on Require Id Number when adding Buyers setting.

-

Set to True to require an ID number. Accept the False default to accept new buyers with an ID number.

Surplus - Configuration and Accounts Receivable

The Surplus tab displays on the Maintain Buyer screen only when the following conditions and prerequisites are met:

-

Go to Configuration > Systypes > Select or Add a Systype, select the Systypeof Buyer Deposits, set an Effective date, and add the systype name of your choice (example, Buyer Deposits).

-

Next, go to Tax > Accounts Receivable > Advance Surplus Mappings > Map Advance Surplus and map the new systype you created to the Buyer Deposit surplus subcode.

-

Set the following application settings as applicable:

-

Buyer Deposit Surplus SubCode = Buyer Deposit (or the systype you created)

-

Require Buyer Deposit = Required

-

Is Minimum Buyer Deposit amount required during tax sale? = true

-

Is Minimum Buyer Deposit a dollar amount or a percentage? = Percentage

- Minimum Buyer Deposit Amount = [Insert an amount]

Registration - Miscellaneous Sources

To be able to pay registration from the Maintain Buyer screen:

-

Secured and unsecured tax sales should exist

-

The miscellaneous source (Cashiering > Setup > Miscellaneous Sources) for buyer registration must be configured

-

Collection types must be set up in Property Sale Setting.

Tax Sale Application Settings

- To exclude or include charge redemption fees on purchases of Agency Certificate, set the Charge redemption fee on purchase of Agency Certificate Tax Sale application setting to true via Tax Sale > Tax Sale Application Settings > Maintain Tax Sale Settings.

IMPORTANT: This must be set to false for Arapahoe, Colorado.

NOTE: See all Tax Sale Settings tax sale settings for any applicable bo Buyer Maintenance.

Property Sale Application Settings

-

The Allow Property to be in Multiple Secure Sales effective date Boolean setting allows tax sale items to be in multiple tax sales, and the tax sale in the Publication List to be in multiple secure sales when set to True. When a tax sale with multiple items is cashiered, the status of any tax sale item; also in another tax sale is set automatically to Non Participant in the non-cashiered tax sale with a Change Reason set to Sold in Another Sale. The Assessor, Auctioneer, and Tax Sale Balance reports include an additional Multiple Sales column that contains a count of the number of tax sales in which an item is participating if this setting is set to True and there are multiple items in a secure tax sale. The Copy function via the Process Items drop-down list in the Tax Items Details panel on the Maintain Property Sales screen is used to copy the item from one tax sale to another. Also, a Multiple Sale link in the header of the Info Center > Tax Information screen for any items in multiple sales opens a pop-up to select the particular tax sale, which opens the Tax Sale Information screen with the selected tax sale information loaded.

NOTE: If set to True, you must configure the Multiple Sales field for the Tax Sale Export via Configuration -> File Input/Output -> Input / Output File Configuration, choose Tax Sale Export.

NOTE: When set to true, the Tax Sale Buyer Payment Import (available via Accounts Receivable > Batch Processes) includes an additional Tax Sale drop-down list for selecting the sale that is being processed. The process then looks for the tax sale item(s) in the designated sale.

-

The Tax sale expiration period (days) effective date string application setting defines the tax sale expiration period in days for tax sale buyer imports. If no value is defined, the Set Input Parameters step in the Tax Sale buyer payment import process (Tax > Tax Sale > Property Sale > Buyer Maintenance) loads all tax sales available. Otherwise, the list shows only the tax sales that have not expired.