Tax Bill Viewer

Navigate:  Tax > Processing > Tax Bill Viewer

Tax > Processing > Tax Bill Viewer

Description

NOTE: This task may not apply to your jurisdiction.

Review the tax bill and accept or reject supplementals and/or corrections.

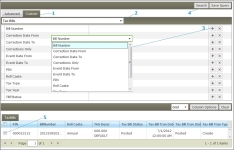

Advanced Search

-

On the Search for Tax Bill screen, enter your search criteria and click Search.

-

In the TaxBills panel, select the checkbox for one or more items in the grid and click Next.

You can also:

-

Click Save Query and define the Data Service Name and Data Service Description.

-

Click the Grid drop-down to display a different view.

-

Click Column Options to define the columns you want displayed by moving them to the Selected Columns panel.

-

On the Review Tax Bill screen, you can review the tax bill details as well as recalculate, accept, reject, and change the installment schedule.

Customized Search

-

On the Search for Tax Bill screen, click the Custom tab.

-

Make a selection from the drop-down list (Tax Bills, Process Corrections Search, or Outstanding Supplemental Bill).

-

Click the + Expand/Contract toggle button next to items in the panel to open an another panel from which to select and define additional search criteria. Repeat this for each option as desired.

-

Click Search.

-

Select the checkbox for items in the results and click Next.

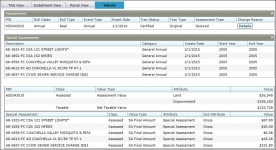

Review Tax Bill screen

-

On the Review Tax Bill screen, make a selection from the Bill Type drop-down list in the Bill Information panel title bar.

-

Make a selection from the Tran Date drop-down list to view the TAG data for the selected transaction date in the TAG View panel.

-

Select the reason code. This field is available only prior to posting of the tax bill.

-

Accept the current date billing date or accept the current date default. This field is available only prior to posting of the tax bill.

-

Click the Installment View tab to view installment information related to the bill. The sum of individual installment amounts is displayed for the selected bill.

-

Click the Parcel View tab to view, which shows the same information as on the TAG View, only in the parcel view format.

-

Click the Corrections View tab to view correction events.

-

Click the Values panel to view values for the particular role. Any prorated values are also displayed.

NOTE: The Values panel is divided into various panels, with a Special Assessments panel if applicable to the tax bill.

-

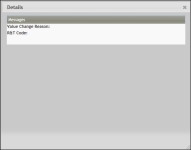

Click Details in the Change Reasons column to open a pop-up showing the reason for any assessment changes.

-

Click the X to close the pop-up.

-

At any time or after all changes are made, click Print Bill to generate the tax bill as a PDF.

-

Click Print Roll Change Document in the Bill Information panel's title bar to generate a property change notice.

-

Click Update Bill in the Command item bar. On the Installment Dates screen, click Edit to define the start and end installment dates for the purpose of proration. Click Update to save your changes.

- Click Apply in the Command Item bar.

- Click Close to return to the Review Tax Bill screen.

NOTE: The proration values are shown on the Values panel after the tax bill is recalculated.

- Click Installment Dates in the Command Item bar. On the Change Installment Dates screen, click Edit for an item in the Charges panel to maintain the installment schedule.

- Click Apply to save your changes.

- Click Cancel to return to the Review Tax Bill screen.

- Click Close to end the task.

- Click Recalc in the Command Item bar to recalculate the tax bill whenever you make changes to the installment schedule.

-

The Accept and Reject buttons are not active unless you have:

-

Made a modification to the installment date(s) on the Change Installment Date screen and you have recalculated the tax bill on the Review Tax Bill screen.

-

A modifier, such as Eminent Domain, is placed on the account and a roll change occurs, kicking off a Tax Bill Correction workflow.

-

Rolls back any tax bill transactions that occurred as a result of a correction, and prevents posting of any updated data to Accounts Receivable.

-

Creates a Correction Reject event that in turn generates a workflow for the tax bill for further review/processing from the View My Worklist screen.

-

Click List to return to the Search for Tax Bill screen.

-

Click Close to end the task.

NOTE: This panel displays only when a correction has occurred to the tax bill or tax roll in which the bill was included.

For the event type Ownership Date, enter a start and or end date to calculate Proration Factor, Prorated Net Taxable, and Prorated Special Assessment Final Amount (when applicable).

NOTE: Whenever you recalculate the tax bill, click Save.

Click Accept to accept the tax bill supplementals and corrections, or click Reject to reject the tax bill. This action:

Jurisdiction Specific Information

Jurisdiction Specific Information

Riverside, California

-

Local Exemptions – Welfare and Land Only. Annual Tax Roll Processing supports roll changes for late filing local exemptions based on R&T Code 270.

NOTE: The Aumentum Implementation team creates the modifiers and value types applicable for this. -

Assessment Administration calculates the penalty.

-

Next, Levy extends the taxes against the penalty value type.

-

Levy caps the charge on the penalty valuation.

-

Levy saves the charges, which can then be viewed in the Tax Bill Viewer

- Outstanding Supplemental Bills can be selected from the Custom tab on the Search for Tax Bill screen. Results returned when performing this search are Supplemental bills that are not paid off and have a split event.

-

Assessment Administration calculates the penalty.

-

Next, Levy extends the taxes against the penalty value type.

-

Levy caps the charge on the penalty valuation.

-

Levy saves the charges, which can then be viewed in the Tax Bill Viewer

- Eminent Domain: The Special Processing Unit (SPU) of the TTC (Treasurer/Tax Collector) office is notified of completion of a roll correction by the Auditor's office for Eminent Domain properties via the workflow. The workflow kicks off a TaxBillCorrection workflow for review and for accept/reject. The first Accept goes to treasurer. The second Accept posts to Accounts Receivable. Valuation changes are done to determine the valuation. The Levy Annual Corrections and Escapes Category, Process of Extend Tax Roll/Create Tax Bill Date executes and posts the correction to billing. Once posted to billing, the tax bill gets sent to the workflow for review. Any funds collected in the Eminent Domain trust can be applied to the bill by a funds transfer. To accommodate Eminent Domain, a Value Change Reason code (Asmt Admin > Setup > Valuation Change Reason Mapping ) of Eminent Domain is available, and a Tax Change reason code (Tax > Levy Management > Setup > Tax Change Reason Mapping) of Eminent Domain is available. Tax Bill correction is available for viewing and accept/reject action on the Corrections View tab of the tax bill viewer (Tax > Assessment Processing > Tax Bill Viewer > Search for Tax Bill > Review Tax Bill).

Dependencies, Prerequisites and Setup

Tax Roll Processing must be complete and a tax bill must be generated and exist in the Aumentum Platform.