Receivables Report

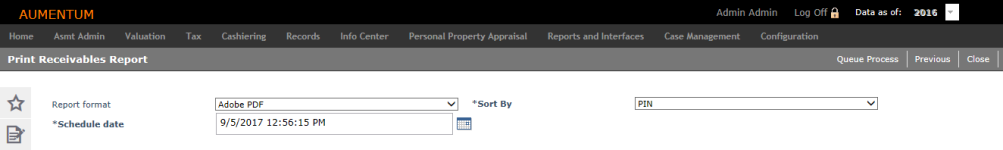

Navigate:  Tax > Special Assessments > Reports > Receivables Report > Search for Special Assessments > Print Receivables Report

Tax > Special Assessments > Reports > Receivables Report > Search for Special Assessments > Print Receivables Report

Description

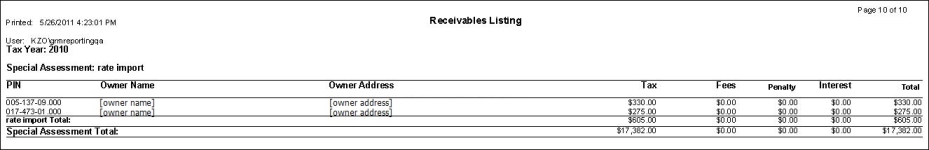

This report lists all revenue objects associated with selected special assessments and the amount of special assessment charges owed (after any payments that have been made). Charge information includes tax, fees (if applicable), penalty, and interest.

NOTE: Special assessments must have been billed for the selected tax years in order to print this report.

IMPORTANT: At this time, this report cannot be printed for amortized special assessments.

Steps

-

Select the Report format you want to print the report in.

-

Select the Sort by option form the drop-down list. The default selection is to sort by PIN. You can also sort by Owner or by PIN, then Owner.

-

Enter the Schedule date and time when you want the batch process to run.

- Click Queue Process.

Click Previous to return to the Search for Special Assessments screen.

Click Close to exit.

Report Sample

Receivables Report