Assessment Methods

Navigate:  Tax > Special Assessments > Setup > Assessment Methods

Tax > Special Assessments > Setup > Assessment Methods

Description

Create and maintain assessment methods for your amortized special assessments.

Steps

-

On the Search for Assessment Methods screen, enter your search criteria and click Search.

-

In the Search Results panel, click to select a code.

-

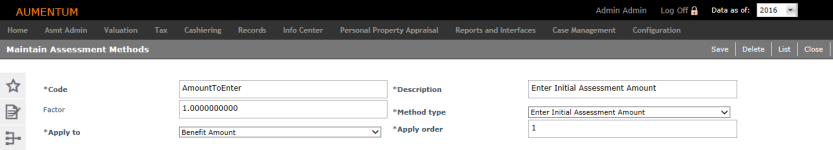

On the Maintain Assessment Methods screen, enter or edit the Code and Description for the assessment method.

-

Enter the Factor. The factor is usually 1.

-

Select the Method type. You can choose from Percent to Raise Method, Amount to Raise Method, or Enter Initial Assessment Amount.

-

Choose the Percent to Raise Method or the Amount to Raise Method if you are going to use this method type for a ditch special assessment.

-

Choose the Enter Initial Assessment Amount Method if you are going to use this method type for a non-ditch special assessment. If this method type is selected, you will not have to enter the cost or budget amount on the Maintain amortized special assessments screen.

-

Select Apply to benefit amount or benefit acres.

-

Enter Apply order. This is the order the assessment methods are applied if there is more than one assessment method.

-

Click Save to keep your changes.

- Click Delete at the top of the screen to delete the assessment method.

-

Click List to return to the Search for Assessment Methods screen.

- Click Close to end the task.

Tips

You can edit an assessment method if it is used for a special assessment; however, you cannot delete an assessment method that is currently in use.