Special Assessment Notices

Navigate:  Tax >

Special Assessments > Reports

> Special Assessment Notices

Tax >

Special Assessments > Reports

> Special Assessment Notices

Description

NOTE: The Special Assessment Correspondence datasource shows the special assessment notice fields.

After an amortized special assessment is created, use this screen to print Aumentum-created notices or user-created correspondence for the amortized special assessment.

The notices are used to notify the tax payer of the amortized special assessment and of their total cost. The notices indicate when the tax payer needs to pay off their entire cost of the special assessment before it becomes amortized and includes amortization interest. An amortization schedule is usually sent along with the notice. This schedule gives the tax payer an indication of what their total amount due will be if they choose to pay it over the length of the amortization period.

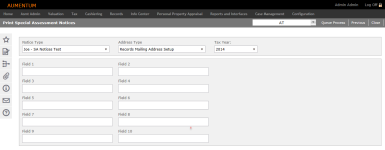

Print Special Assessment Notices

-

On the Search for Amortized Special Assessments screen, enter your search criteria and click Search.

-

In the Search Results panel, select the checkbox for one or more items in the grid and click Next.

-

On the Print Special Assessment Notices screen, make a selection from the Notice TypeAddress Type, and Tax Year drop-down lists.

-

Optionally, define additional information in the user-defined fields.

-

Click Queue Process in the Command Item bar. The Monitor Batch Processes screen opens automatically.

Mail Merge Document Setup

User-created Correspondence creates a mail merge document to produce notices and other correspondence for mailings specific to your jurisdiction. The correspondence process merges the data from Aumentum Special Assessments with a document prepared via the Mail Merge feature of Microsoft Word™. The process inserts data into data source fields that are in the mail merge document and prepares the individual documents for printing.

To create a mail merge document to use for the Special Assessment Notices:

-

Click Reports and Interfaces > Correspondence > Setup > Report Setups.

- On the Manage Report Setups screen, click New.

-

On the Edit Report Setup screen, enter a description and make a selection from the Category drop-down list.

-

In the Data Source panel, click the Select a data service hyperlink.

- In the Select Data Service pop-up, type Special Assessment Notice Data in the Search field, then click to select it.

- In the panel's title bar, click Download definition files and choose the file type you want to use to create your notice.

-

In the Document Information panel, make a selection from the Engine drop-down list and click Select a template to create a Mail Merge document using Microsoft Word.

-

Click Upload in the Select Template pop-up.

-

Click Browse to find your Mail Merge document.

-

After the upload, search and select the mail merge document.

-

Click Save on the Edit Report Setup screen.

IMPORTANT: Existing Special Assessment Notice mail merge documents from Aumentum versions prior to v 10.00 must be updated to use the new data service.

Correspondence Installation

-

Correspondence installation must be performed successfully by implementation staff, including installing Microsoft Word 2003 and .Net Programmability Components on the batch server and setup of the DSN. Installation follows the steps of the Aumentum Correspondence configuration guide.

-

You or your Aumentum Implementation team must set up the Data Service for the report, upload the service via the Manage Templates task, then associated the Data Service to the template using the Report Setups task.

-

Application Settings must be configured:

-

Maximum upload file size (Common) – This setting is also shared by Import Tax Bill Addresses for Mail Presort, Select Bills or Revenue Objects, and Import Lender Revenue Objects in Billing; and A/R Batch Collection imports.

-

Word is installed and configured on Aumentum batch servers (Configuration) – Verify that Microsoft Word has been installed on your batch server and this application setting is set to true.

Tips

Special Assessment do not have to be a receivable at the time notices are sent out.

The notice contains the following information: owner of record name for parcel, parcel number, initial assessment amount (by tract for ditches), short legal description of the tract (ditch only), and date due for payment without interest being added.

Dependencies, Prerequisites, and Setup

Configuration

-

Click Configuration > Security and User Maintenance > Roles > Maintain a Role.

-

Select to edit a Role to advance to the Edit Role Details screen.

-

Click the + Expand button in the granted menu items tree for Tax > Special Assessments > Reports > Special Assessment Notices.

-

Set the security rights for the role as applicable to all users in the role.

-

Click Details under Special Assessment Notices to edit any additional roles details for the specific view son the Edit Additional Role Details.