Collections Report

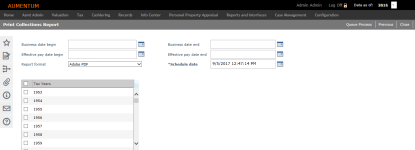

Navigate:  Tax > Special Assessments > Reports > Collections Reports

Tax > Special Assessments > Reports > Collections Reports

Description

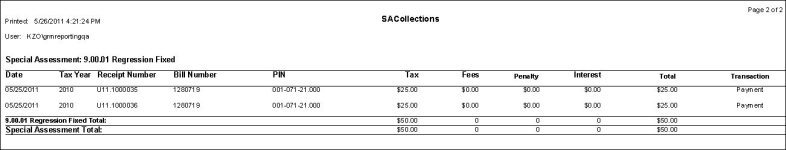

This report lists the amount collected for selected special assessments for a given date range. The report lists, grouped by special assessment, each receipt for each revenue object and the amount of special assessment charges, including tax, fees, penalty, and interest, collected on the receipt.

IMPORTANT: At this time, this report cannot be printed for amortized special assessments.

Steps

-

On the Search for Special Assessments screen, enter your search criteria and click Search.

- In the Search Results panel, click on a name in the Description column.

-

On the Print Collections Report screen, enter the report parameters:

-

Business Date Begin and Business Date End for the collections you want listed on your report. Leave blank for all dates.

-

Effective Pay Date Begin and Effective Pay Date End for the collections you want listed on your report. Leave blank for all dates.

-

Report format. The default report format is PDF.

-

Schedule date and time. The default date and time is the current date and time.

-

In the Tax Years panel, select the checkbox for years you want to include.

-

Click Queue Process in the Command Item bar. The Monitor Batch Processes screen opens automatically.

-

Click Close to return to the Print Collections Report screen.

-

Report Sample

Collections Report

Tips

Fees are now included on the Balance Due report when a special assessment has an associated charge fee that is billed separately from the special assessment.