Banks

Navigate:  Tax

> Tax Accounting >

Setup > Banks

Tax

> Tax Accounting >

Setup > Banks

Description

Bank accounts are used to track deposits, payments for distribution of collected money, payments of refunds, and NSF charges.

Set up and maintain bank information, including transit routing numbers, account information, and associated branches and their addresses.

Steps

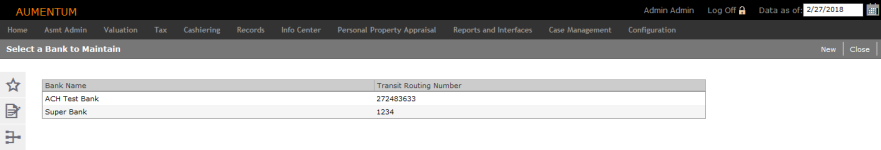

Maintaining a Bank

To work with bank and bank account information, look through the grid to find an existing bank, or add a new bank.

- On the Select a Bank to Maintain screen, click on a bank name or click New in the Command Item bar.

-

On the Maintain Banks screen, enter or edit the bank name and the 9-digit transit routing number.

IMPORTANT: The combination of the two must be unique. You must complete these two fields before proceeding to the next step.

-

In the Bank Accounts panel, click Edit for an item in the grid, or click Add.

-

In the first column, enter or edit the bank account number.

-

In the second column, make a selection from the Bank Acct Type drop-down list.

-

In the third column, make a selection from the drop-down lists.

- NSF Fee (non-sufficient funds), if applicable. This is the fee charged for bad checks or returned checks.

- Charge Code. This is the code used by Accounts Receivable to identify the NSF fee.

- GL Fund Number.

-

In the fourth column, make a selection from the drop-down lists and enter a description.

- Distribution Type. This indicates how the NSF fee is distributed, either Manual distribution, to TAG or to Agency. If TAG is selected, the fee is distributed to all authorities and funds in the TAG; if Agency is selected, the fee is distributed to a single agency.

- Enter or edit the bank description.

- GL Account Number. Accounts are set up using the Maintain Funds and Accounts screen.

-

Click Apply to save your changes.

- To delete a bank, click Delete and click OK in the confirmation message.

- In the Associated Branches panel, click Add

- On the Records Search for Legal Party screen, search for and select the legal party to associate with the branch.

-

On the Records Search Results for Legal Party screen, select a legal party.

-

On the Maintain Banks screen, the new branch is displayed in the Associated Branches panel.

-

Click Save on the top task bar when all bank information has been entered or modified.

NOTE: The branch must first be established as a legal party before you can associate it with the related bank information.

Tips

To delete a branch, click Delete on the grid row of the branch you want to delete and click OK on the confirmation message. Deleting a bank branch does not actually delete the branch legal party, but it does remove the association of the branch to the bank information.

Bank accounts are used to track deposits, payments for distribution of collected money, payments of refunds, and NSF charges.

The branch must first be established as a legal party before you can associate it with the related bank information.

Rate tables for fees are created in Maintain Rules and Rates.

Bank accounts are related to general ledger cash accounts.

One bank account can be related to multiple general ledger cash accounts.

One general ledger cash account can be related to only one bank account.

Dependencies, Prerequisites, and Setup

NOTE: Bank Account Number Encryption is available for bank accounts numbers and is established with a special script. Contact your Aumentum Implementation team for details. When creating new bank account, and when adding/maintaining a bank account associated a legal party (Common Action - Taxpayer ACH Information > Maintain Tax Payer ACH Information), the account number is encrypted upon saving and closing the screen. When re-opening a screen with the bank account number, the number is not shown but an encryption is displayed instead.

Tax Accounting

-

Set the correct effective year in the side panel. You can set it back to the earliest year on the system (or earlier) prior to setting up accounts if you want the accounts available for all years.

-

Set the Tax Accounting setting Payment Debit to Bank Account - Location to define customer deposits collections by location so the system can track and post information by location.

Records

-

Maintain Legal Parties - A legal party for each bank location need to be set up if bank locations are used.